- RBNZ signals 2022 rate hike, kiwi surges, but ECB plays down taper talk, knocking euro

- US yields edge up from lows after Fed’s Clarida suggests taper debate could begin soon

- ‘Talking about talking about” tapering doesn’t faze gold as price hits $1,900/oz

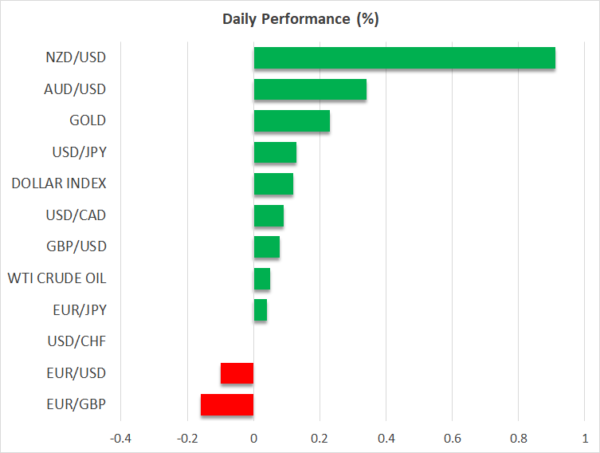

RBNZ plans its exit strategy, kiwi jumps 1%

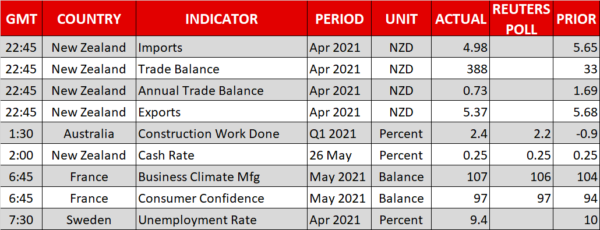

The Reserve Bank of New Zealand took its first step to exit the pandemic-era stimulus on Wednesday, projecting a rate hike by September 2022 and an end to its large-scale asset purchase (LSAP) programme. Although the Bank maintained caution that it would require ‘considerable time and patience” to meet its inflation and employment objectives, Governor Orr did not push back on the idea of using the projected rate path as guidance.

There was no change to the NZ$100 billion LSAP programme, which expires in June 2022, but the RBNZ admitted that it will probably not be able to reach that limit, suggesting that the pace of bond purchases has already slowed down.

The yield on New Zealand’s 10-year government bonds shot up more than 10 basis points to 1.90% after the announcement, catapulting the kiwi above its recent trading ceiling to a 3-month high of $0.7316.

The Australian dollar also got a leg up, coming just shy of the $0.78 level even as the US dollar firmed overnight. However, other majors struggled against the greenback today as the euro and pound posted modest losses.

Euro softer but resilient as ECB dismisses taper talk

The European Central Bank seems to be toning down expectations of a taper move at its June 10 policy meeting, with a number of policymakers signalling in recent days that it’s too soon to start reducing the pace of asset purchases. Executive Board member Fabio Panetta was the latest to dash expectations that the ECB would begin winding down its pandemic emergency purchases as early as June, dragging Eurozone bond yields further below recent peaks.

Euro area yields were soaring until last week before President Christine Lagarde put a damper on the rally with some dovish comments. Germany’s 10-year yield has slumped towards -0.20%, having peaked at -0.074% just a week ago.

However, although the euro’s rally also appears to have lost some steam today, slipping to around $1.2240, the single currency remains buoyed against the US dollar as the sudden upturn in the Eurozone’s economic outlook hasn’t been fully priced in yet.

The same cannot be said for sterling, where much of the good news about the UK’s recovery is already baked in and traders are seeking new drivers to take the currency forward.

Dollar steadier as Fed signals taper talk may be near

The US dollar was attempting to pare some losses on Wednesday after finding some support from firmer Treasury yields. US yields edged up marginally on speculation that the Federal Reserve will decide at one of its upcoming meetings whether to start tapering. Fed Vice Chair Richard Clarida yesterday echoed the message from the FOMC minutes that ‘there will come a time in upcoming meetings we will be at the point where we can begin to discuss scaling back the pace of asset purchases”.

Nevertheless, his confirmation that taper discussion is on the cards didn’t spark any alarm, partly because yesterday’s data releases out of the United States provided more evidence that the American economy is not quite roaring as previously thought. New home sales for April and the May consumer confidence index both disappointed, keeping a lid on the gains in Treasury yields.

The dollar index was last up about 0.15%, barely recovering from yesterday’s 4½-month lows.

Gold extends winning streak

The dollar’s sluggish rebound gave investors the green light to pour into gold as Tuesday’s data only reinforced the narrative that the Fed will sit back and let the inflation story unfold as it waits to see whether the episode will be transitory or not.

In the meantime, the persisting inflation jitters along with subdued US yields, as well as some rotation out of cryptocurrencies following the recent crash, have all accelerated gold’s rebound during May. The precious metal broke above the $1,900/oz level today, recouping its year-to-date losses and hitting the highest since early January.