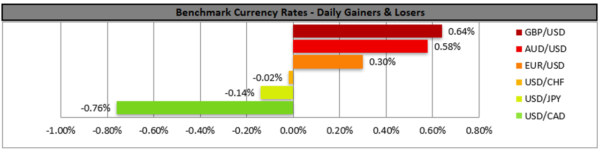

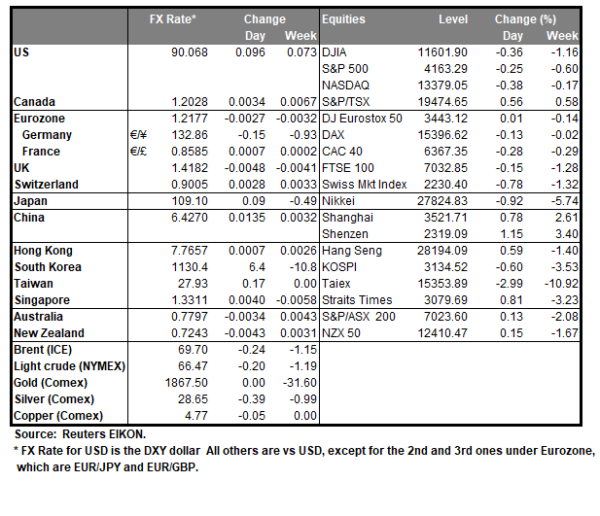

The USD tended to retreat further against a basket of its peers yesterday, as the market sentiment seems to have been influenced by the expectations of the Fed keeping its interest rates at low levels for a long period. Fed’s policymakers seem to maintain their dovish view and Dallas Fed President Kaplan reiterated that any rate hike should not happen before 2022. On the other hand, the Fed policymaker also stated that he would support a trimming of the bank’s QE program rather sooner than later. The overall message did not convert to a clear cut risk on sentiment, which would allow the US stockmarkets to rise, which provided mixed signals. On the other hand, gold’s prices tended to benefit from the weaker USD despite the US yields rising just a bit. We note the US financial releases today yet also on the any comments by the Fed’s policymakers which are scheduled to speak today.

USD/CAD continued to drop yesterday breaking below the 1.2060 (R1) support line, which now turned to resistance. It’s indicative of how low the pair trades currently as it has reached a six-year low level. We tend to maintain our bearish outlook as long as the downward trendline characterizing the pair’s movement since the 21st of April, continues to guide it. Please note that the RSI indicator below our 4-hour chart has reached the reading of 30, while the pair’s price action has reached the lower Bollinger band and despite both indicators confirming the dominance of the bears, may also imply that a correction higher is possible. Should the bears actually maintain control over the pair’s direction, we may see the pair breaking the 1.1995 (S1) support line and aim for the 1.1920 (S2) support level. Should the bulls take over, we may see the pair breaking the 1.2060 (R1) resistance line and aim for the 1.2140 (R2) level.

GBP seems to gain ahead of UK’s employment data

The pound tended to gain against the USD, EUR, CHF and JPY yesterday, as the market sentiment tended to be somewhat positive for the sterling. It should be noted that the UK took another step towards reopening its economy given that a number of social restrictions were lifted yesterday. Restaurants, bars and cafes do now serve also indoors, and international travelling is now permitted amidst a number of other easing measures. There is growing concern about the Indian variant of the coronavirus though which may be even more transmittable than the UK variant and UK scientists tend to warn that it may become the dominant variant as reported by Reuters. On the other hand, the UK government maintains its intense vaccination efforts in order for the reopening of the UK to continue. Today we expect market attention to be also on the release of UK’s employment data for March, yet fundamentals may continue to affect the pound.

GBP/USD tended to have bullish tendencies yesterday, breaking just above the 1.4145 (S1) resistance line, now turned to support. We see the case for the bulls to have the advantage, given that the RSI indicator below our 4-hour chart is approaching the reading of 70, yet that may also imply a possible correction lower. Also it should be noted that the 50 MA increases its distance from the 200 MA, also confirming the accelerated rise of the pair. Should buyers maintain control over the pair’s direction, we may see cable aiming if not breaking the 1.4275 (R1) resistance line. Should a selling interest be displayed by the market, we may see GBP/USD breaking the 1.4145 (S1) support line and aim for the 1.3990 (S2) level.

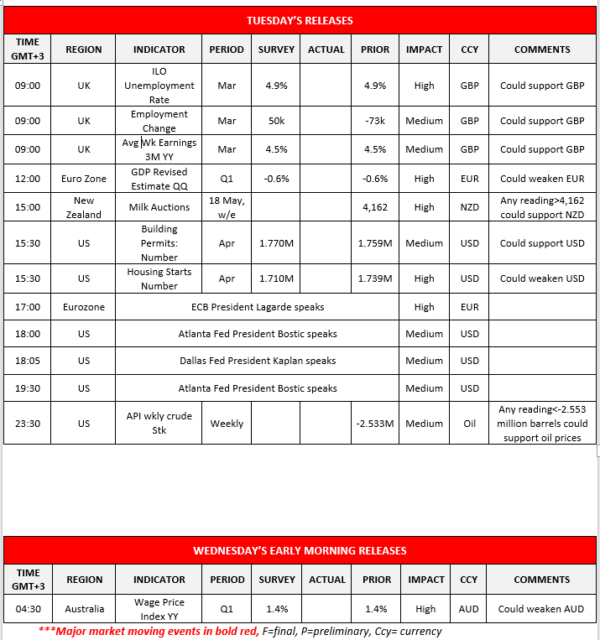

Other economic highlights today and the following Asian session:

Today in the European session we get UK’s employment data for March and Eurozone’s revised GDP estimate for Q1, while in the American session the US construction data stand out and just before Wednesday’s Asian session starts we get weekly API crude oil inventories figure. During tomorrow’s Asian session we highlight Australia’s wage price index for Q1. Also note that in the American session to speak, ECB President Lagarde, Atlanta Fed President Bostic and Dallas Fed President Kaplan are scheduled to speak. Calendar follows

Support: 1.1995 (S1), 1.1920 (S2), 1.1840 (S3)

Resistance: 1.2060 (R1), 1.2140 (R2), 1.2230 (R3)

Support: 1.4145 (S1), 1.3990 (S2), 1.3845 (S3)

Resistance: 1.4275 (R1), 1.4390 (R2), 1.4530 (R3)