U.S. Highlights

- Consumer and producer price inflation surprised on the upside on the back of rebounding energy prices, supply disruptions and strong fiscal-stimulus fueled demand.

- Despite inflation overshooting 2%, several Fed officials reassured markets that there won’t be any tapering of asset purchases any time soon since the spike in inflation is viewed as transitory.

Canadian Highlights

- Canada is slowly emerging out the third wave of the pandemic. As we look ahead to a summer with less restrictions, there are signs of rising inflation on the horizon.

- Strains to the supply chain and a strong recovery in consumer demand could boost price growth, similar to what was observed in the U.S. in April. As supply chain kinks are smoothed out, these pressures should dissipate.

Special Feature – U.S. Small Businesses Struggle to Hire Workers, Despite High Unemployment

- Unfilled job openings among U.S. small businesses rose to a new record high in April. But, finding qualified workers is proving difficult and expectations that these openings will be filled lag behind.

- Small businesses are boosting pay to try and attract talent. The share of firms raising compensation rose to 31% in April, one of the better historical showings. Another 20% plan to raise compensation in the next three months.

U.S. – Inflation is Here but Don’t Let it Get to You

George Bernard Shaw, once famously quipped: “If all economists were laid end to end, they would not reach a conclusion.” This week’s inflation data gave economists plenty of fodder for debate and disagreement: How transitory will inflation be? How much of the rise in producer prices will pass through to consumer prices? When will the Fed react?

Consumer prices surprised on the upside this week. The consumer price index (CPI) rose by 0.8% month-on-month (m/m) in April. That boosted the headline inflation rate to 4.2% year-on-year (y/y), the fastest increase since 2008. Meanwhile, core inflation rose to 3% y/y. Naturally, these data have raised concerns about a more sustained increase in prices. Digging into the data, many of the biggest price hikes were in areas that had seen the biggest disruptions during the pandemic – travel-related areas like airline fares, car rentals and hotels. As Americans are vaccinated, these industries are now seeing demand pick up sharply. Still, amid this demand resurgence there are worries that other pandemic-related factors – supply-side bottlenecks, higher energy costs, and rising wage pressures – could cause a sustained surge in prices. Many of these pandemic related price swings are likely to be transitory, but will stick around long enough to put upward pressure on inflation in the months ahead.

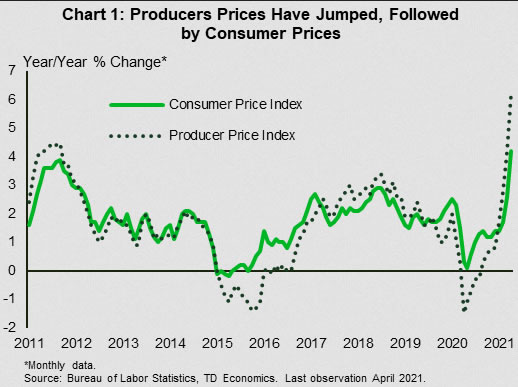

Its not just the consumers that are facing the pinch. Producer Price Index (PPI) inflation in April came in at a staggering 6.2%, the highest inflation rate in the history of the current series going back to 2004 (Chart 1). The jump in producer prices is due to supply chain disruptions that have raised shipping costs and have led to shortages of key manufacturing inputs. What this means for CPI inflation depends on how much of the increase in costs are passed on to consumers. Given surging demand, businesses are in a good position to do so and some have already announced plans on this front. So, its not a matter of ‘if’ but ‘when’ you see consumer prices rise.

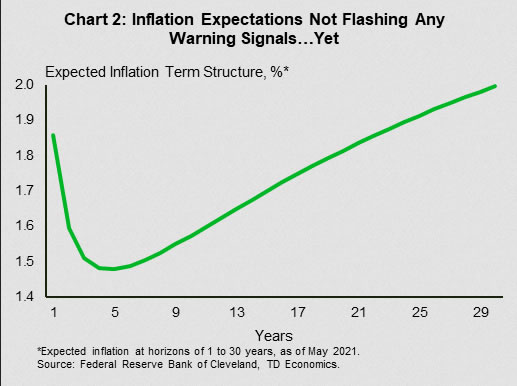

Still, the Fed doesn’t seem to be worried about inflation. The Fed’s change in strategy to target an average inflation rate has a lot to do with its more relaxed attitude. Since inflation has undershot 2% for several years prior to the pandemic, it has to push above it for some time in order to hit 2% on average. Meanwhile, the unemployment rate is still 2.6 percentage points higher than its pre-recession level and there are still 8.2 million fewer jobs. Finally, the Fed’s composite measure of inflation expectations currently stands at ‘only’ 2.01% and expectations are for it to stay below 2% over the long-term (Chart 2).

Nonetheless, there is some question about just how transitory it will be. Just this week, several Fed officials reassured markets that there won’t be any tapering any time soon since the labor market recovery is uneven and the inflation spike is transitory. Fed Governor Waller defines transitory as inflation staying above 2% until end-2022. That’s a long time!

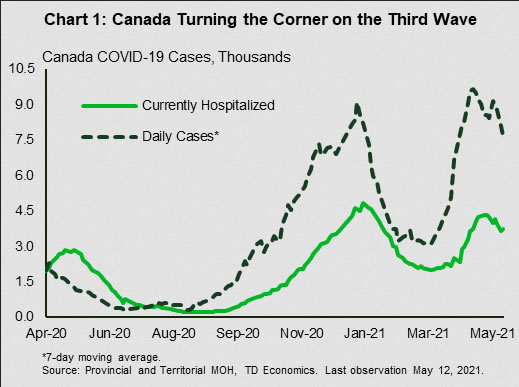

Canada – Inflation Up Ahead

Slowly, but surely Canada is emerging out of the third wave of the pandemic. Daily case counts have fallen from around 9,000 in mid-April to a little over 7,000 this past week (Chart 1). Hospitalizations also appeared to have peaked and are now beginning to trend downward. At the same time, the vaccination rollout has sped up. Of the adult population, 50% have received at least one dose of the vaccine. These are all great signs as we look ahead to a summer that could potentially bring us closer to the good ol’ pre-pandemic days.

Still, the transition out of the pandemic could be a bumpy one. After being subdued for many many years, near-term inflationary pressures are building. As we have written in a recent report, recovering global demand is exacerbating existing stresses in supply chains. And until supply chain kinks are smoothed out, businesses will probably pass on these costs to consumers.

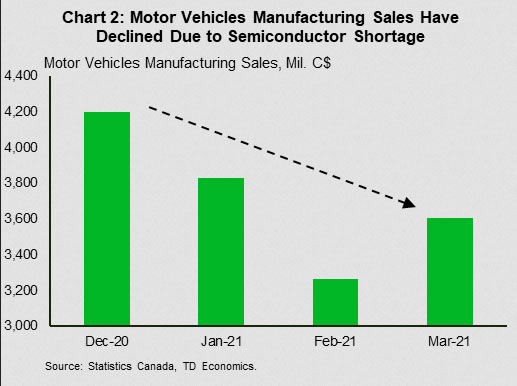

Supply chain impacts could also surface through indirect channels. For example, in the U.S. April inflation figures released this week — which showed consumer prices rising by 0.8% month-on-month — the main driver was used vehicle prices. This component was heavily influenced by the global semiconductor shortage weighing on new car inventories, thereby limiting consumers to the used car market. And given the strong pick up in travel demand due to easing public health restrictions, used car prices surged.

The scarcity of semiconductor chips is impacting Canada as well. As of March, shipments for Canadian motor vehicle manufacturers were down 14% since December due to the shortage (Chart 2). This will likely worsen in the coming months as some automakers have announced intentions to reduce output in assembly plants. If these issues persist, they could introduce inflationary pressures, similar to the U.S., when provinces gradually lift restrictions (hopefully) in the early summer months. In the meantime, next week’s consumer price index data for April will likely continue to show contained price inflation given ongoing lockdown measures dampening consumer demand across most of the country.

The Bank of Canada will be monitoring price developments closely. In the last Monetary Policy Report (MPR), the Bank was clear that it thought any near-term price pressures will be transitory. And they likely will be. However, if rising prices elevate consumer perceptions on inflation, it could stoke greater spending activity and make inflation more persistant. Offsetting this, the Canadian dollar has been on a tear, suggesting less inflationary pressure than we see stateside.

The Bank will be monitoring inflation risks, while also assessing the perils of an overheating housing market. Home sales and price indicators are due to be released next week, and they will likely show continued sizzle in residential activity. As we note in a recent report, there are signs that increases speculation is bolstering residential activity recently in Canada. The upcoming Financial System Review should provide greater insight into the Bank of Canada’s thinking on the matter, and how it sees risks evolving going forward. .

Special Feature – U.S. Small Businesses Struggle to Hire Workers, Despite High Unemployment

The U.S. labor market has made considerable progress in recent months, but it still has a long way to go before it’s back to pre-pandemic levels. The latest U.S. jobs report showed that in April there were 8.2 million fewer Americans employed than prior to the pandemic. Broader measures of unemployment put the tally even higher. For example, the number of people receiving unemployment benefits from all available programs (including pandemic emergency programs) stood at 16.9 million in the week ending on April 24th. Indeed, by all accounts, there’s still a lot of slack left in the labor market. Yet, despite this, there are also growing voices among businesses about the difficulty of finding qualified workers.

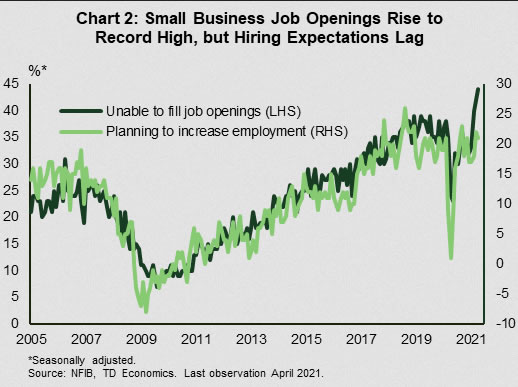

These concerns are rooted in a surge in unfilled job openings, as the pandemic continues to loosen its grip on the economy. Data from the Job Openings and Labor Turnover Survey shows that job openings expanded by nearly 1.4 million during the first three months of the year to 8.1 million – a record high. Firms of smaller sizes have joined in on this trend (Chart 1). A survey from the NFIB, which focuses exclusively on small businesses, reveals more of the same, with job openings setting a new record high for the third consecutive month in April (Chart 2).

Small businesses generally reflect employees that exhibit a higher quit rate relative to those of the largest firms. While job openings among them are plentiful, expectations that these openings will be filled (and thus result in an increase in employment) lag (Chart 2). This is likely a testament of the difficulties that small businesses face in hiring the right talent in the current environment.

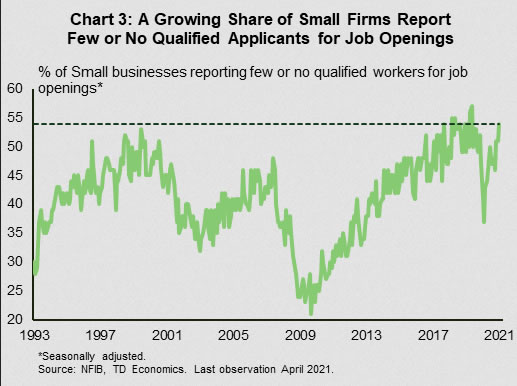

Last month, about a third of small businesses reported few qualified applicants to their openings, while more than a fifth reported no applicants. This makes for a total of 54% of businesses reporting few or no qualified applicants – not far off from the pre-COVID levels and among the highest in the survey’s history (Chart 3). What’s more, despite the myriad of issues that small businesses cite as areas of concern, such as competition from large business, taxes and inflation (the latter has seen a notable uptick recently), they continue to point to quality of labor as the single-biggest problem.

Pinpointing the reasons as to why businesses are having a hard time finding qualified workers when there’s plenty of labor market slack is not straightforward. Recent headlines have gravitated toward the role that enhanced unemployment benefits may be playing in discouraging some individuals in returning to the workforce. In this vein, many states are now moving to remove the enhanced unemployment benefits early. The role of unemployment benefits should not be overlooked, especially when it comes to the potential impact for lower-paid industries. But, evidence that even more highly paid industries are struggling to fill job openings (i.e. manufacturing and construction), speaks to a much broader issue. Indeed, a number of other factors are suspected to be at play.

A skills mismatch is another element to consider. The pandemic appears to have had a profound impact on those that became unemployed in making them reassess their career paths. A recent study shows that two thirds of those that lost their jobs had “seriously” thought about changing their field of work or occupation. The fact is that skills from one industry may not be easily and readily transferable to another industry. For example, skills in leisure and hospitality, the sector that bore the pandemic’s brunt on job losses, may not be adequately transferable to manufacturing. The goal of upgrading their skills in the hopes of switching careers can make some workers hesitant to jump in the same industry or role as before, while unemployment benefits keep rolling in.

A steep reduction in immigration and the fact that there were plenty of relocations within the country during the pandemic (such as the shift in population to the suburbs, or the Sunbelt), could also be contributing to the misalignment in the supply and demand of labor. At the same time, while the fear of contracting the virus has eased recently, it is likely still weighing on the eagerness of some workers to get back to work. Similarly, the balancing of family obligations while the pandemic is ongoing (i.e. caring for older parents or children when some schools and daycares remain closed), may also be limiting the ability of some workers to get back on the payroll. Competition from large businesses, although not cited as a major obstacle at the national level, is likely playing a notable role in some regions. Large employers like Amazon, Walmart, McDonald’s, Costco and Chipotle have boosted or are planning to further boost wages in order to attract workers.

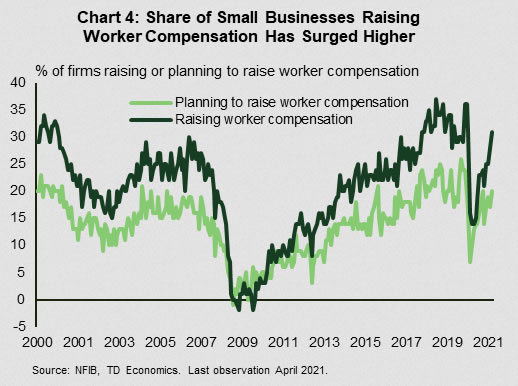

Most of the aforementioned obstacles will dissipate as the pandemic further loosens its grip on the economy (i.e. fear of contracting the virus will ease further and more daycares and schools will reopen). But, for the here and now, one of the most effective ways to attract the right talent would be to increase compensation. Plenty of small businesses are doing just that. The share of firms increasing worker compensation rose to 31% in April – one of the better showings in NFIB survey’s history (Chart 4). Meanwhile, another 20% plan to raise worker compensation in the next three months.

The ability of small businesses to keep raising wages will be limited by the squeeze on profit margins. Sales and earnings have trended higher in recent months, facilitating the increase in compensation. Should the expanding economic cycle continue unperturbed, a continuation of the positive earnings trend should allow more increases. However, it should be noted that as of now, small businesses are still somewhat skeptical regarding an improvement in the economy.

Another way for firms to retain profit margins is to unload some of the added costs from wages and other input costs to the end-user through higher prices. Again, plenty of small businesses are doing just that, with the share of those that are raising prices increasing to 36% – the highest level since the 1980s and yet an added element that supports the “reflation” narrative.

All in all, the fact that small businesses are having difficulty in finding qualified workers at a time when there’s still plenty of labor market slack should be added to the list of anomalies caused by the pandemic. While some of the obstacles that are currently at play will dissipate with time, in the near term, the implication of this conundrum may be for it to weigh on the pace of labor market recovery.