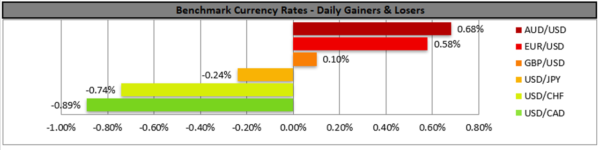

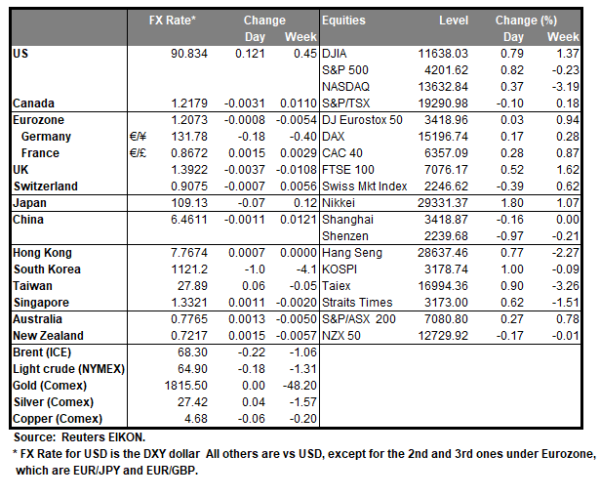

The USD weakened against a number of its counterparts yesterday, ahead of the US employment report for April is being released later today. The rates and figures forecasted show a tightening of the US employment market, with the NFP figure expected to remain at high levels, the unemployment rate dropping, while on the negative side the average earnings growth rate is expected to slowdown. It should be noted that yesterday, the initial jobless claims figure for past week dropped providing an encouraging sign for the US labour market. Should the actual rates and figures show a further tightening for the US employment market, that could lay some worries of the Fed which are associated with it to rest and provide for some confidence among the Fed’s policymakers. Overall bear in mind the dual nature of the report’s possible effects. On the one hand, very good rates and figures could boost the confidence of the market for the US economic recovery, which in turn could boost US equities market. On the flip side, very good rates and figures could support high expectations for further inflationary pressures thus raising US bond yields.

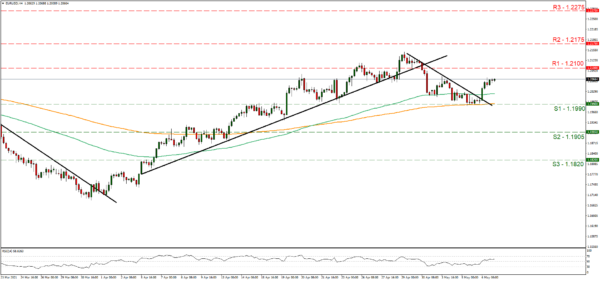

EUR/USD bounced on the 1.1990 (S1) support line, which held its ground and aimed for the 1.2100 (R1) resistance line. As the pair in its upward motion broke the downward trendline guiding its price action since the 29th of April, we switch our bearish outlook in favour of a sideways movement bias initially. Please note that the RSI indicator below our 4-hour chart was able to surpass the reading of 50 and seems to have stabilised somewhat, providing a slight advantage for the bulls. Should the bulls actually take charge over the pair’s direction, we may see EUR/USD breaking the 1.2100 (R1) resistance line and aim for the 1.2175 (R2) resistance level. Should the bears regain control over EUR/USD, we may see the pair breaking the 1.1990 (S1) support line and aim for the 1.1905 (S2) support level.

Looney reaches 3 ½ year high against the USD

The Canadian dollar reached a 3 ½ record high against the USD yesterday amidst the optimistic climate created from the US recovery data. It should be noted that oil prices tended to remain at relatively high levels, thus providing support for the Loonie, given that Canada is a major oil producing country. We expect CAD traders to focus on the release of Canada’s employment data for April and the rates and figures forecasted are quite gloomy. The unemployment rate is expected to rise and the employment change figure to drop significantly into the negatives and if forecasts are realized we may see the CAD weakening, unless a positive market feeling keeps it afloat. It should be noted that such rates and figures could moderate BoC’s optimism somewhat which may also weigh on the CAD.

USD/CAD reached new 3 ½ year record lows by testing the 1.2140 (S1) support line, which proved its worth. We tend to maintain a bearish outlook for the pair as the downward motion of the past two days has broken lower boundary of its past sideways movement, being the 1.2230 (R1) support line, now turned to resistance, yet today’s financial releases could alter the pair’s direction. Please note that the RSI indicator below our 4-hour chart is below the reading of 30, which may imply that the pair is oversold. Should the selling interest of the market be maintained we may see the USD breaking the 1.2140 (S1) support line and aim for the 1.2060 (S2) support level. On the other hand, should a correction higher be in play we may see the pair aiming if not breaking the 1.2230 (R1) resistance line.

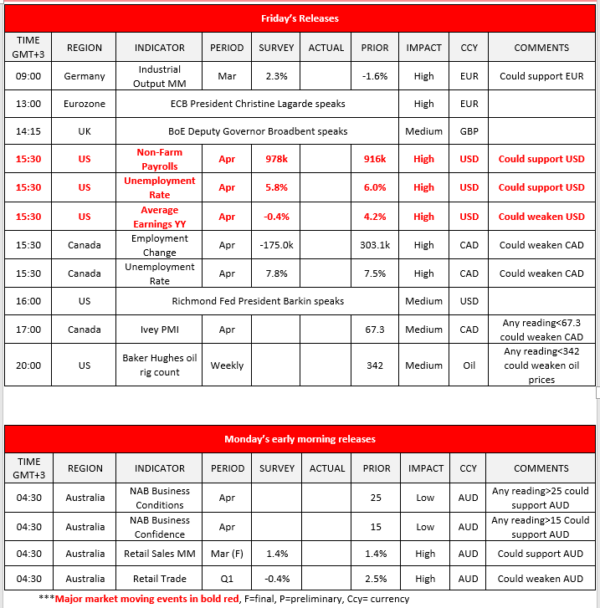

Other economic highlights today and the following Asian session:

Besides the US and Canadian employment market data for April, we would note also the final rate of Australia’s retail sales for March. On the monetary front, we would note that ECB President Lagarde, BoE Deputy Governor Broadbent and Richmond Fed President Barkin are scheduled to speak. Calendar follows

Support: 1.1990 (S1), 1.1905 (S2), 1.1820 (S3)

Resistance: 1.2100 (R1), 1.2175 (R2), 1.2275 (R3)

Support: 1.2140 (S1), 1.2060 (S2), 1.1995 (S3)

Resistance: 1.2230 (R1), 1.2315 (R2), 1.2400 (R3)