Summary

Despite sky-high readings from surveys of manufacturers, the hard factory data continue to come in short of expectations. Durable goods orders rose just 0.5% in March after a 0.9% dip in February. Yes, aircraft orders were largely to blame, but supply chain issues are holding back activity as well.

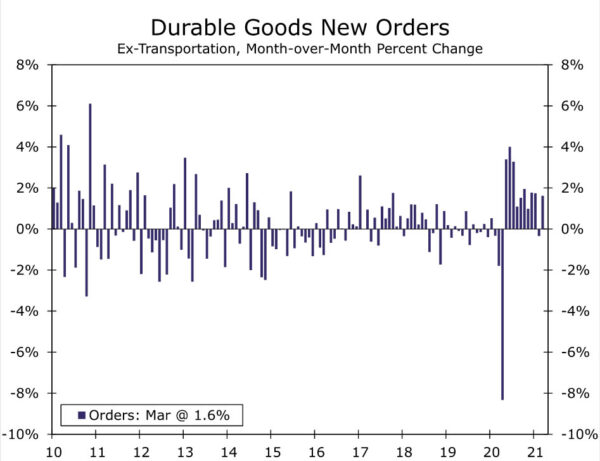

Ex-Transportation, Orders Held Up Reasonably Well

March data have generally been coming in well-ahead of expectations, but the latest durable goods report was more of a mixed bag. When it comes to capex in 2021, there is no shortage of corporate cash nor a lack of conviction among purchasing managers; there is, however, an ongoing supply chain problem and that is evident in the details of today’s report.

Durable goods orders rose just 0.5% in March which was well short of consensus expectations for a gain of 2.3%. The fact that February durable goods figures were revised to show a smaller decline than initially reported takes some, but not all, of the sting out of it. A drop in orders in categories not closely tied to near-term business spending, like aircraft as well as defense, account for much of the shortcomings.

Excluding transportation categories, durable goods orders was bang-on expectations for the month, up 1.6% in March and the initially reported 0.9% decline for this category last month was cut by two-thirds to a decline of just 0.3%. After accounting for revisions then, ex-transportation orders increased a bit more than expected.

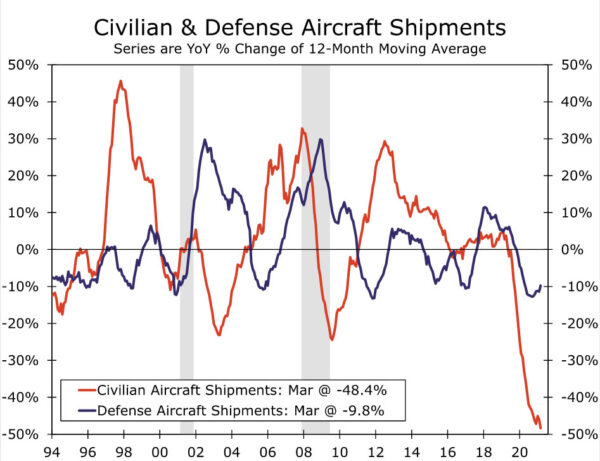

Low Base Effects to Support 2021 Aircraft Orders

Civilian aircraft orders tumbled 46.9% after more than doubling in February. Aircraft orders are notoriously choppy, but we would not be surprised to see things even more mercurial this year amid an industry dealing with substantial changes in demand, widespread supply chain issues and the return of production and deliveries for Boeing’s 737-MAX line. Despite these inevitable ups and downs, we look for this category to trend higher throughout the year and help lift overall orders, even though it was a drag in March.

Base effects will be less supportive for autos where spending was particularly strong last year. Motor vehicles still posted solid monthly gains for both orders (up 5.5%) and shipments (up 5.8%) in March. That said, the good times for the auto sector are poised to be interrupted by supply chain constraints. Both GM and Ford have announced temporary plant closures will extend into May amid shortages for microchips and other key input components. Between that and an expected transition to a consumer spending environment driven more by services than goods, the auto sector will have headwinds to overcome this year.

More Room to Run

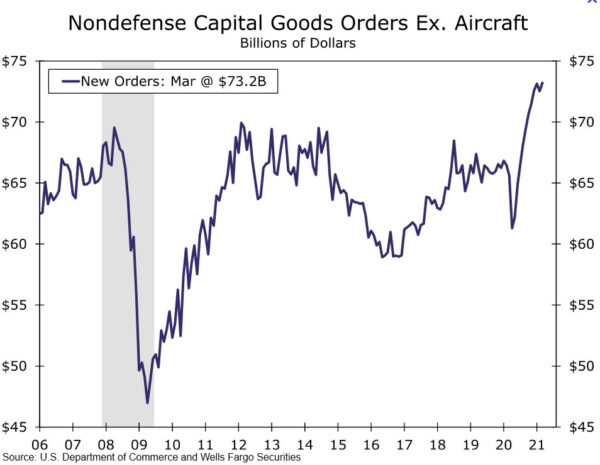

Excluding transportation, orders rose a solid 1.6% and suggest that the impressive run in household goods spending and business investment since COVID is far from over. However, strength in March looks to be more closely tied to robust demand from consumers as another round of direct checks from the federal government went out last month and retail sales soared. Core capital goods orders, which exclude aircraft and defense, rose “only” 0.9% in March, barely overcoming February’s drop. Yet that still puts core capex orders up an impressive 10.2% since February 2020. Equipment spending is expected to slow in Thursday’s Q1 GDP release, but with nondefense capital goods shipments bouncing back 1.9% in March, business investment is still on track to grow at a double-digit pace.

While the factory sector continues to contend with the unique growing pains caused by a global pandemic, the underlying momentum in manufacturing remains strong. Hiring picked up in March, with factories bringing on an additional 53K workers in a sign strength is expected to continue, and the early April purchasing manager indices have done just that. The new order indices in the New York, Philadelphia and Kansas City Fed manufacturing surveys rose to a 17-year high in April when averaged together.