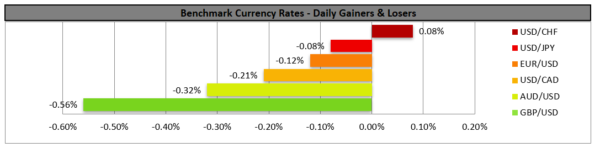

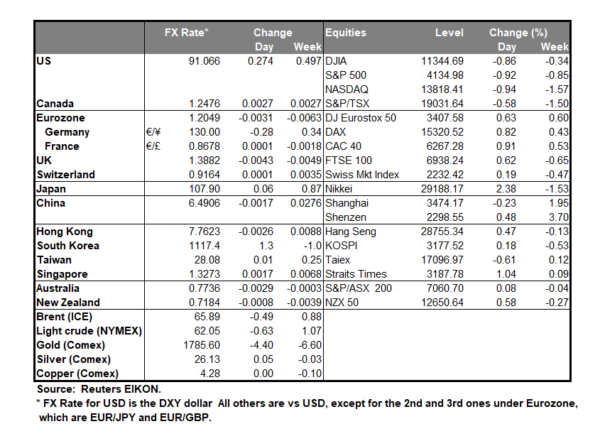

The USD maintained a largely sideways motion against a number of its counterparts yesterday, despite the better than expected weekly initial jobless claims figure, which may have indicated a tightening of the US employment market. On the other hand, the euro had losses against USD, JPY and CHF, but not the pound caused primarily by the ECB’s dovish stance as expressed by its President Christine Lagarde in her press conference. The ECB President underscored that rising coronavirus vaccination rates and an improving economic outlook are positive signals, yet implied that the tapering of its PEPP program was premature currently. We expect traders to day to focus on the preliminary release of the Markit PMIs for April, as the indicators could imply a differential in the expansion of economic activity in various economies, while EUR traders may also keep an eye out for Lagarde’s speech today. EUR/USD dropped yesterday testing the 1.1990 (S1) support line, yet the overall movement seems to have stabilised the pair’s price action. As the pair broke the upward trendline incepted since the 5th of April, we switch our bullish outlook in favour of a sideways movement for the time being. Currently the RSI indicator below our 4-hour chart seems to be running along the reading of 50, implying a rather indecisive market. Should the pair find fresh buying orders, we may see EUR/USD aiming if not breaking the 1.2100 (R1) resistance line, thus paving the way for the 1.2175 (R2) level. Should a selling interest be displayed by the market, we may see EUR/USD breaking the 1.1990 (S1) support line and start aiming for the 1.1905 (S2) support level.

Pound falls near the end of the week

The pound dropped against the USD, EUR and JPY yesterday practically erasing a substantial portion of the gains made in the week. Fundamentally the UK outlook is supported by an intense vaccination program and an early reopening of the economy as a result of it, which could provide a boost in economic activity, especially in the services sector, as UK’s HORECA sector opened. It should be noted that UK manufacturers’ expectations for a rebound of the economy rose substantially in April yet at the same time the CBI trends for orders indicator dropped for April instead of rising as expected. We expect pound traders to focus on the release of UK’s retail sales growth rate for March as well as the preliminary PMI figures for April especially for the services sector. GBP/USD dropped yesterday yet seems to have found support at the 1.3845 (S1) support line during today’s Asian session. We maintain our bias for a sideways movement for the time being, yet the bears may be just around the corner for the pair, given that RSI indicator below our 4-hour chart is between the reading of 50 and 30. Should the bears actually take charge of pair’s direction, we may see cable breaking the 1.3845 (S1) support line and aim for the 1.3700 (S2) support level which was able to resist the downward pressure by the pair on the 24th of March and the 12th of April . Should the bulls be in charge of GBP/USD’s direction on the other hand, we may see the pair aiming for the 1.3990 (R1) resistance line, which capped the pair’s upward movement on the 12th of March, the 18th of March and the 20th of April, overall proving its worth and drawing the notice of traders to it.

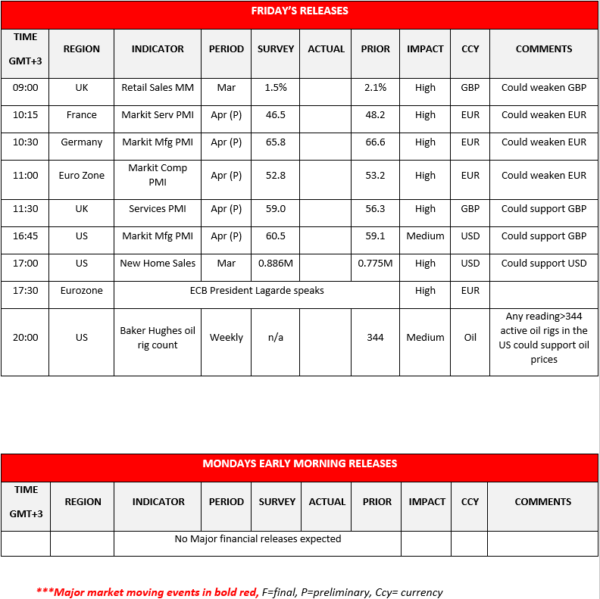

Other economic highlights today and early Tuesday:

Today during the European session, we note the release of UK’s retail sales growth rate for March as well as France’s, Germany’s, Eurozone’s and the UK’s preliminary PMI readings for April. In the American session, we get the US Preliminary PMI readings for April, the New Home sales figure for March, while oil traders may be more interested in the weekly US Baker Hughes oil rig count. On the monetary front, we highlight ECB President Christine Lagarde’s speech in the AS.

Support: 1.1990 (S1), 1.1905 (S2), 1.1830 (S3)

Resistance: 1.2100 (R1), 1.2175 (R2), 1.2280 (R3)

Support: 1.3845 (S1), 1.3700 (S2), 1.3565 (S3)

Resistance: 1.3990 (R1), 1.4145 (R2), 1.4275 (R3)