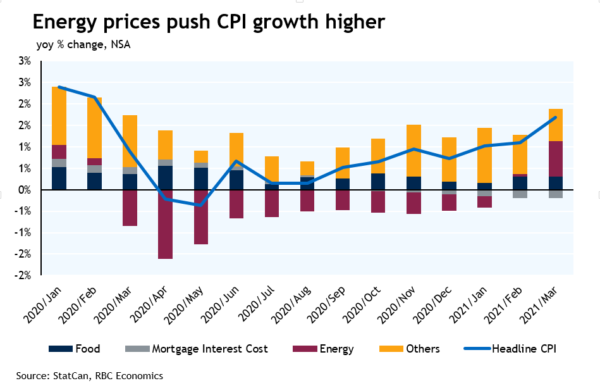

- Headline CPI jumped 2.2% year-over-year in March, on the back of slumping energy prices a year ago

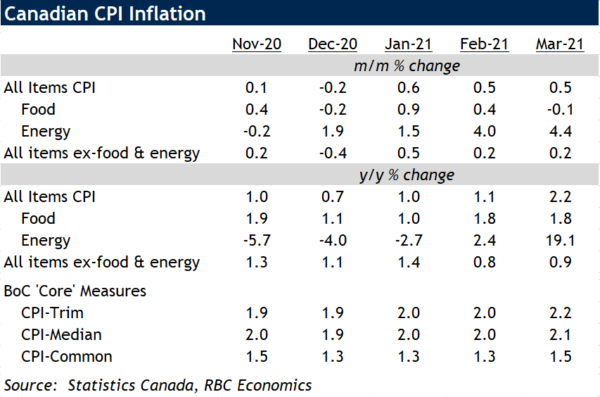

- Ex-food and energy products still soft at 0.9% but BoC preferred core measures edged higher

- Firming underlying price pressure to come with higher demand

As expected, headline CPI growth printed an eye-catching 2.2% increase year-over-year, driven by a rebound in the energy component (+19%). Oil prices in March of last year were exceptionally low as demand fell while production from key OPEC countries rose. Price growth for the shelter and transportation components both dialed higher in March as well, propped up by lower year-ago electricity, natural gas and gasoline comparables.

Food prices continued to grow at a pace close to 2%. Prices for household furnishings and equipment grew sharply again (+5.3% yoy) as consumers stayed closer to home. Homeowner replacement costs (the cost of a newly built home) also surged 7.3% from a year ago but mortgage payments fell 6.3% thanks to lower interest rates. Lessened demand also pushed prices for clothing and footwear much lower. Core CPI excluding food and energy components grew moderately, up 0.9% from year ago. Still, there are signs of underlying inflation pressure building, with over 50% of the goods and services in the CPI basket growing 2% or more in March.

Year-over-year CPI readings will continue to accelerate near-term because of exceptionally low oil prices in the spring a year ago. Monetary policymakers will look through that energy price volatility. More closely watched will be broader underlying inflation trends aside from energy prices. The supply side of the economy has been ringing the inflation bell as input prices increase. And a stronger-than-expected rebound in household spending may collide with capacity constraints to propel prices higher. We see that as a risk for later in 2021, contingent on the healthy reopening of the economy.