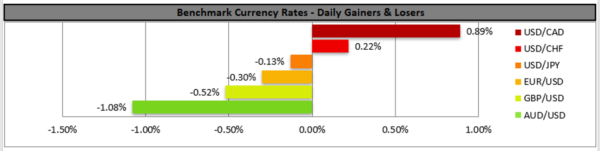

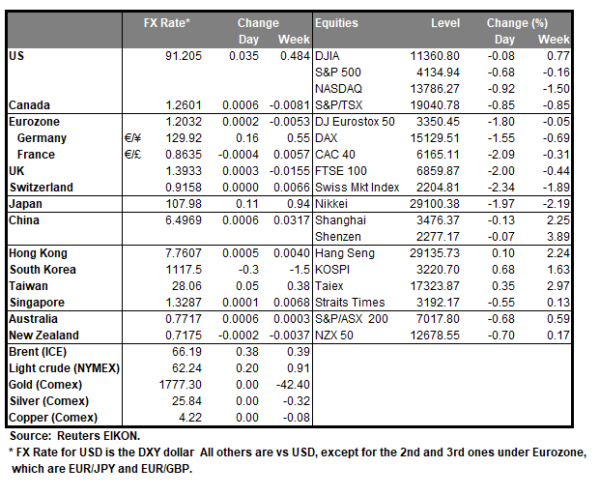

The USD tended to gain against most of its counterparts yesterday, enjoying some safe haven inflows as coronavirus cases seem to be on the rise in a number of countries, from India to Canada. It should be noted that the USD gained despite US yields edging lower yesterday amidst an overall downward tendency, a sign that the market may expect the Fed to tighten its monetary policy rather later than sooner. It’s characteristic how the uncertainty blurred the demand outlook for oil as well, thus weakening its prices, while major US equities indices also retreated yesterday. On the other hand, Gold’s prices undeterred by the strengthening of the USD, also tended to gain given the retreat of the US yields. Overall, we highlight the switch in the market’s mood, which could be viewed not only in the FX market, but in other markets as well. As a low number of high impact financial releases are scheduled today from the US, we expect fundamentals to play the key role in its direction and should the market’s cautiousness be maintained we may see the USD gaining.

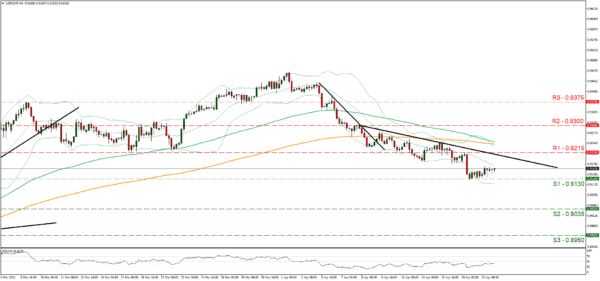

USD/CHF bounced on the 0.9130 (S1) support line yesterday yet gains of the USD seemed to be capped against safe haven CHF. Overall, we maintain a bearish outlook for the pair, as long as its price action remains below the downward trendline, which has eased it’s slope since the 8th of April. We note that the RSI indicator below our 4-hour chart remains between the readings of 50 and 30 once again reminding us of the presence of the bears. Should the bears actually maintain control over the pair’s direction, we may see USD/CHF breaking the 0.9130 (S1) support line and start aiming for the 0.9035 (S2) level. Should the bulls take over, we may see the pair breaking the prementioned downward trendline, the 0.9215 (R1) resistance line and aim for the 0.9300 (R2) resistance level.

BoC expected to remain on hold yet could taper bond buying

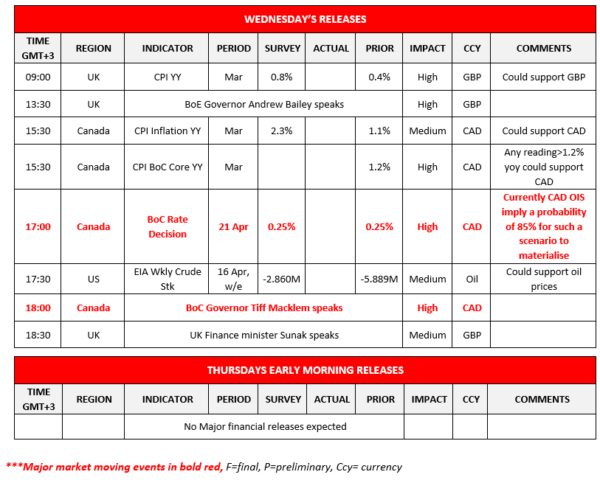

Today during the American session, we get from Canada BoC’s interest rate decision, and the bank is expected to remain on hold at 0.25%. It should be noted that CAD OIS imply a probability of almost 85% for such a scenario to materialize. The economy in Canada is recovering also quite fast, and it was indicative that March’s employment data outperformed market expectations widely. Also, the bank has to face a rise in the Canadian house prices, which tended to create substantial worries, that even BoC governor Tiff Macklem made some statements about the issue. On the other hand, the country is still facing a third wave of the pandemic which tends to create some uncertainty about Canada’s economic outlook. Overall, we could expect some cautiousness from the bank, yet at the same time, we must note that improved data could allow for some tightening of the bank’s monetary policy by tapering its bond purchases. Should the market’s optimism outweigh its cautiousness we may see the Loonie getting some support.

USD/CAD jumped yesterday breaking the 1.2520 (S1) resistance line, now turned to support and continued higher to test the 1.2610 (R1) resistance line, stabilising at that level during today’s Asian session. As the pair broke the downward trendline incepted since the 7th of April, we switch our bearish outlook in favour of a bias for a sideways motion, for the time being. Should buyers have the initiative over the pair’s direction, we may see USD/CAD breaking the 1.2610 (R1) resistance line and aim for the 1.2700 (R2) level. Should a selling interest be displayed by the market, we may see the pair breaking the 1.2520 (S1) support line and aim for the 1.2400 (S2) support level.

Other economic highlights today and early Tuesday:

Today during the European session, we note the release of UK’s inflation measures, for March, with special interest being on the headline CPI rate, while in the American session, besides BoC’s interest rate decision, we also get Canada’s CPI rates for March and from the US the EIA weekly crude oil inventories figure. Also please bear in mind that BoE Governor Andrew Bailey, BoC Governor Tiff Maclem and UK finance minister Rishi Sunak are scheduled to speak.

Support: 0.9130 (S1), 0.9035 (S2), 0.8950 (S3)

Resistance: 0.9215 (R1), 0.9300 (R2), 0.9375 (R3)

Support: 1.2520 (S1), 1.2400 (S2), 1.2315 (S3)

Resistance: 1.2610 (R1), 1.2700 (R2), 1.2765 (R3)