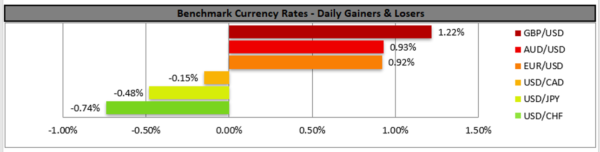

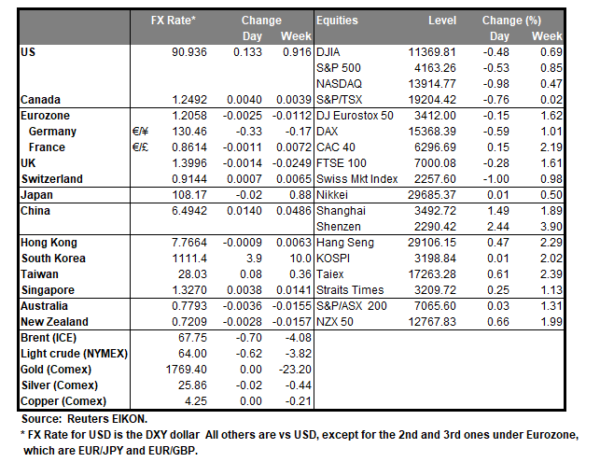

Yesterday the dollar retreated to lows last seen six weeks ago, practically at the beginning of April, against a basket of its counterparts. It should be noted that commodity currencies were supported by a positive market sentiment, while the common currency got substantial support on news improving its vaccination program. It should be noted that the USD had allready been losing traction, given that it has relented ground over the past two consecutive weeks. Analysts tend to note that gains made in first three month of the year are being reversed also due to the fact that US yields remain soft, despite a small rise yesterday in the 10 year US Treasury yield. We expect that fundamentals are to continue to direct market sentiment given also that there is a lack of high impact financial releases from the US today and should market optimism continue to guide it, we may see the USD retreating further.

AUD/USD was on the rise yesterday and despite some hesitation was able to break above the 0.7785 (S1) resistance line, now turned to support. We tend to maintain a bullish outlook for the pair as long as it continues to remain over the upward trendline incepted since Monday’s Asian session. Please note that the RSI indicator below our 4-hourt chart is between the readings of 50 and 70, reminding us of the presence of the bulls for the pair. Should the bulls actually maintain control over the pair’s direction, we may see AUD/USD, breaking the 0.7850 (R1) resistance line and aim for the 0.7905 (R2) resistance level. Should the bears take over, we would expect the pair to break the 0.7785 (S1) support line , the prementioned upward trendline and start aiming for the 0.7725 (S2) level.

GBP rises ahead of data heavy week

The pound kicked off the week by impressively gaining against the USD, EUR, JPY and CHF yesterday, as a number of high impact financial releases are expected to show how healthy UK’s economic recovery actually is. It should be noted that today we get data for the employment market in the UK, while also inflation rates, retail sales and April’s preliminary PMIs are to clear somewhat the fog regarding the progress made so far. On the fundamental side, a fast roll-out of vaccinations against COVID-19 in the whole country, lowering expectations for negative interest rates by BoE and the smoothening of Brexit seem to support the pound. Today we may see pound traders focusing on the release of UK’s employment data for February and should the rates and figures lay to rest some of the market worries, we may see the pound being allowed to advance further.

Cable rallied yesterday breaking consecutively the 1.3845 (S2) and the 1.3990 (S1) resistance lines, both now turned to support. As the pair’s upper boundary of its past sideways motion was broken, we switch our sideways bias in favour of a bullish outlook for the pair and we intend to keep it as long as the upward trendline formed since the 16th of April, continues to guide GBP/USD. On the other hand, it should be noted that the RSI indicator below our 4-hour chart has surpassed the reading of 70, confirming on the one hand the dominance of the bulls, yet on the on the other may imply that a correction lower for the pair is possible. Should the pair actually find fresh buying orders along its path, we may see cable aiming if not breaking the 1.4145 (R1) resistance level, which has not seen any price action since the 25th of February. Should a selling interest be displayed by the market, we may see GBP/USD breaking the 1.3990 (S1) support line, the prementioned upward trendline and start aiming for the 1.3845 (S2) support level.

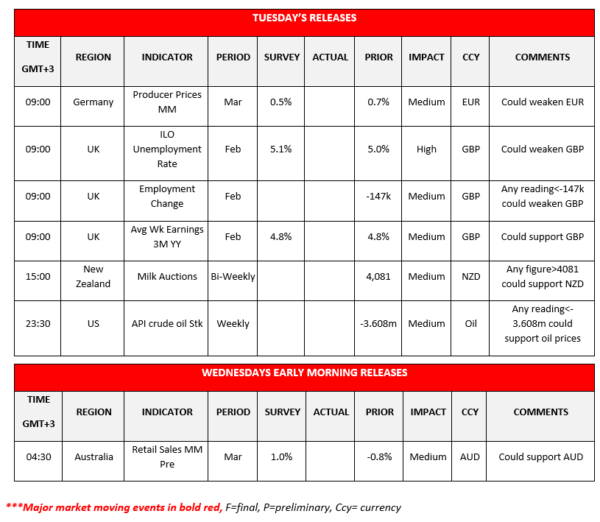

Other economic highlights today and early Tuesday:

Today during the European session, we get Germany producer prices growth rate for March, UK’s employment data for February as noted earlier, New Zealand’s Milk Auctions figures and just before Wednesday’s Asian session starts we get from the US the API weekly crude oil inventories figure for last week. During tomorrow’s Asian session we note Australia’s preliminary retail sales for March.

Support: 0.7785 (S1), 0.7725 (S2), 0.7665 (S3)

Resistance: 0.7850 (R1), 0.7905 (R2), 0.7945 (R3)

Support: 1.3990 (S1), 1.3845 (S2), 1.3700 (S3)

Resistance: 1.4145 (R1), 1.4275 (R2), 1.4390 (R3)