The Bank of Canada (BoC) will set its policy on Wednesday at 14:00 GMT, two days after Trudeau’s government tables its first budget in two years. Given earlier warnings, the central bank is expected to stick to its plan and scale down its bond program, although the economy is reliving the worst days of the pandemic. With the decision having already largely priced in, the loonie may need an extra hawkish message to resume its rally.

Bond tapering widely expected

Despite the rumors for a bond tampering announcement back in March, the BoC left its benchmark interest rate flat at 0.25% and the quantitative easing program steady at the pace of at least C$4 billion per week, acknowledging that monetary policy should remain accommodative until the best possible recovery is underway, and the central’s bank’s midpoint 2.0% inflation target is sustainably achieved. The rate statement expressed that transitory factors and base-year effects could drive the CPI inflation measure temporarily around the top of the range target of 1-3%, though downside pressure may persist until 2023 thanks to the virus uncertainty.

While the decision was perceived as somewhat dovish overall, the policy review left a hawkish taste too, saying that the economy is more resilient than initially thought, and if the recovery gains extra confidence, the pace of government bond purchases will adjust accordingly. The latter signalled that the scenario of bond tapering came back on the table following the cut to C$4 billion per week in October, but serious assurances were provided a few weeks later when the Deputy Governor Toni Gravelle mapped the easing process route during his speech before the CFA Society of Toronto. Particularly, Gravelle clearly disclosed that the bank will discontinue its repo operations in early May as “Canadians save more during the pandemic” while three other asset purchases programs (commercial paper, provincial and corporate bonds) will not be extended beyond their end dates. Besides that, and in a more important note, he admitted the weekly amount of government bond purchases, which account for more than 70% of total assets and represent a little over 35% of the fiscal debt—the highest when compared to the Fed, ECB and BoE—will be gradually dialled back with respect to the macroeconomic outlook and the durability of the recovery, pledging to reactivate some programs if market stress returns.

Economic data support the case of monetary tightening

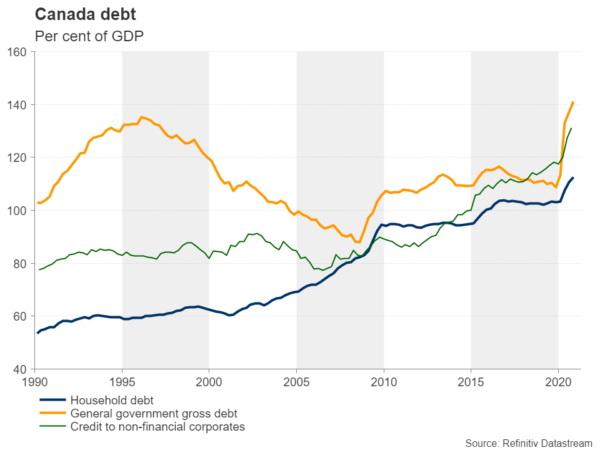

Indeed, the data continues to reflect improving economic conditions. The month of March was another positive blowout for the labor market, with the unemployment rate falling to the lowest since the pandemic hit. Moreover, business surveys kept trending higher comfortably within the expansion area and the central bank’s latest business outlook survey revealed a week ago that companies feel less uncertain about the future and more optimistic that demand will recover. The booming housing market is another sign that the economy is heating up and some policy tightening may be needed to balance the risks from the mounting household debt levels.

Therefore, a cut in the pace of bond purchases, currently largely estimated at C$1 billion to reach C$3 billion per week, could find sufficient backing among policymakers. Of course, such an action could be a controversial one at a time when a third wave of infections is developing in the country and a new four-week lockdown is depressing Ontario. However, with the inoculation program having quickened and Trudeau set to build up his political base with an ambitious fiscal spending of more than C$100 billion, which is expected to subsidize wages and new hiring, and finance new projects for the next three years, the central bank could find the opportunity to phase out some stimulus to fix its balance sheet. Analysts also expect another C$1 billion reduction to emerge in the rest of the year.

The process, however, would likely be “gradual and in measured steps”, as Gravelle underlined, in order to maintain a thick layer of stimulus under the economy and avoid any sharp deviation from other key central banks, which could consequently trigger another rally in bond yields.

Market reaction

As regards the market reaction, a cut in bond purchases seems to be largely priced in. Hence, the news may not significantly boost the loonie unless the central bank announces a larger reduction than analysts forecast. A hopeful view on the economy and a hawkish tone during the press conference coupled with stronger economic projections could be the ideal cocktail for the loonie, especially as the US dollar is melting.

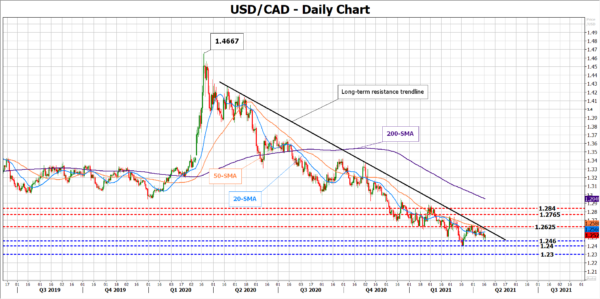

Looking at dollar/loonie the pair has been stuck below a heavy descending trendline for a year now. Perhaps a hawkish BoC could break the support within the 1.2460 – 1.2400 region and stretch the long-term downtrend to fresh lows around 1.2300.

In the negative scenario, if the Bank holds its policy the same and publishes more conservative economic projections, citing the uncertainty around the virus evolution, the pair may retest the tough resistance trendline within the 1.2560 – 1.2625 territory. Note that the 20- and 50-day simple moving averages (SMAs) have been cancelling upside corrections in the same neighbourhood. Beyond them, the next obstacle could be detected between 1.2765 and 1.2840.