The Reserve Bank of Australia meets on Tuesday for its policy meeting, with a decision expected at 05:30 GMT. No change in policy is anticipated at the April meeting despite a turbulent month for bond markets that prompted some heavy intervention by the central bank, wrong-footing some traders. But as the upward pressure on yields isn’t about to go away anytime soon, policymakers will probably want to reassert their commitment to keeping borrowing costs low. A dovish statement could land a further blow to the battered Australian dollar, which has been in a corrective mode versus the greenback over the last month.

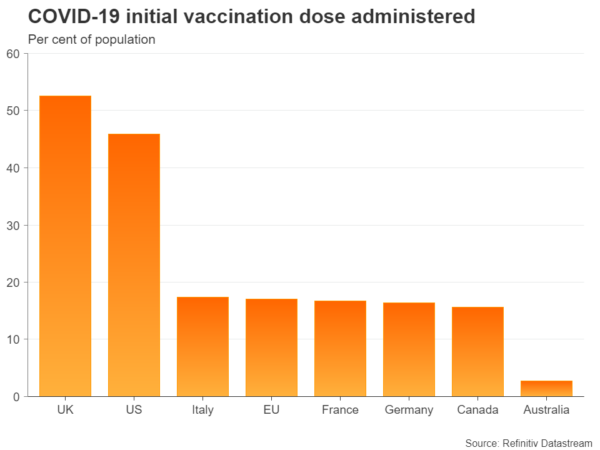

A slow start to vaccinations

Australia’s vaccine rollout has gotten off to a very slow start. It’s currently lagging the European Union and Canada in terms of Covid jabs administered per 100 people. Yet, investors are hugely optimistic about the county’s economic outlook. That’s because Australia’s success in keeping the virus under wraps from the onset of the pandemic has meant that lockdowns have been shorter in duration and its economy has remained largely open. Hence, you could say that the further relaxation of virus measures will probably be determined by how well other countries’ inoculation programmes go than its own before restrictions such as those on travel can be lifted.

Exports are booming

However, as far as the aussie rally is concerned, it was never about vaccines and everything about global trade. Exports to China – Australia’s biggest market – have soared to record levels in recent months, and combined with higher commodity prices and the overall positive signs for the global recovery, 2021 should be a bumper year for Australian miners and manufacturers. Add to the mix the upbeat stimulus and vaccine narrative that’s offered some certainty to the outlook and investors got a bit carried away in February and March by bringing forward the first post-pandemic rate hike to late 2022.

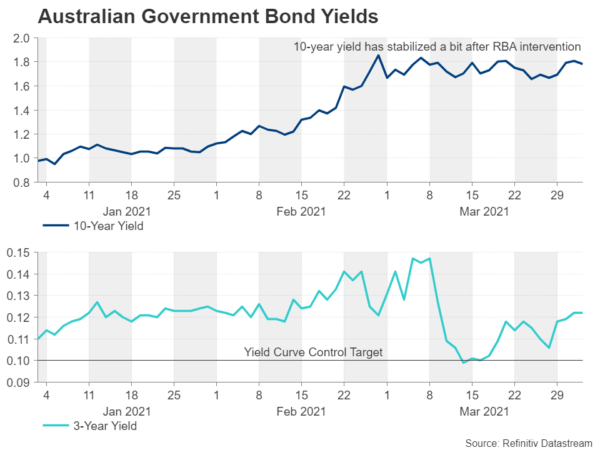

RBA’s commitment to QE is being tested

The RBA has set the cash rate (currently at 0.1%) as the target for the three-year yield on Australian government bonds (AGB) so the fact that markets think there will be a rate hike before 2024 implies traders are questioning the central bank’s commitment to its yield curve control policy. The RBA was tested again in early March when the global bond selloff accelerated. Both the three- and 10-year yields spiked higher before the RBA stepped in to contain the fallout.

Policymakers responded by not only doubling the amount of daily bond purchases but by also squeezing out short sellers – a move that caught traders by surprise but consequently succeeded in bringing the three-yield back down to the 0.1% target. But that’s not all. Governor Philip Lowe has followed up these actions by delivering some stern messages to the markets, first by signalling that the Bank’s A$200 billion bond purchase programme could be expanded further and then by hinting that the yield curve target may be moved from bonds with a maturity of April 2024 to new bonds maturating in November 2024.

Aussie under pressure

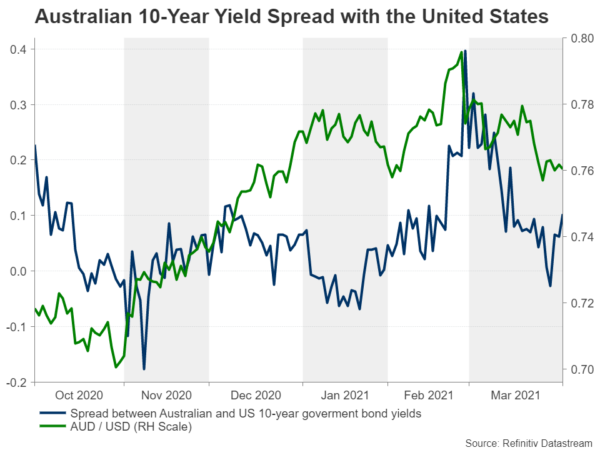

The RBA has also set a higher bar for meeting its inflation goal. It now wants to see actual inflation and not forecasted inflation reach its 2-3% target band sustainably before considering raising rates. All this has put quite a dampener on the Australian dollar as AGB yields have been steadier lately whereas US Treasury yields have continued to scale fresh highs.

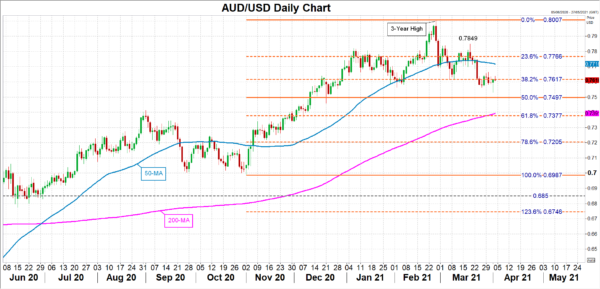

The narrowing spread between 10-year Australian and US yields has pulled the aussie below its 50-day moving average (MA) against the US dollar. It is currently hovering around the 38.2% Fibonacci retracement of the November 2020-February 2021 uptrend around $0.7617. Failure to hold within this support region could see the aussie slip towards the $0.75 level, which coincides with the 50% Fibonacci. Further down, the 61.8% Fibonacci at $0.7377, where the 200-day MA is converging, would be the next major target for the bears.

Another dovish statement

After the recent episodes, the RBA is unlikely to back away from its firm pledges to keep the three- and 10-year yields tamed so investors should not anticipate anything other than a dovish statement. At this point, the aussie’s best chance of restoring some bullish momentum is if the US Federal Reserve were to follow in the RBA’s footsteps and begin targeting the long end of the curve.

That probably won’t happen anytime soon, if at all. But should the yield spread widen again, the aussie’s immediate challenge on the upside would be to climb back above its 50-day MA, currently at $0.7718, before aiming for the March peak of $0.7849.