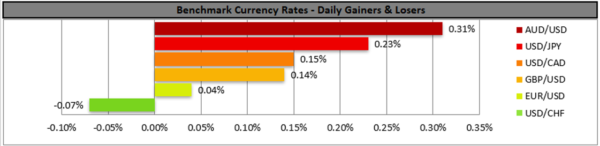

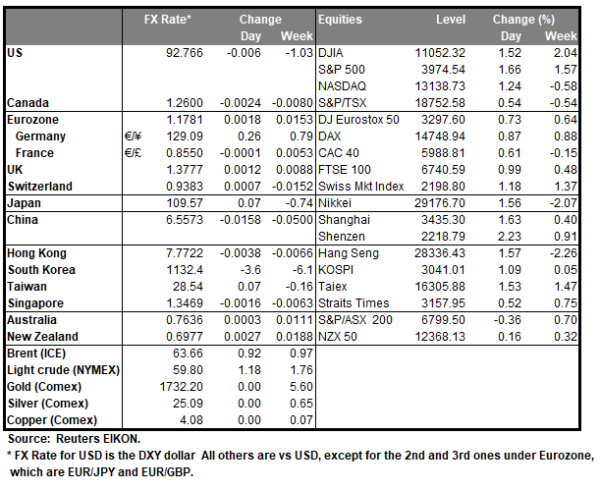

With little volatility on Friday and during today’s Asian session the USD maintained its position against a basket of currencies, while US stock markets tended to gain, characterizing a positive mood in the markets. A fast vaccination program along with solid financial data from the US tended to provide support for such an optimism in the US markets. It’s characteristic that despite consumption declining more than expected for February, optimism among consumers seems to prevail for March as University of Michigan consumer sentiment rose more than expected. We expect fundamentals to take the lead for the USD today given the lack of high impact financial releases from the US today.

EUR/USD stabilised somewhat after bouncing on the 1.1760 (S1) support line. As the stabilisation of the pair broke the downward trendline incepted since the 22nd-23rd of the month, we switch our bearish outlook in favour of a sideways movement until the pair decides the direction of its next leg. Yet we must note that the RSI indicator below our 4-hour chart is running along the reading of 30, reminding us of the presence of the bears Should the pair come under a selling pressure of the market, we may see it breaking the 1.1760 (S1) support line and aim for the 1.1695 (S2) level. Should EUR/USD find extensive buying orders along its path, we may see it breaking the 1.1830 (R1) resistance line, thus opening the way for the 1.1905 (R2) level.

AUD remains rather stable

The Aussie tended to remain rather stable against the USD on Friday and during today’s Asian session and despite initially gaining somewhat, later on a stabilisation followed. Fundamentally there were a few worries after authorities reportedly announced a snap 3-day lockdown in Brisbane yet also the tensions in the US-Sino and Australian-Sino relationships could be weighing on AUD. On the other hand, the positive market sentiment may be supporting the commodity currency, given the prospects for improved global trade. We expect fundamentals to maintain the initiative for yet financial data from Australia and China during the week could generate interest.

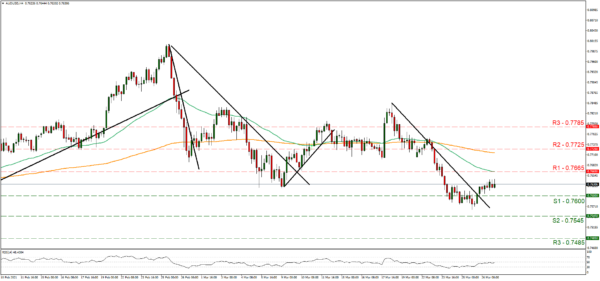

AUD/USD rose slightly during early Friday, yet remained rather stable until today, hovering between the 0.7665 (R1) resistance line and the 0.7600 (S1) support line. Given that the pair has also broken the downward trendline characterizing its movement since the 18th of the month, we switch our bearish outlook in favor of a sideways bias initially. Should the bears have the initiative, we may see the pair breaking the 0.7600 (S1) support line and aim for the 0.7545 (S2) support level. Should the bulls take over, we may see AUD/USD breaking the 0.7665 (R1) resistance line and aim for the 0.7725 (R2) resistance barrier.

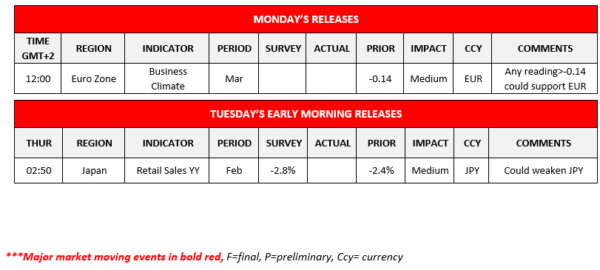

Other economic highlights today and early Tuesday:

On an easy Monday, during the European session, we note Eurozone’s business climate for March, while during tomorrow’s Asian session we get Japan the retail sales growth rate for February.

As for the rest of the week

On Tuesday, we get Eurozone’s economic sentiment, Germany’s preliminary HICP rates and the US consumer confidence, all for March. On Wednesday, we get Japan’s preliminary industrial output for February, Australia’s building approvals for February, China’s NBS manufacturing PMI for March, UK’s GDP rates for Q4, UK’s Nationwide house prices for March, France’s and Eurozone’s preliminary HICP rates for March as well as Canada’s GDP rates for January. On Thursday, we get Japan’s Tankan indicators for Q1, Japan’s Mfg PMI for March, Australia’s final retail sales growth rate for February, Australia’s trade data for February, China’s Caixin manufacturing PMI for March, Germany’s final manufacturing PMI for March, the weekly US initial jobless claims figure, Canada’s Markit manufacturing PMI for March and the US ISM manufacturing PMI for March. On Friday, we highlight the release of the US employment report for March with its NFP figure.

EUR/USD H4 Chart

Support: 1.1760 (S1), 1.1695 (S2), 1.1620 (S3)

Support: 1.1760 (S1), 1.1695 (S2), 1.1620 (S3)

Resistance: 1.1830 (R1), 1.1905 (R2), 1.1990 (R3)

Support: 0.7600 (S1), 0.7545 (S2), 0.7485 (S3)

Resistance: 0.7665 (R1), 0.7725 (R2), 0.7785 (R3)