- Mood brightens after Wall Street posts late rebound but risks from quarter-end flows

- Dollar slightly off highs, euro barely recovers as EU leaders clash over vaccines

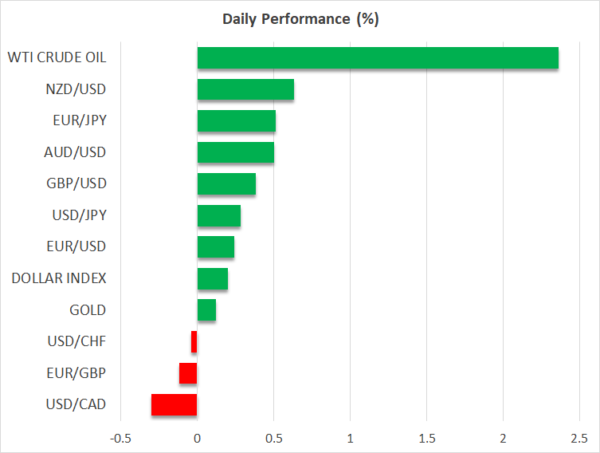

- Aussie and kiwi lead gainers, oil jumps again as Suez Canal blockage could last weeks

Stocks head higher as traders focus on US recovery

World stocks look set to end a turbulent week on a more positive note after upbeat news on the US economy fuelled a late rally on Wall Street on Thursday. The S&P 500 reversed an earlier 0.9% dip to close 0.5% higher. The Dow Jones rallied even harder to finish the day up by 0.6%, though the Nasdaq Composite could only manage to just about recoup its losses (+0.1%), highlighting some rotation out of tech stocks and into old economy stocks.

However, there’s a broader rotation equities need to worry about as quarter-end rebalancing by pensions funds could shift billions of dollars away from stocks and into bonds in the final days of March. The rebalancing may have already started, which would explain why bond yields have been edging lower all week, while stocks have been on the backfoot. Either way, more choppy trading is on the cards for the next few sessions.

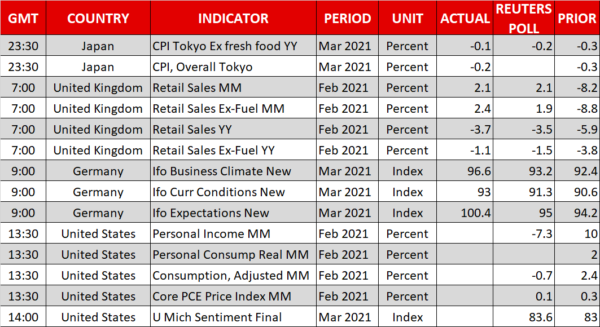

For now, however, equities are cheering America’s success on steering its economy out of the pandemic and launching a speedy vaccine rollout. US weekly jobless claims fell to 684k in the week ending March 20 – the first time they’ve fallen below 700k since the start of the pandemic. In the meantime, President Biden announced that he is doubling his administration’s goal of vaccinating 100 million Americans to 200 million in the first 100 days of his presidency, having met his original target sooner than expected.

European shares opened sharply higher following a strong session in Asia. However, while US stock futures were also in the green, they pointed to only modest gains of about 0.3% at today’s open.

Dollar holds near 4-month highs

The US dollar, meanwhile, remained supported even as it gave back some ground to risk-sensitive currencies. Its index against a basket of six currencies hovered around 92.75, having spiked to a 4-month peak of 92.92 yesterday. The greenback extended its gains versus the yen, hitting a 9½-month high of 109.48 earlier today, but was largely down against other majors.

Higher Treasury yields ensured that those losses were contained, however, as the robust drop in jobless claims brought forward the recovery timeline for the US economy, leading to a small sell-off in bonds. In fresh remarks yesterday, Fed Chair Powell said the central bank would only being withdrawing stimulus when the economy has “all but fully recovered”. But when all the indications are that a full recovery will probably happen sooner than most predictions, or at least, before other countries, it might be difficult to keep Treasury yields steady for much longer.

Euro claws higher after bruising week, aussie and kiwi bounce back

The European recovery in contrast pales against that of the US, as the continent has been hit by renewed lockdowns amid a third wave of the coronavirus. European Union leaders struggled to display unity at a tense virtual summit on Thursday but did agree to tighten the criteria for exporting EU-produced vaccines to outside of the bloc.

The move could further strain relations with former member, the United Kingdom, though both sides have said they want to achieve a “win-win” solution to the vaccine supply issues. Nevertheless, investors are optimistic Britain will be able to meet its target of vaccinating all adults by the end of July and the pound sought to extend its rebound against the dollar today, climbing to around $1.3780.

After three straight days of sharp losses, the euro is also on track for a positive close today and was last up at $1.1794.

But the biggest risers today were the Australian and New Zealand dollars, rebounding by about 0.5% after a bruising week that saw both currencies tumble against the mighty US dollar. The Canadian dollar also firmed, helped by higher oil prices.

Oil boosted from Suez Canal blockage

It’s looking like another volatile day in oil markets as the blockage of the Suez Canal doesn’t look like its going to end anytime soon. The salvage company working to free the massive container ship that got trapped in the canal has said it could take ‘weeks’ to clear it, raising fears of oil supply shortages as oil tankers are unable to pass through the route.

WTI futures were last trading 2.1% higher, while Brent futures were up about 1.9%, reversing more than half of yesterday’s losses.