The latest dispute between the EU and the UK over AstraZeneca vaccines is a blow to the post Brexit relationship of the two. Some analysts believe the EU is putting pressure on the UK after it failed to deliver the amount of vaccines initially agreed. In any case the matter remains of crucial importance for both as the cooperation between them is the only way out of the pandemic. Yet some believe a storm could surface in the following days. If the EU manages to keep more doses for its own population then some analysts see the EUR gaining against the USD and GBP. Today, GBP traders will be focusing on the release of the UK employment data for January coming out during the early London session. The unemployment rate is expected to increase from 5.1% to 5.2%. The employment change is expected to move deeper in the negatives while the Average Earnings figures are expected to improve. It all comes down to what direction the majority of the readings will go. Yet we believe the unemployment rate could have the first say as to the direction of the pound.

Cable continues to trade nearby the monthly low price that was reached from the 5th of March until the 9th. The levels we have noted in a possible move upwards for the currency pair is first the (R1) 1.3930 resistance barrier that was seen on the 19th while even higher the (R2) 1.4025 hurdle is also imminent. Please note the (R2) was attempted on the 4th of March but was not clearly reached. Yet the attempt was the highest price reached in March for Cable. At the top we have set the (R3) 1.4135 line as a possible target if the bullish run extends. In the opposite direction, the (S1) 1.3795 support level could be the first stop for the bears. Below that we have also set the (S2) 13690 barrier which is a level last seen in February while at the bottom we have set the (S3) 1.3570 support hurdle. The RSI indicator below our daily chart is running under the 50 level implying some bearish movement is currently in play. Overall the pair has been in a sideways movement between the (R2) 1.4025 resistance barrier and the (S1) 1.3795 support level during March. Thus we tend to views these levels as important for trading decisions.

Kiwi falls to three month low

The New Zealand dollar dropped to a three-month low against the USD in the latest sessions after housing affordability measures were announced. The Kiwi’s drop was a result of new introduced taxes on investment property sales announced by the government. This could be a measure to control risks of housing speculation. Some reports imply this could be a strategic move that will allow RBNZ to hold interest rates lower for longer with less risk of a property bubble. This could also be a clue that the bank will not hike anytime soon. The dovish sentiment seems to have overtaken traders at this point. Today in the late US session we get the New Zealand Trade Balance report which could be of great interest for traders especially after the latest price action.

The latest drop lower for NZD/USD has brought the currency pair closer to our (S1) 0.7040 support level. Please note this level has not been engaged since the 23rd of December. However, if the selloff is to continue then the next stop lower could be the (S2) 0.6980 barrier and even lower the (S3) 0.6915 hurdle that were both seen back in November 2020. On the contrary, if the currency pair to move higher and regain ground, then the (R1) 0.7160 line could be a target for the bulls. Above that the (R2) 0.7240 resistance level could be tested as was the case on the 17th and 18th of March. The highest level reached in March is the (R3) 0.7310 barrier. Yet during March the currency pair has been in a downward movement and with the latest drop this trend has been highlighted even more.

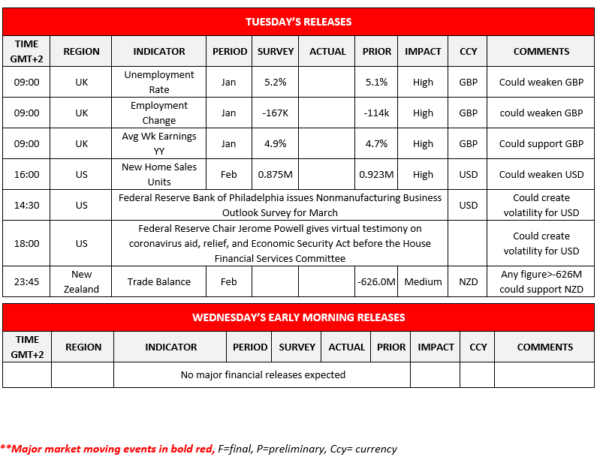

Other economic highlights today and early Tuesday:

In the European morning we get the UK employment data for January while in the afternoon we receive the US New Home Sales for February. In the late US session we receive the New Zealand Trade Balance report for February. As for speakers in the European afternoon we get Federal Reserve Bank of Phil. Non-manufacturing Outlook and later the Federal Reserve Chair Jerome Powell gives virtual testimony on coronavirus aid.

Support: 1.3795 (S1), 1.3690 (S2), 1.3570 (S3)

Resistance: 1.3930 (R1), 1.4025 (R2), 1.4135 (R3)

Support: 0.7040 (S1), 0.6980 (S2), 0.6915 (S3)

Resistance: 0.7160 (R1), 0.7240 (R2), 0.7310 (R3)