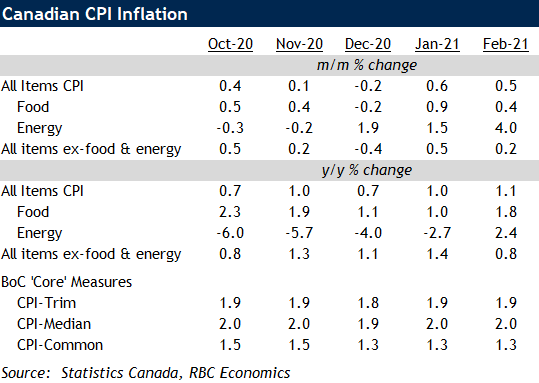

- Headline CPI growth still low at 1.1% year-over-year in February

- Year-over-year energy price growth to spike sharply higher in coming months thanks to very low year-ago spring oil prices

- Underlying inflation trends holding steady for now. BoC preferred core measures all held at or below 2.0% in February

Year-over-year energy price inflation shifted back into positive territory in February (+2.4%) for the first time in a year, and will jump sharply higher over March and April because oil prices have recovered after crashing lower last spring during the first virus wave and containment measures.

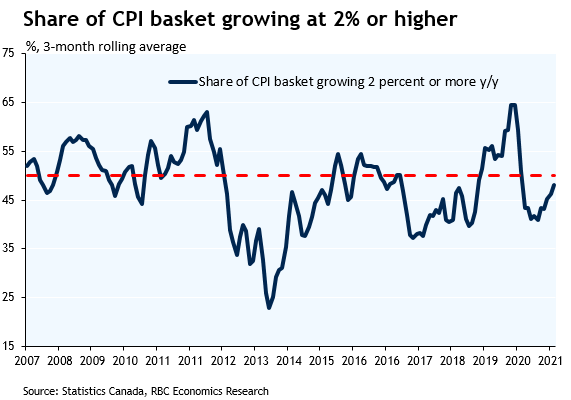

Outside of energy prices, current inflation trends have been less worrying. Food prices initially increased in the spring, but had cooled to a more manageable 1.8% above pre-shock levels in February (although that’s up from 1.0% in January). Prices of furniture and equipment, including household appliances, have spiked ~5% higher over the last year with households spending more on the comforts of home and home offices. But in all, just about half of the goods/services that make up the consumer price index basket have been growing at a 2% or higher rate year-over-year, compared to closer to 55% in 2019. Shelter costs have been running below 2% through the pandemic because even though house prices surged, for existing homeowners lower interest rates have sharply lowered mortgage interest costs and growth in rent prices has slowed.

Concerns around inflation are less about current trends and more about the potential for a surge in household spending as the economy reopens, potentially outpacing growth in supply, particularly of hospitality services. An initial energy-driven spike higher in headline CPI growth over the spring will largely reflect energy price volatility and will fade into the end of the year. Underlying trends in inflation outside of the energy component will be watched more closely for signs that price growth is firming. Our forecast assumes core price growth will increase into 2022 but will remain relatively closely anchored to the Bank of Canada’s 2% inflation target.