- Yields fall back as selloff in government bonds cools, but is the panic over?

- Stocks get off to firm start as vaccine and stimulus hopes still at play

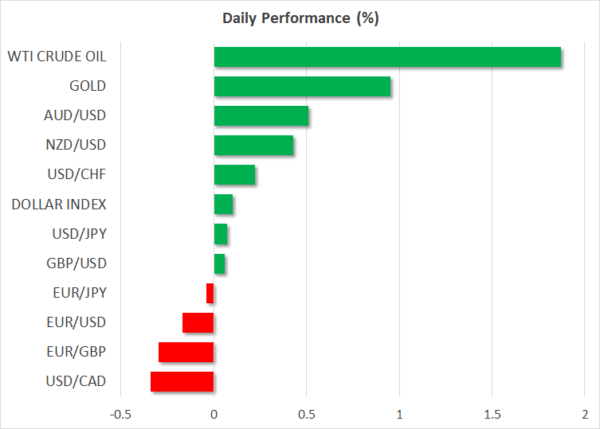

- Risky currencies pare losses as dollar recedes from highs, gold bounces off lows

Calm returns to bond markets, but maybe not for long

Long-dated Treasury yields started the new month well off their one-year highs from last week as a bit of calm was restored in battered bond markets. The 10-year yield was hovering around 1.40%, having spiked to 1.6140% on Thursday. European, Australian and Japanese 10-year yields were also sharply lower on Monday.

However, with central banks such as the Federal Reserve and Bank of England insinuating that the steepening of the yield curve is a ‘healthy’ thing, and only the Reserve Bank of Australia so far openly intervening to put a cap on the surge, it’s probably too soon to interpret this pullback as a permanent move.

After all, optimism about the global recovery is still running high with vaccinations speeding up and more stimulus on the way. The United States approved its third vaccine over the weekend, giving the go-ahead to Johnson & Johnson’s single-dose jab, while President Biden’s $1.9 trillion relief package passed a key hurdle after the House of Representatives approved the bill. In Britain, Chancellor Rishi Sunak is due to unveil more support for the economy in his Spring Budget on Wednesday as the country crosses the 20 million milestone of the number of people who have been vaccinated.

With the outlook for the second half of 2021 continuing to improve and the threat of higher inflation lurking in the background, the tantrum in bond markets could easily get worse, eventually forcing the Fed to step in. But we’re not there yet, and for now, the pause in the selloff has given way to some risk-on trades.

Stocks and gold attempt a rebound

The positive sentiment and the dip in long-term borrowing costs lifted equities globally with the Nikkei 225 closing 2.4% up on the day in Tokyo and London’s FTSE 100 surging by 1.9% in European trade. Futures for Wall Street’s leading share indices were pointing to more than 1% gains at the US open, with the Nasdaq Composite set to enjoy the biggest rise, having already bucked the trend on Friday to begin its recovery from the rout in tech stocks.

Gold, meanwhile, sought to extend its bizarre positive correlation with stocks, climbing higher on Monday after a similarly devastating week. The jump in global sovereign bond yields pushed the spot price in the non-yielding bullion to an 8-month low of $1,716.85/oz on Friday. The precious metal was last trading about 0.9% higher, though with losses for the year running at 7%, it will be hard to reverse the bearish trend in the bigger picture without a very significant pullback in bond yields.

Aussie and loonie bounce back, but euro slips again

The US dollar started the week on a negative footing, but its index was back in positive territory before long as Treasury yields edged up from their lows. The euro slid for a second day to hit 1½-week lows, unable to draw any strength from the improved risk tone as the single currency is looking increasingly isolated among its peers, which are being supported by stronger fundamentals.

However, the euro was not alone on Monday as sterling also struggled a bit. After rebounding solidly earlier in the day, the pound fell back when it failed to break the $1.40 resistance.

The Australian dollar outperformed its rivals, advancing by about 0.35%, though this was only a fraction of the near 4% drop it endured last week from its 3-year top of $0.8007. The RBA is due to announce its latest policy decision early on Tuesday, with any language around the recent volatility in bond markets potentially jolting the aussie.

The loonie the was next best performer, rebounding by about 0.3% versus the greenback as oil prices headed back up again. Oil prices fell only modestly during last week’s turmoil, underlining the ongoing optimism for the growth outlook. However, there could be a setback later in the week if OPEC and its allies decide to raise output when they meet on Thursday.