- Carnage in bonds sends US yields flying, equities in a world of pain

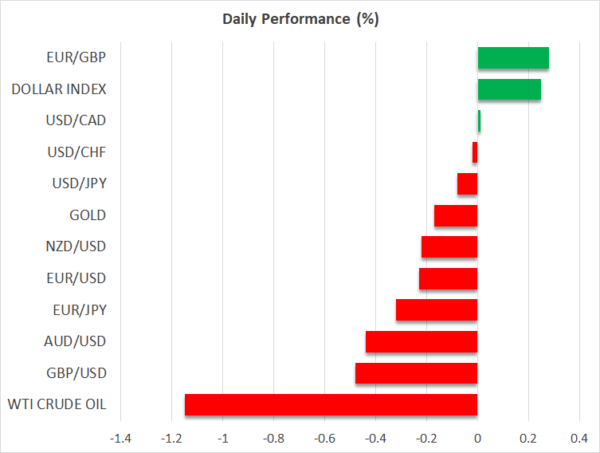

- Dollar comes back from the dead, commodity FX and pound lose altitude

- Just a disastrous bond auction or a harbinger of bigger moves?

Near-disaster in bonds infects everything else

What started out as a relatively calm session evolved into a near-apocalypse in the bond market on Thursday, sending shockwaves across every other asset class. Investors are dumping government bonds at a stunning pace, pushing the yields on those bonds higher and in turn making stocks less attractive as the opportunity cost of holding them increases.

The S&P 500 fell by almost 2.5% while the Nasdaq suffered a 3.5% drop. Leveraged investors losing money on bonds may also be forced to liquidate some of their stock holdings to cover margin calls.

Why have bonds suddenly become radioactive? There is no single concrete explanation behind this selloff, but there are a few potential ones. In the short-term, a disastrous 7-year US bond auction yesterday likely left some primary dealers holding securities they didn’t want, which they immediately dumped on the market, sending yields in the middle of the curve flying.

In the bigger picture, it probably comes down to investors bringing forward the timeline of Fed rate hikes, despite what policymakers have been saying lately. The spike in yields might have started as a reflection of a stronger economy and supermassive federal deficits, but it evolved into speculation that the Fed might tighten policy sooner, with momentum-chasing strategies likely adding fuel to the entire move.

Self-correcting mechanism?

On the plus side, there are reasons to be optimistic this episode won’t spiral out of control. The first is the Fed itself. Several officials stated yesterday they are ‘not worried’ about the latest spike in yields, but that tune could change soon.

Simply put, the speed of the spike is threatening. It’s one thing for yields to rise over several months, but it’s another story when this repricing happens in a few days – it threatens financial stability in a highly leveraged world. Perhaps more importantly, real rates have risen very sharply as inflation expectations have retreated as well, which is a red flag for central banks.

There might also be a self-correcting market mechanism at play. If bond yields continue to soar and stock markets are devastated as a result, there will come a point where investors are willing to buy bonds again just for their safety, pushing yields back down and calming markets overall. In other words, either central banks will step in soon or the market pain will become so excruciating that bonds will calm themselves down.

Beyond all this, it’s crucial to note that for all the panic in the stock market, the Nasdaq is merely back to unchanged levels for the year, while the S&P 500 is still positive. That is quite encouraging considering the seismic moves in yields.

Dollar rebounds, gold can’t catch a break

The ripple effects were naturally felt in the FX arena as well. The dollar came back to life as risk aversion deepened, mostly to the detriment of the commodity currencies and sterling, which have been trading like rocket ships lately.

The yen also reclaimed some lost ground, mostly against the ‘risk currencies’ like the pound and aussie. The Japanese currency has been on the retreat overall in recent weeks thanks to the Bank of Japan’s yield curve control strategy, which keeps a ceiling on Japanese yields.

Gold has been another fatality of the yield rally. Rising real rates and a recovering dollar are a bane for bullion, which pays no interest to hold and is denominated in dollars. There is a solid argument for gold as an inflation hedge, but the market is not buying into that so far. If the $1760 support territory doesn’t hold, the yellow metal could be in real trouble.

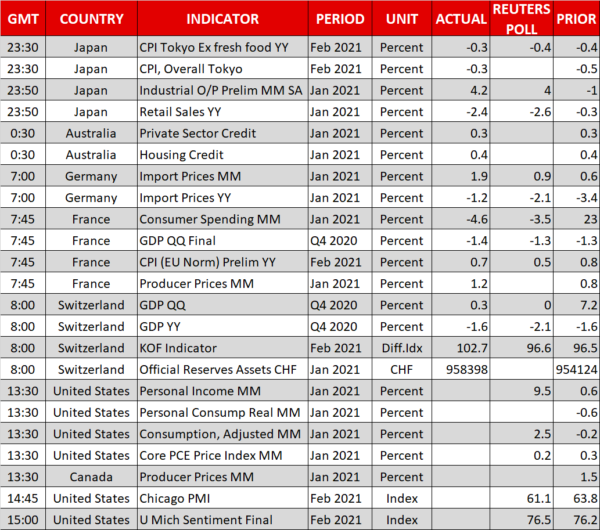

As for today, all eyes will be on the US core PCE data. An unexpected acceleration in inflation is the last thing markets need right now.