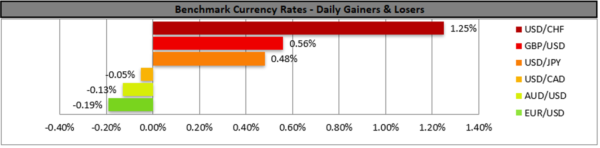

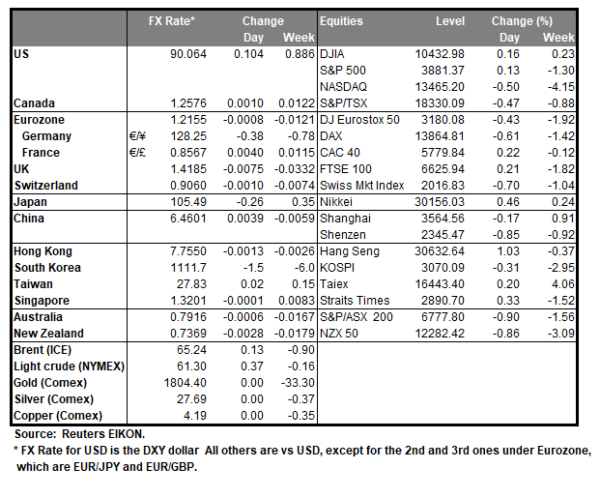

The USD gained against safe haven CHF and JPY and tended to lose ground against commodity currencies AUD and CAD and the riskier GBP. It should be noted that Fed Chairman Jerome Powell yesterday repeated before the Senate in his testimony that rates are to remain low and that the Fed will continue to buy bonds to support the US economy, maintaining a rather dovish stance as was expected. At the same time the Fed’s Chairman refuted claims that a loose monetary policy by the bank could lead to an overheating economy, with inflation running out of control and financial bubbles, easing market worries somewhat about these two issues. The last comment tended to provide support for the US stockmarkets, which recovered some ground in the latter half of yesterday’s session yet were unable to recover all of the losses made. Overall, we tend to see the markets switching to a more risk on sentiment and fundamentals could be taking the lead, yet Powell’s second testimony should not be underestimated, as well as other Fed officials scheduled to speak.

USD/CHF rallied yesterday, breaking the 0.9010 (S1) resistance line, now turned to support and aiming for the 0.9090 (R1) resistance level. We maintain our bullish outlook given that the pair’s price action remains above the upward trendline incepted since the 16th of January. On the other hand we have to note that the RSI indicator below our 4-hour chart has breached the levels of 70 to the upward, confirming the bulls dominance yet at the same time may imply that the pair is overbought. Also the price action has broken the upper boundary of the Bollinger bands hence a correction lower could be possible. Please note that the pair is currently trading at the highest level since the 1st of December last year. Should the bulls maintain control over the pair, we may see it breaking the 0.9090 (R1) resistance level, aiming for a the 0.9190 (R2) resistance line. Should the bears be in charge, we may see the pair breaking the 0.9010 (S1) support line and aim for the 0.8935 (S2) level.

Aussie stabilises at high levels

The Aussie seems to be stabilizing near an almost three year high against the USD, as the market mood tends to support the commodity currency. It should be noted that iron ore prices are still at high levels, despite a slight retreat yesterday, while copper prices are still rising, both supporting the AUD in the near term, as they imply increased demand. At the same time the Australian yields tend to remain at rather high levels, which tends to increase the attractiveness of the Australian currency. Also, we note that Australia’s wage price index for Q4 outperformed market expectations, increasing possibly inflationary pressures. We may see the AUD getting some support should the market sentiment be more risk on, yet AUD traders could also eye the capital expenditure rate growth rate for Q4, due out during tomorrow’s Asian session.

AUD/USD aimed for the 0.7950 (R1) resistance line yesterday yet failed to reach it, retreating lower. Overall, we maintain a bullish outlook given the upward trendline incepted since the 8th of February, but we cannot pass unnoticed the stabilisation occurring in the past two days between the 0.7950 (R1) and the 0.7875 (S1) levels. Should the pair find fresh buying orders along its path, we may see it breaking the 0.7950 (R1) resistance line and aim for the 0.8030 (R2) level. Should the market display a selling interest we may see the pair breaking the 0.7875 (S1) support line and aim for the 0.7785 (S2) level.

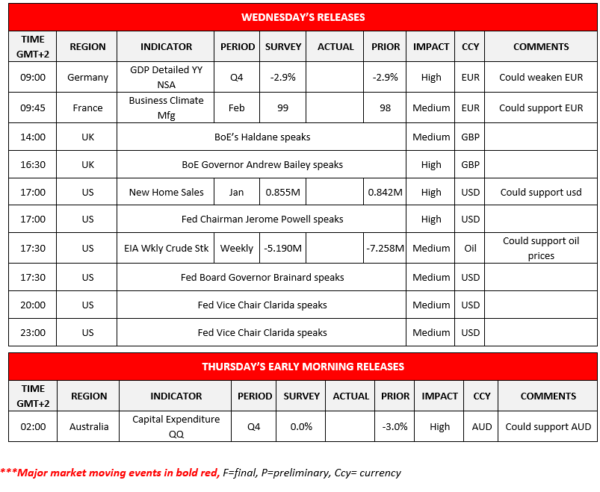

Other economic highlights today and early Tuesday:

During today’s European session, we note Germany’s Detailed GDP rate for Q4 and France’s business climate for February. In the American session, we note the release of the US new home sales for January and the EIA crude oil inventories figure for the past week. During tomorrow’s Asian session, we get Australia’s capital expenditure growth rate for Q4. As for speakers we note BoE Governor Andrew Bailey and BoE’s chief economist Andy Haldane are scheduled to speak, while Fed Chairman Powell testifies before the House, and Fed Board Governor Brainard, Fed Vice Chair Clarida speak.

Support: 0.9010 (S1), 0.8935 (S2), 0.8855 (S3)

Resistance: 0.9090 (R1), 0.9190 (R2), 0.9300 (R3)

Support: 0.7875 (S1), 0.7785 (S2), 0.7725 (S3)

Resistance: 0.7950 (R1), 0.8030 (R2),0.8120 (R3)