The Reserve Bank of New Zealand will hold its first policy meeting of the year on Wednesday, with an announcement expected at 01:00 GMT, followed by Governor Orr’s press conference at 2:00 GMT. While other central banks have been keen to stress that they are nowhere near thinking about scaling back some of the unprecedented stimulus they’ve unleashed during the pandemic, the RBNZ was the first to formally tone down its dovish aspirations slightly back in November. Since then, economic data have only gotten better, yet the firmer US dollar is keeping a lid on the kiwi’s gains. So will policymakers attempt to walk a fine line or will they admit that negative rates are no longer on the table?

Lockdowns – the New Zealand way

New Zealand’s largest city – Auckland – has been in and out of lockdown since the pandemic struck last year. The latest, which lasted just a few days, was only lifted on Wednesday. However, it is this snap decision-making of Jacinda Ardern’s government, combined with strict travel restrictions and effective contact tracing, that has helped the country stave off prolonged shutdowns like Europe. Add to that, the stronger recovery in New Zealand’s closest trading partners in Asia (particularly China), the domestic economy has been defying gloomy predictions since the autumn.

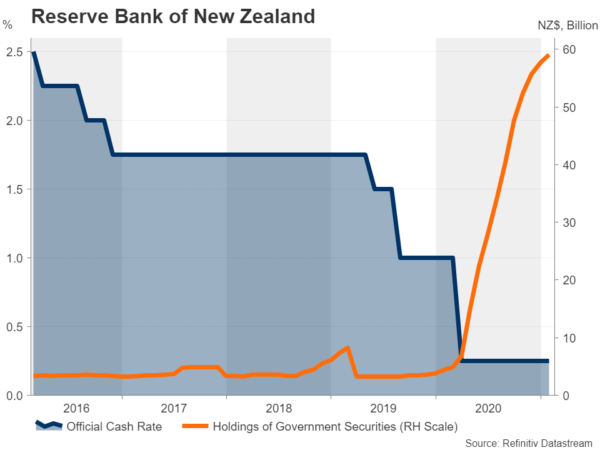

The faster-than-expected turnaround has taken the RBNZ by surprise, acknowledging in the November meeting that the economy “has proved more resilient than earlier assumed”. The bank nevertheless pressed ahead with the launch of its Funding for Lending Programme (FLP), and together with its asset purchase programme, which has been expanded twice, the combined policies will probably be sufficient in negating the devastating effects of the pandemic on the economy.

The RBNZ’s housing dilemma

However, even if the RBNZ is quite possibly done with further easing, its job isn’t about to get any less difficult. Primarily because policymakers will not want to give the impression that there’s no prospect of additional stimulus out of fear of boosting the exchange rate. Hence, communication will be key going forward.

But sending the right signals could be quite challenging as it will be hard to convince investors that the bank is maintaining an easing bias when the housing market is running hot. Record low interest rates have fuelled a property boom, raising house price inflation to the double digits. Although the RBNZ announced a number of tighter lending rules for mortgages earlier this month, these may not be enough to cool the housing market if the official cash rate is stuck at a record low of 0.25% for too long.

Striking the right balance

Another potential pitfall policymakers will want to avoid is sounding too optimistic when they publish their updated forecasts in the quarterly Monetary Policy Report on the day of the meeting. Fourth quarter data on the labour market and inflation were sharply stronger than anticipated and New Zealand was one of the few major economies that grew fast enough in Q3 to recoup all of the lost output from the initial virus slump.

That’s not to say that all is well. Credit card data indicate consumer spending fell back in January. Official numbers on Q4 retail sales are due on Tuesday and these should also shed some light on where consumption was headed at the end of 2020. Furthermore, given the nature of the coronavirus, future outbreaks cannot be ruled out. Thus, the outlook is far from certain.

However, compared to other advanced nations, there can be no doubt that New Zealand is doing a much better job in keeping the virus at bay and in turn, the economy open. As the global vaccination campaign gathers pace and the ensuing optimism pushes commodity prices higher, the RBNZ may well become the first of the big central banks to hike rates.

Kiwi will be sensitive to any change in tune

Negative rates have already been priced out of futures markets and if the RBNZ does not play its cards right, investors may next turn their attention on when the first interest rate hike will arrive. Such speculation could be what it takes to refuel the New Zealand dollar’s rally.

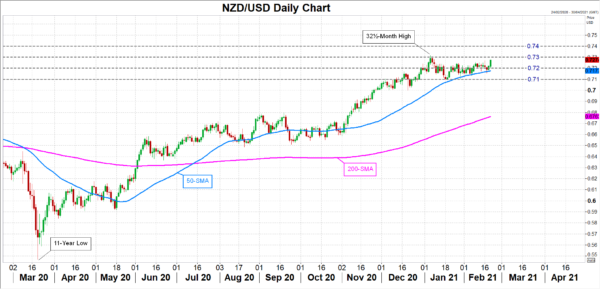

After a strong rebound from the March 2020 lows, kiwi/dollar lost momentum in 2021, trading sideways since January as dollar bulls staged a comeback. The pair is currently being propped up by its 50-day moving average (MA) around $0.7172. Should Governor Adrian Orr strike a dovish enough tone on Wednesday and there are no positive surprises in the policy statement, kiwi/dollar could slip below the 50-day MA to head towards the $0.71 support.

However, if the RBNZ revises up its forecasts and further dampens expectations of more easing, kiwi/dollar could advance further above the 50-day MA to retest the January top of $0.7314 – a 32½-month high. Surpassing this peak would bring the $0.74 level into range.