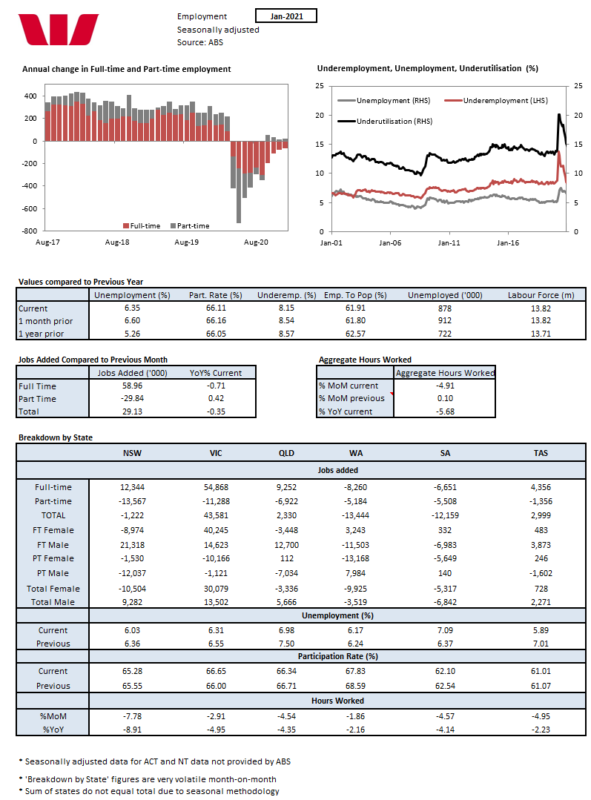

January 2021 Labour Force: Total employment: 29.1k from 50k (unrevised from 50k). Unemployment rate: 6.4% from 6.6% (unrevised 6.6%). Participation rate: 66.1% from 66.2% (unrevised 66.2%).

- The labour market continues its sharp V-shaped recovery which has been much stronger than anticipated.

- Total employment has recovered 813.6k, or 6.7%, from the May low to be just 58.5k or 0.5% below the pre-COVID level.

- The improvement in unemployment has not been as solid with a 6.4% print it is still 1.1ppt higher than it was in March. This would be due to a solid participation rate which at 66.1% is just 0.5ppt below where it was in March and thus has not fully offset the gap in employment.

- At 8.1% under-employment is 0.7ppt lower that it was in March, a surprisingly strong outcome given the dominance of part-time employment in the current recovery.

- In January there was a reversal of this trend with a 59.0k gain in full-time employment vs a -29.8k fall in part-time employment. Interestingly hours worked fell -4.9% (employment rose 0.2%) suggesting that the softness we’ve seen in payrolls was more reflected in hours worked than employment but we have to be careful as hours worked is very volatile month to month.

- Nevertheless, the Northern Beachers lockdown would have had its greatest impact in January and it appears that firms responded with hours, rather than jobs, especially given all the employment gains were full-time. Those working zero hours due to annual leave, flexi time etc gained 104% seasonally adjusted in January. In January 2020 this group lifted 16%.

- Those working zero hours for economic reasons fell further 11% to 75.8k. This group peaked at 770k last April.

- Most of the employment gains can be accredited to Victoria (+43.6k +54.9k full-time/-11.3k part-time) while employment contracted in NSW (-1.2k +12.3k full-time/-13.6k part-time).

- The recovery shifted back to Victoria in early 2021 but this was before the February Melbourne lockdown but as this occurred later in the month it is likely to appear in the March survey rather than the February survey.

- The current momentum is looking good for our assumption that it will provide an offset to the ending of the JobKeeper package in March.