The preliminary PMIs for February will be watched out of the Eurozone on Friday (09:00 GMT) as much of Europe remains under tight lockdown. There was a slight relaxation of Covid rules in some countries in February, and this is expected to have led to a modest pickup in business activity. However, without a clear timeline of when the most stringent restrictions will be lifted in Europe’s biggest economies, the euro will likely stay stuck in a consolidation pattern against its US counterpart.

Europe and Covid: What went wrong?

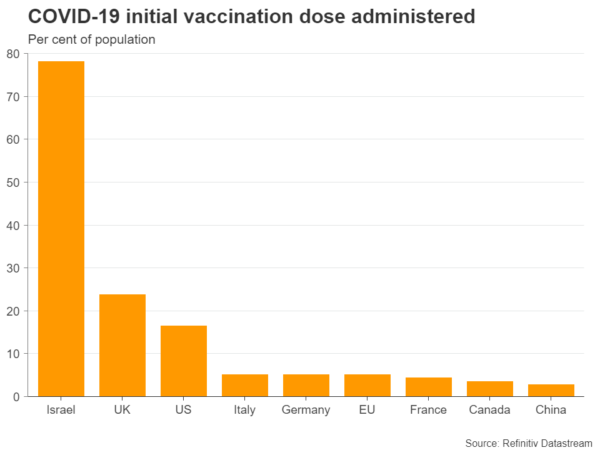

When the euro first began to appreciate against the dollar in the summer of 2020, positive sentiment was running high for the Eurozone economy. After all, virus cases were dropping sharply, lockdowns were being eased and stimulus was flooding in through both monetary and fiscal gates. A year after the pandemic struck the continent, infections have resurged, many businesses have been shuttered again and the €750 billion recovery fund that was targeted for the first wave will only begin to be disbursed to member states by the middle of this year. To top it all up, the European Commission, which is responsible for overseeing the bloc’s vaccination programme, has been accused by national governments of botching the vaccine rollout.

It should come as no surprise therefore as to why the euro has been hit the hardest by the dollar’s revival this year, as investors have had to reassess the relative performance of the Eurozone and US economies over the coming months. The outlook could still improve quite dramatically for the second half of 2021 as the EU is stepping up its investments in vaccines and the better late than never recovery package should provide substantial assistance to the worst virus-stricken economies.

Waiting for the elusive end to lockdowns

For now, though, it’s hard to ignore America outrunning Europe at every turn, whether it’s the billions of dollars of more stimulus, the faster immunization pace or stronger resilience to the pandemic downturn. Hence, until investors start to see real progress in the vaccine rollout and there is an exit strategy from the crippling lockdowns, it will be difficult for the single currency to regain its positive footing.

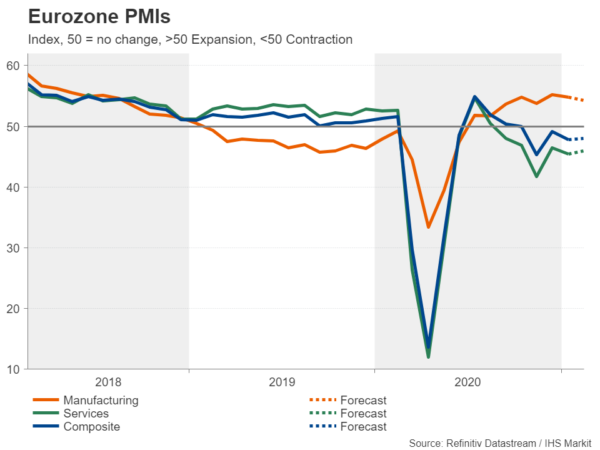

Incoming data is therefore not expected to alter the near-term picture much for the euro area, even if there are some positive surprises. Friday’s flash readings for the February PMIs by IHS Markit are unlikely to be an exception.

Euro might shrug off PMI improvement

After some countries cautiously eased their restrictions in early February, activity in the services sector is expected to have improved a little. The services PMI is forecast to have edged up to 45.9 from 45.4, pushing the composite PMI up a nudge to 48.0. The manufacturing PMI is projected to fall to 54.3 from 54.8, as the global manufacturing rebound that began late last year cools slightly.

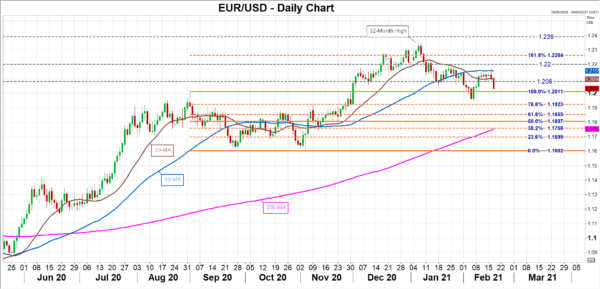

Nonetheless, even if the industrial sector remains in the healthy growth region, the broader economy might not be able to resume its recovery until late spring at the earliest. This means the euro will probably continue to trade within a range, or even extend its negative correction versus the greenback until then.

As euro/dollar approaches the $1.20 level, a drop below it could open the way for the 78.6% Fibonacci retracement of the September-November downtrend at $1.1923. Further losses would shift focus to the 61.8% Fiboancci of $1.1855.

However, if the data are stronger than anticipated, an upside move is possible in the short-term, especially if the dollar itself were to face some selling pressure. An upward attempt could pull euro/dollar back above its 20- and 50-moving averages, at 1.2096 and 1.2255 respectively. A stronger bullish momentum could help the pair reclaim the $1.22 handle.