- Global stocks surge to fresh highs as no end to euphoria, but quieter day expected

- Dollar jolts back down, pound and aussie roar ahead on vaccine boost

- WTI oil smashes above $60 a barrel to new post-pandemic high

No stopping the bulls

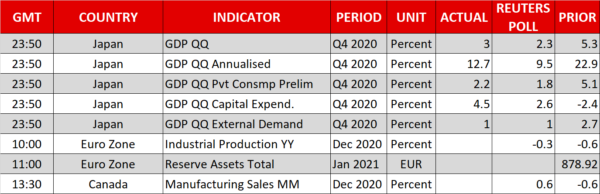

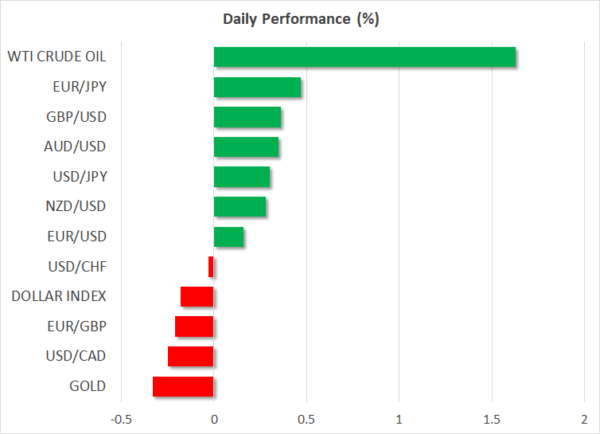

The stimulus and vaccine-led euphoria continued to bolster sentiment on Monday even as US markets are shut for Presidents’ Day and China is still celebrating the Lunar New Year. Asian markets closed sharply higher, led by Japan’s Nikkei 225 index, which surged above 30,000 for the first time since 1990.

European stocks jumped at the open and Wall Street futures indicate the S&P 500 and Nasdaq Composite are on track to extend their record streaks when US markets reopen tomorrow. Both indices closed at all-time highs on Friday as progress globally on the vaccination front and expectations that the US Congress will soon pass a near $2 trillion stimulus package are feeding the optimism about the recovery from the pandemic.

With Trump’s impeachment trial out of the way, US lawmakers can now turn their attention to President Biden’s economic agenda. But as the Democrats seem poised to push Biden’s virus relief aid through the Senate via the budget reconciliation process, are investors overestimating support for the bill among Democratic Senators?

The $15 minimum wage proposal and who should be eligible for the $1,400 stimulus checks are two major points of contention as Democrats appear split on these issues. However, even if those proposals were to be watered down, the markets would probably still be satisfied with the size of the overall package, though, it’s nevertheless a potential risk on the horizon.

Soaring US yields unable to prop up the dollar

Expectations that the Biden administration’s ambitious spending plans will further boost debt issuance weighed on Treasury bond prices, pushing up their yields. The 10-year yield broke above 1.20% to climb to an 11-month high, while the 30-year yield shot above 2.0% to hit pre-pandemic levels.

However, the jump in long-term borrowing costs did little to sustain the US dollar’s doomed attempt at a rebound late last week as the currency came crashing down on Friday. Recent soft numbers on the US labour market and consumer prices have taken the wind out of the greenback’s mini rally. But neither have the data been abysmal, meaning the American economy remains a bright spot globally, just not bright enough to worry Fed policymakers about runaway inflation.

This ‘goldilocks recovery’ phase could keep the dollar’s gains in check for the foreseeable future, or at least until higher inflation starts to become a real threat.

The greenback was last trading about 0.15% lower versus a basket of currencies.

Pound tests $1.39, aussie at 1-month top

Sterling’s relentless charge showed no sign of abating on Monday as cable set its sights on the $1.39 handle, while euro/pound slumped to a 9-month low. The pound was also unstoppable against the safe-haven yen, rising above the 146 level for the first time since December 2019.

Boris Johnson’s government met its target over the weekend of vaccinating 15 million people by mid-February, which covered the elderly and most vulnerable. At the current rate, the UK could become the first major nation to vaccinate enough of the population to achieve herd immunity against Covid-19, allowing the economy to fully reopen. Johnson has hinted that some easing of the lockdown restrictions could be announced as early as next week.

Vaccinations are also gathering pace in other parts of the world. The United States just hit the 50 million milestone and Australia on Monday rolled out its immunization programme. The Australian dollar was the second-best performer today, climbing to one-month highs against the greenback. But its kiwi cousin lagged as New Zealand ordered its biggest city – Auckland – into another lockdown.

Oil extends rally amid Mideast tensions

It was a bullish mood in commodity markets as well on Monday as rising optimism for the economic outlook fuelled expectations of higher demand for commodities such as oil and copper. WTI oil was up almost 2%, breaking above $60 a barrel today to a new 13-month high. Brent crude was also up sharply (1.3%) to trade above $63.

Aside from the growth optimism, fresh tensions in the Middle East also supported oil prices following reports of an Iranian-backed drone attack in Yemen against Saudi-led forces.