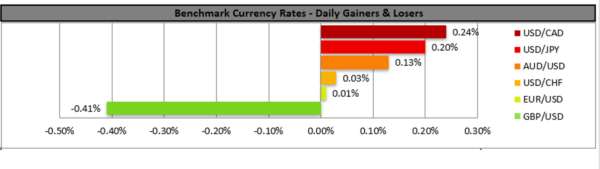

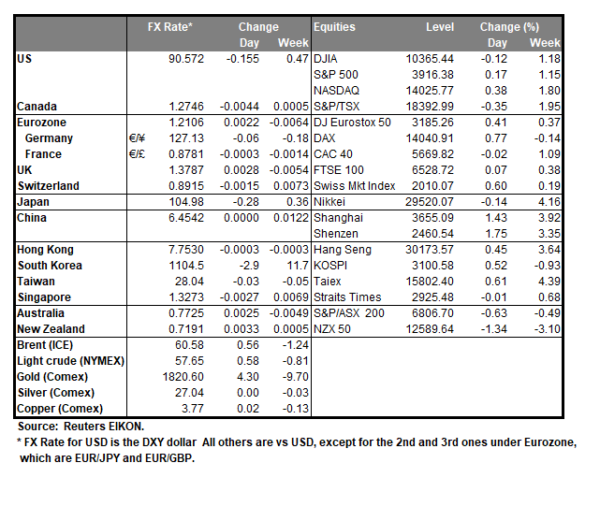

The Canadian Dollar retreated against the USD yesterday after reaching an almost three weeks high, given also that WTI prices slid lower yesterday. Recent comments made by US President Biden about China, where he stated that the US must raise its game in the face of the challenge from China tended to drive the markets to a more cautious sentiment and intensified worries for global trade up. On the other hand, the drop of oil prices tended to also weigh on the Loonie which is closely related to oil as Canada is a major oil producing country. Statements made by OPEC and the EIA about lockdowns and new variations of Covid 19 tended to reduce the expectations of a quick recovery of oil demand. Comparative to its southern neighbour the Canadian economy maybe lacking a bit behind given that the US has a more intense vaccination program. Should the market sentiment turn more cautious, we may see CAD losing ground, while oil prices are also expected to be closely watched by CAD traders.

USD/CAD rose yesterday after reaching an almost three week low, breaking the 1.2700 (S1) resistance line now turned to support. In its upward motion the pair also broke the downward trendline incepted since the 4th of February, forcing us to switch our bearish outlook in favour initially for a sideways movement bias, yet we suspect that the bulls may be just around the corner for the pair. Should the bulls actually take charge we may see the pair aiming if not breaking the 1.2800 (R1) resistance line, which reversed the pair’s upward motion on the 18th of January and the 3rd of February. Should the bears take over once again, we may see USD/CAD reversing course, breaking the 1.2700 (S1) support line and aim for the 1.2610 (S2) level.

GBP loses steam

The pound declined against the USD yesterday and also lost ground against the EUR, JPY and CHF indicative of the pound’s weakness. It should be noted that UK’s vaccination program is ongoing and intense and tends to create substantial hopes for a quicker economic recovery. Also, BoE’s persistence on keeping rates above zero tends to create some support for the pound as it could be regarded as a floor for the bank’s monetary policy for the time being. On the other hand though, statements by EU officials and especially Michel Barnier’s comments that the EU is no hurry to grant UK banks access to the European markets could be weighing on the pound. The importance of the issue was highlighted as BoE Governor Bailey warned the EU not to pick a fight on the financial sector. We expect that the correction lower could be extended, yet pound traders may also be interested in the release of UK’s GDP rates today for Q4 and December.

GBP/USD started to decline yesterday after unsuccessfully attempting to break the 1.3835 (R1) resistance line. We expect that the correction lower may be maintain, yet our bullish outlook remains as long as cable doesn’t break the upward trendline incepted since the 24th of September. Should the buying interest be renewed, we may see GBP/USD finally breaking the 1.3835 (R1) resistance line and aim for the 1.3990 (R2) barrier. Please note that any price action above the 1.3835 (R1) resistance line has not been active since April 2018, which also underscores the current high level of the pair. On the other hand, should the correction lower be extended, we may see GBP/USD testing if not breaking the 1.3700 (S1) support hurdle.

Other economic highlights

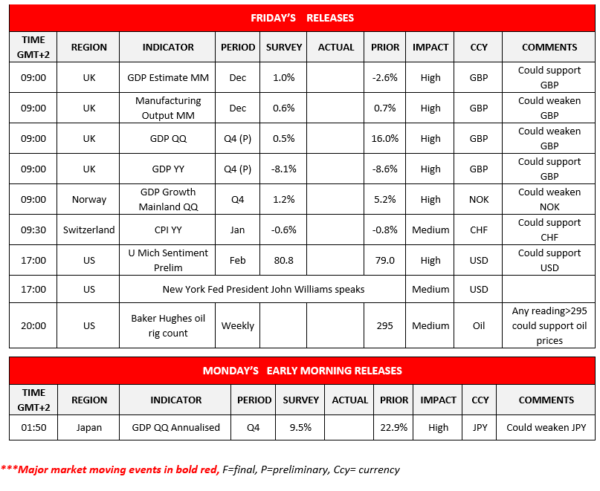

Today during the early European session, we note UK’s GDP rates for Q4 and December as well as the manufacturing output growth rate for December. Also in the European session we get Norway’s GDP rates for Q4 and Switzerland’s inflation rates for January. In the American session we highlight from the US the preliminary University of Michigan consumer sentiment for February, while oil traders may be also interested in the US Baker Hughes oi rig count, As for speakers in the American session we would note New York Fed President Williams which is scheduled to speak. During Monday’s Asian session we get from Japan the preliminary GDP rates for Q4.

Support: 1.2700 (S1), 1.2610 (S2), 1.2520 (S3)

Resistance: 1.2800 (R1), 1.2875 (R2), 1,2955 (R3)

Support: 1.3700 (S1), 1.3585 (S2), 1.3470 (S3)

Resistance: 1.3835 (R1), 1.3990 (R2), 1.4145 (R3)