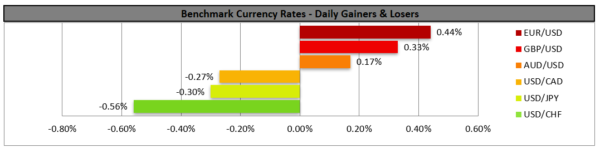

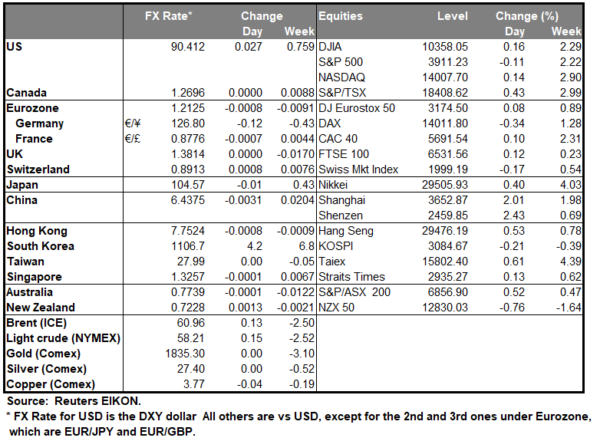

USD’s slide lower against a number of its counterparts seems to be ongoing with some analysts mentioning the possibility of safe haven outflows as the market’s expectations for an economic recovery in the US remain strong. President Biden’s fiscal stimulus plan along with the swift pace of vaccination in the US and the Feds’ loose monetary policy seems to bolster such a view forcing the USD to relent further ground. US Stock markets seem to continue their wild ride higher as all three main indexes, Dow Jones, S&P 500 and Nasdaq reached new record highs fuelled by optimism in the markets. On the political theatre the US Senate voted to proceed with the second impeachment trial President Trump yet the possibility for a conviction seems slim for the time being, as Democrats lack the necessary two thirds of the votes to achieve it. Today, we may see traders focusing on the US CPI rates for January as well as Fed Chairman Powell’s speech. USD/CHF continued its slide lower breaking the 0.8935 (R1) support level, now turned to resistance. We maintain a bearish outlook for the pair as long as it remains below the downward trendline incepted since the 8th of February. It should be noted though that the RSI indicator below our 4-hour chart is at the reading of 30 which confirms the bear’s dominance, yet at the same time may imply that the pair is oversold and a correction higher could be in the cards. Also, the pair seems to have consolidated somewhat when it reached the lower boundary of the Bollinger bands during today’s Asian session, yet now the bears seem to have room for further advancement. Should the bears actually maintain control over the pair, we may see it aiming if not breaking the 0.8855 (S1) support line on its journey southwards. Should the bulls take over we may see USD/CHF breaking the prementioned downward trendline, break the 0.8935 (R1) resistance level and aim for the 0.9010 (R2) level.

Pound’s ascent is ongoing

The pound continued to gain against the USD and EUR yesterday yet may have relented some ground against safe havens JPY and CHF and its characteristic that cable hasn’t seen such high levels since April 2018. UK’s vaccination process is swift, and analysts tend to highlight the benefits of a potential quicker recovery of the UK economy, also given that the number of daily Covid infections has dropped to levels last seen in early last December, boosting optimism. Interestingly enough the UK has also publicized data from its actual mass vaccination, which showed that the Pfizer vaccine provides as much as 65% protection with one shot, while the rate rises to 84% with two shots. Should the optimistic climate continue, the pound could continue to rise, yet Pound traders may be eyeing Bailey’s speech today and the UK GDP rates on Friday. GBP/USD continued to rise yesterday aiming for the 1.3835 (R1) resistance line. For our bullish outlook to change we would require a clear breaking of the upward trendline characterizing GBP/USD movement since the 24th of September to be clearly broken. Also note that the RSI indicator below our 4-hour chart, has reached the level of 70, confirming the bullish sentiment yet at the same time may be warning that the pair’s long position maybe somewhat overcrowded and some buyers may want to bail out. Should buying interest be maintained, we may see cable breaking the 1.3835 (R1) line and aim for the 1.3990 (R2) level. Should a selling interest be displayed by the market, we may see GBP/USD aiming if not breaking the 1.3700 (S1) line.

Other economic highlights

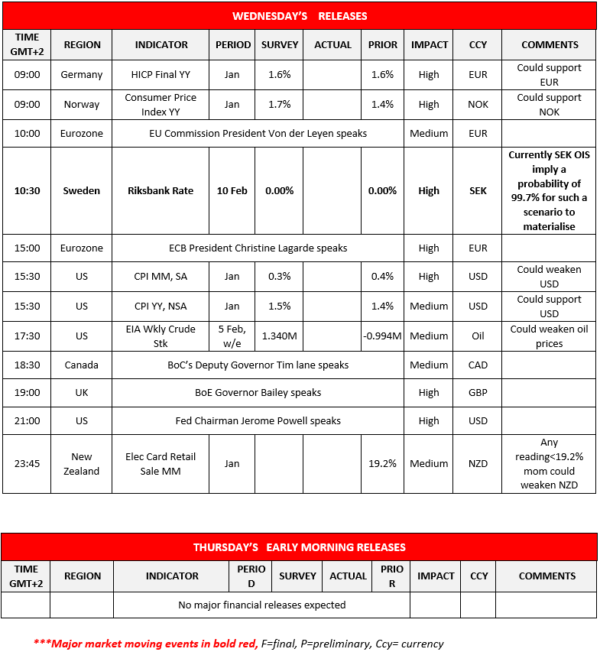

Today we note Germany’s final HICP rate for January, Norway’s CPI rate also for January and from Sweden Riksbank’s interest rate decision. In the American session, we get the US CPI rates for January while oil traders may be more interested in the EIA weekly crude oil inventories figure, especially after the drawdown reported by API last night. As for speakers please note that ECB President Lagarde, BoC Deputy Governor Lane, BoE Governor Bailey and Fed Chairman Powell are scheduled to speak. Also, just before the Asian session starts, we get New Zealand’s electronic card sales for January.

Support: 0.8855 (S1), 0.8780 (S2), 0.8700 (S3)

Resistance: 0.8935 (R1), 0.9010 (R2), 0.9090 (R3)

Support: 1.3700 (S1), 1.3585 (S2), 1.3470 (S3)

Resistance: 1.3835 (R1), 1.3990 (R2), 1.4145 (R3)