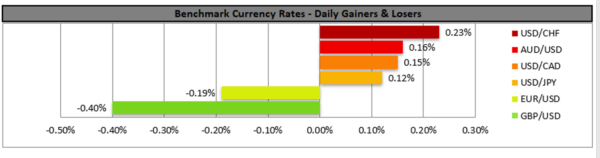

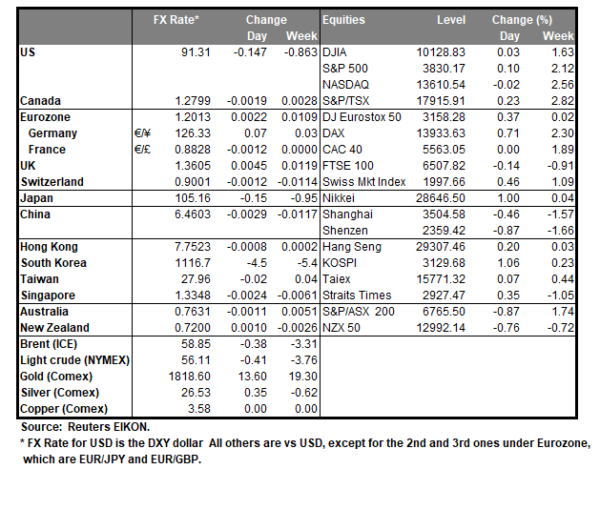

The USD tended to gain against a number of its counterparts, yet there seem to be some signs of fatigue as gains seemed rather capped. The recent developments tend to show that the Biden administration is about to start the process of approving the fiscal stimulus even without the bipartisan support from the Republicans. Such a scenario seems to bring the possibility of the stimulus coming in to effect faster than what the market may have been expecting, possibly boosting the US stock markets and underscoring the possibility of a quicker recovery for the US economy. Also, the pace of vaccination seems to have picked up creating some hopes for the rebound of the US economy boosting the market’s optimism. Today the markets may be focusing also on the US financial releases, while they may also be positioning ahead of the release of the US employment report tomorrow while fundamentals are still to play role in the USD’s direction.

USD/CHF continued to rise yesterday aiming for the 0.9010 (R1) resistance line. We tend to maintain a bullish outlook for the pair as long as the upward trendline incepted since the 29th of January keeps guiding the pair. On the other hand, it should be noted that the RSI indicator below our 4-hour chart is at the reading of 70 confirming the dominance of the bulls yet may imply that the pair may be overbought and a correction lower is possible. Should the bulls actually maintain control we could see the pair breaking the 0.9010 (R1) resistance line and aim for the 0.9090 (R2) level. Should the bears take over we may see USD/CHF reversing course, breaking the prementioned upward trendline and aim if not breach the 0.8935 (S1) support line.

BoE’s interest rate decision eyed

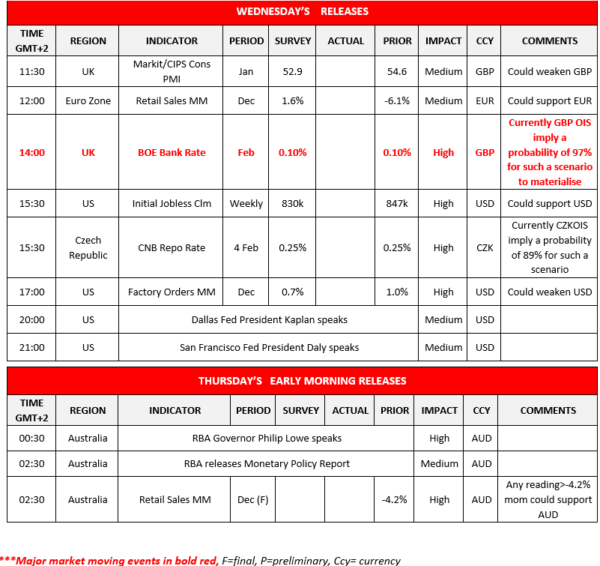

The pound relented some gains against the USD yesterday, despite optimism for the UK economy’s outlook still being present and ahead of BoE’s rate decision. The bank is widely expected to remain on hold at 0.10% and currently GBPOIS imply a probability of 97% for such a scenario to materialize. Also, we would not be surprised to see the bank keeping its QE program unchanged at £895 billion (in total, £20B corporate and £875B Gilts) given that it was raised only recently. Economic activity in the UK is understandably at low levels as implied also by January’s PMIs while the employment market remains a substantial worry. The bearish scenario for the pound from the event could include the reiteration on behalf of the bank that negative rates are still an option, while on the bullish side the bank may employ a touch of optimism as well, despite its cautiousness. Should the bank choose to concentrate on prospects of a rebound rather than the current hit from the lockdown measures, we may see the pound getting some support and vice versa.

GBP/USD dropped yesterday aiming for the 1.3585 (S1) support line. Given that cable’s price action has broken the upward trendline incepted since the 24th of September, we switch our bullish outlook in favour of a sideways movement initially with a bearish bias. Also note that the RSI indicator below our 4-hour chart , is clearly below the reading of 50 implying that the selling interest may persist. Should pair remain under the market’s selling interest as mentioned before, we may see GBP/USD breaking the 1.3585 (S1) support line and aim for the 1.3470 (S2) level. Should buyers take the initiative, we may see the pair reversing course aiming if not breaching the 1.3700 (R1) level and as a key risk event for the pair’s direction we would highlight BoE’s interest rate decision, which may affect the pair’s direction considerably either way.

Other economic highlights today and early Tuesday:

Today in the European session, beside BoE’s interest rate decision we note UK’s construction PMI for January, Eurozone’s retail sales growth rate for December and from the Czech Republic CNB’s interest rate decision. In the American session we note the release of the US weekly initial jobless claims figure and the factory orders growth rate for December. In tomorrows’ Asian session, we get Australia’s final retail sales growth rate for December. On the monetary front Dallas Fed President Kaplan, San Francisco Fed President Daly and RBA Governor Philip speak, and RBA is to release its Monetary Policy Report. Calendar follows

Support: 0.8935 (S1), 0.8855 (S2), 0.8780 (S3)

Resistance: 0.9010 (R1), 0.9090 (R2), 0.9190 (R3)

Support: 1.3585 (S1), 1.3470 (S2), 1.3350 (S3)

Resistance: 1.3700 (R1), 1.3835 (R2), 1.3990 (R3)