- GDP increased at a 4.0% annualized pace in Q4 returning the economy to within 2.5% of pre-shock levels

- Household spending on hospitality services accounts for a disproportionate share of shortfall

- Virus spread and containment measures are stalling near-term recovery, but stronger growth expected alongside vaccine rollout

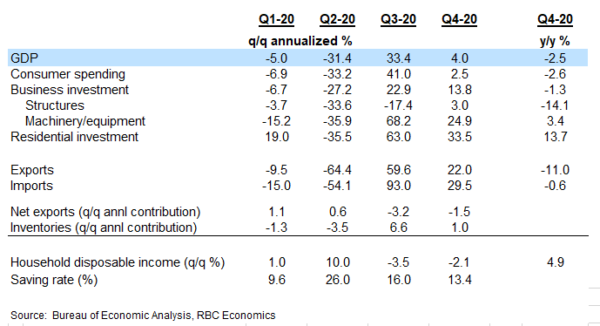

The US economic recovery lost strength into the end of 2020 alongside escalating virus spread – but GDP still rose 4.0% (annualized) in Q4. That built on the 33% surge in Q3 to leave the level of economic output within 2.5% of year-ago (pre-shock) levels. The bounce-back in the second half of the year limited the annual GDP decline to (a still large) 3.5% in 2020 after the plunge in output in the spring.

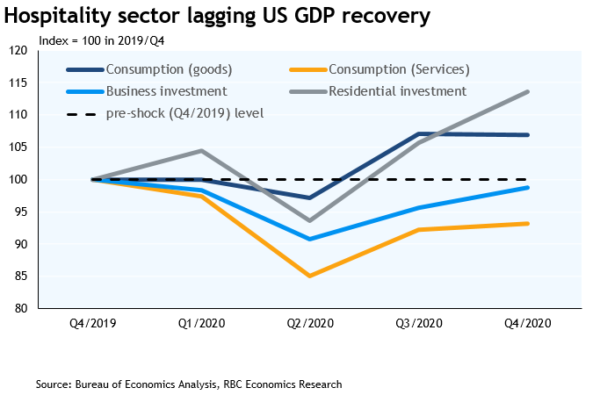

Remaining weakness is increasingly concentrated in consumer spending on hospitality services. Spending on food services and accommodations was still 21% below pre-shock levels in Q4 with recreation spending down by a third. Spending on services overall rose in Q4 (from Q3) as healthcare spending continued to recover, though remained down almost 7% from a year earlier. Spending on goods held steady at elevated levels and residential investment was up a whopping 13.7% from a year ago, supported by exceptionally low interest rates. Business investment also continued to recover, boosted by a sharp rise in equipment purchases.

The slower recovery in household spending on services has not been due to a lack of household purchasing power. Job losses have been concentrated at the lower-end of the wage scale, and government support programs have helped offset wage losses. Household disposable incomes were almost 5% above pre-shock levels in Q4 and the household savings rate was 13.4%. Given virus spread and containment measures, options available to spend on things like travel and hospitality have been limited.

The impact of the virus on the economy intensified into the end of the year, with retail sales falling significantly in November and December and employment dropping in the latter month for the first time since the spring. Still, shutdowns have not been as extensive as in the spring of 2020, and accelerating vaccine distribution has brightened the light at the end of the pandemic-tunnel. We expect US GDP growth will slow, but remain positive, in the first quarter of 2021 before strengthening in Q2 and beyond as an increasingly large proportion of the population receives vaccines.