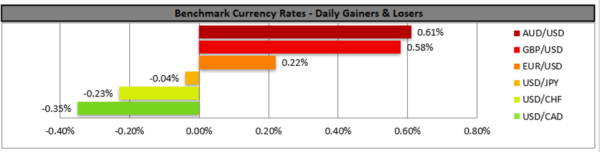

The USD tended to be on the retreat against some of its counterparts yesterday, also as the market may have been positioning itself ahead of the Fed’s interest rate decision later today (19:00,GMT). The bank is expected to remain on hold keeping rates at the range of 0.0-0.25% and currently Fed Funds Futures imply a probability of 95% for such a scenario, yet also various statements made by Fed officials seem to also point to low rates for an extensive period of time. The Fed’s loose monetary policy in conjunction with the expansive fiscal plans of the Biden administration seem to underpin a quick recovery of the US economy and its characteristic that January’s preliminary Markit PMIs implied an expansion of economic activity in the US. On the flip side though, a contraction of retail sales and employment data point to the other direction as Decembers’ employment report indicated that employers axed some 140k jobs, a painful reminder of the current situation in the US employment market. So the rebound seems to be coming, but the US economy is still not out of the woods. That could imply that the Fed may continue to worry more about a possible reversal of the rebound rather than the economy overheating, thus prompting possibly another cautious if not dovish stance on behalf of the bank. Such a stance could create bearish waves for the USD while at the same time hit the US yields, polishing gold and making it shine more for the bulls. Should the bank fail though to meet the dovish expectations of the market, we may see the USD getting substantial support asymmetrically higher than a possible dovishness by the Fed would weaken it. Also note Powell’s press conference half an hour later which could extent volatility in the markets.

AUD/USD jumped yesterday breaking the 0.7725 (S1) resistance line, now turned to support. We tend to maintain a bias for a wide sideways movement of the pair between the 0.7785 (R1) line and the 0.7680 (S2) level, given also that the RSI indicator below our 4-hour chart seems to hover near the reading of 50 implying a rather indecisive market. Should the pair find fresh buying orders along its path, we may see it breaking the 0.7785 (R1) resistance line aiming for the 0.7835 (R2) level. Should a selling interest be displayed by the market, we may see the pair breaking the 0.7725 (S1) support line and aim for the 0.7680 (S2) level.

GBP gains as risk sentiment improves

The pound gained against the USD, EUR, JPY and CHF yesterday, despite the adverse employment data released for November, given also that the unemployment rate reached its highest level in years, as a risk on mood characterized the markets. On the Covid front the situation seems to improve, given that the number of daily new infections is dropping , while an intense vaccination program tends to underscore the prospects for a quicker rebound to some sort of normality, also supporting the pound despite the alarming number of daily deaths released. Also the UK seems to plan to widen the ties with Switzerland for its vital services sector, which may support the economic rebound of the UK. Should the risk on sentiment continue to characterize the markets we may see the pound advancing further in the coming day.

GBP/USD continued to rise yesterday breaking the 1.3700 (S1) resistance line now turned to support. We maintain a bullish outlook for cable as long as the upward trendline incepted since the 24th of September continues to guide the pair. Should the bulls actually maintain control over the pair, we may see it aiming if not breaking the 1.3835 (R1) resistance line, aiming for higher grounds. Should the bears take over, we may see the pair breaking the 1.3700 (S1) support line and aim for the 1.3585 (S2) level.

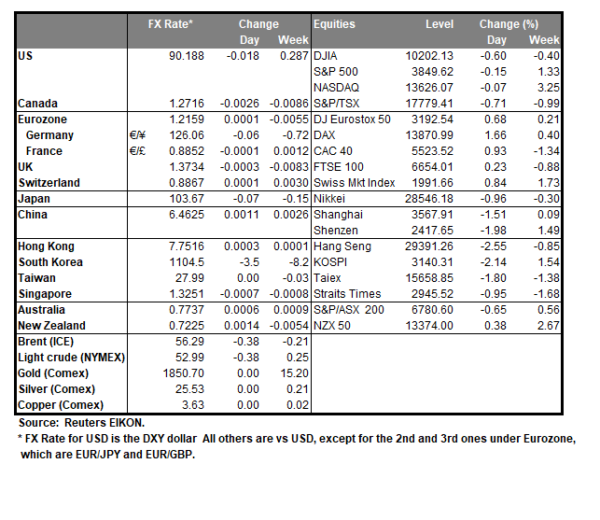

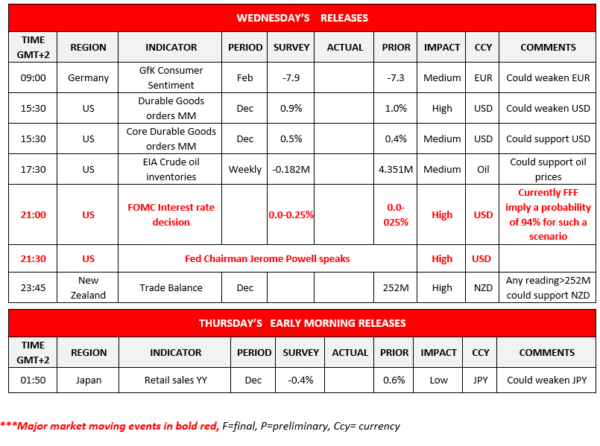

Other economic highlights today and early Tuesday:

Today during the European session, we note Germany’s GfK consumer Sentiment for February while in the American session we get the US durable goods orders for December and the EIA weekly crude oil inventories figure. Just before the Asian session starts we note New Zealand’s trade data and later on Japan’s retail sales growth rate, both for December.

Support: 0.7725 (S1), 0.7680 (S2), 0.7625 (S3)

Resistance: 0.7785 (R1), 0.7835 (R2), 0.7875 (R3)

Support: 1.3700 (S1), 1.3585 (S2), 1.3470 (S3)

Resistance: 1.3835 (R1), 1.3990 (R2), 1.4145 (R3)