U.S. Highlights

- President-elect Biden unveiled a proposal for a new relief package this week. The $1.9 trillion plan includes additional one-time stimulus checks, unemployment benefit supplements and funding for state and local governments.

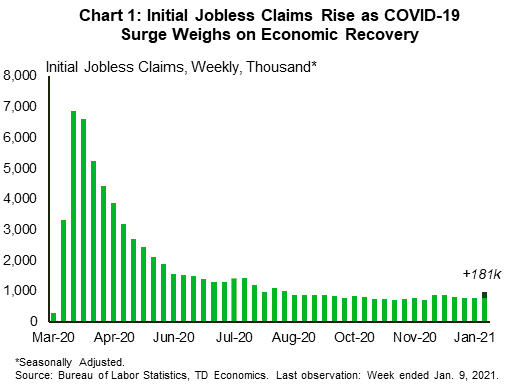

- Additional fiscal support will help bolster a faltering economy. Initial jobless claims rose by 181k last week to levels not seen since last summer, while retail sales fell 0.7% last month, their third straight month of decline.

- This week, Fed Chairman Powell brushed aside concerns about higher inflation and reiterated the central bank’s commitment to maintain an accommodative monetary policy stance until the economic recovery is complete.

Canadian Highlights

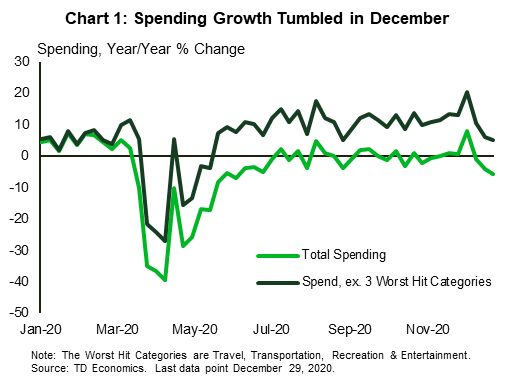

- The second wave of the pandemic has thrown a bucket of cold water on the economic recovery. Last week’s data showed employment declining in December. TD’s aggregate spending data showed that growth also slumped at the end of the year.

- While the eventual ramp up in vaccine distribution offers hope of a strong economic rebound in the second half of the year, the economy is entering 2021 on a wobbly footing and could suffer a modest contraction in the first quarter.

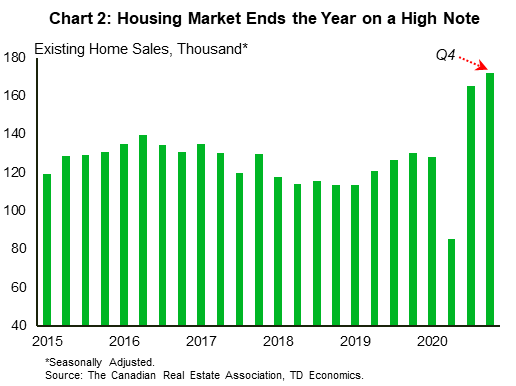

- One area that is yet to see any slowdown is the housing market. December data, released today, showed Canadian home sales jumped 7.2% month-on-month to a new record high, sending the year-on-year sales pace to a blistering 47.2%.

U.S. – New Year, New Stimulus

This week offered some welcome respite following the turbulent events that marked the start of the year. From an economic standpoint, the biggest news came from President-elect Biden’s address on Thursday as he unveiled a new $1.9 trillion coronavirus relief plan. The proposal, which will need to go through Congress, notably includes a round of $1,400 stimulus checks for individuals with expanded eligibility, a $400-per-week unemployment insurance boost through September, as well as funding for state and local governments. With eviction and foreclosure moratoriums set to expire later this month, Mr. Biden also called to extend these measures until September.

Additional fiscal support will go a long way toward breathing new life into a faltering economic recovery. Indeed, the heavy toll of the third wave of COVID-19 infections was on full display in economic data released this week. Initial jobless claims rose by 181,000 last week to levels not seen since last summer (Chart 1). This marked the largest weekly increase since last spring and suggests that layoffs are picking up speed. The near-term outlook is not particularly bright. The U.S. economy already lost 140,000 payroll jobs last month, mainly in the leisure and hospitality industry, which was hit hard by restrictions imposed across the country to curb the spread.

These difficult conditions are weighing on business confidence. In December, the NFIB small business optimism index plummeted by 5.5 points to 95.9 – one of the steepest drops in the survey’s history. The decline was driven by lower expectations for real sales, earnings trends and economic improvement in the near-future. This downbeat tone was also echoed in last month’s retail sales report. Sales contracted by 0.7% in December from the previous month, marking their third consecutive month of decline. They fell the most at nonstore retailers (-5.8%), electronics and appliance stores (-4.9%) and food services and drinking places (-4.5%). By contrast, sales at gasoline stations increased by 6.6% on the month.

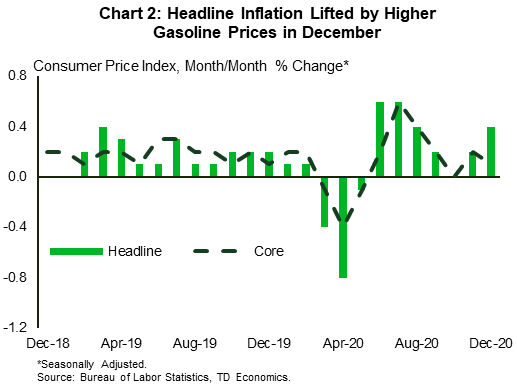

Alongside stronger gasoline sales came higher prices at the pump, which lifted overall consumer prices in December. The headline Consumer Price Index (CPI) rose by 0.4% month/month, while the core series – which excludes volatile food and energy items – was more muted at 0.1% (Chart 2). On the whole, the pandemic continues to dampen consumer price growth, particularly for core services, which are now trailing their goods counterpart. This is a notably rare occurrence, which usually manifests itself on the heels of an economic recession.

Inflation will likely pick up later this year as vaccination rates increase and the economy gets back on track, but the Federal Reserve is in no rush to shift away from its accommodative monetary policy stance. This week, Chairman Powell brushed aside concerns about higher inflation, noting that the central bank has the tools to stave off unwelcomed price growth, though he doesn’t expect to use them anytime soon. What is more, Mr. Powell indicated that the U.S. economy is still a long way from a complete recovery. The message was clear – interest rates will remain low for the foreseeable future.

Canada – Recovery Shifts In Reverse Amid Rising Infections

Following a solid gain last week, financial markets were less upbeat this week with weaker economic data sapping investors optimism. The S&P/TSX moved sideways, ultimately ending the week 0.8% lower (at the time of writing). Crude prices were also volatile, ending the week slightly lower. The WTI benchmark is still up meaningfully since the start of the year, and only slightly below its year-ago level. Crude prices have been buoyed by production cuts, vaccine hopes and new fiscal stimulus announced in the U.S. even as surging COVID-19 cases and renewed restrictions are expected to weigh on economic activity in the near term.

Indeed, with cases and hospitalizations surging across Canada, the second wave of the pandemic threw a bucket of cold water on the economic recovery. Last week’s data showed employment declining by 63k in December. Ditto for consumer spending. TD’s aggregated spending data showed that year-over-year spending growth slumped by 14 percentage points to -5.5% in the final week of December (Chart 1) after a solid pick-up in early December due to Black Friday and Cyber Monday shopping. Government-mandated restrictions have continued to tighten in the New Year, with Ontario issuing stay-at-home orders this week, suggesting that the near-term outlook will remain challenged.

One area which is yet to see any slowdown is the housing market. December data released today showed Canadian home sales jumped 7.2% month-on-month to a new record high of nearly 60k units, thus sending the year-on-year sales pace to a blistering 47.2% (Chart 2). Last year was a banner year for the housing market, with sales boosted by the relative resilience in high-wage employment, record low mortgage rates, a rising supply of homes and solid demand for larger units amid the pandemic. For the year as a whole, home sales were up 12.6%, marking the strongest increase since 2001.

However, in many other areas the situation is far less rosy. Slowing demand and restrictions are exacerbating challenges faced by businesses in hard-hit sectors. Many businesses already weakened by the first bout of the crisis will find it harder to survive the second wave. With the health crisis intensifying, speedier vaccine distribution could not come soon enough. On that front, this week the Federal Government secured another 20 million doses of the Pfizer-BioNTech vaccine, expected to arrive in April or May, which would allow Canada to gain greater access to vaccines sooner. However, today news broke out that production issues in Europe will temporarily reduce near-term deliveries of Pfizer-BioNTech vaccine to Canada.

All in all, while the eventual ramp up in vaccine distribution offers hope of a strong economic rebound in the second half of the year, the economy is entering 2021 on a wobbly footing and could suffer a modest contraction in the first quarter. This is something the Bank of Canada is surely pondering and will likely be reflected in its policy rate announcement and economic projections next week.

Canada: Upcoming Key Economic Releases

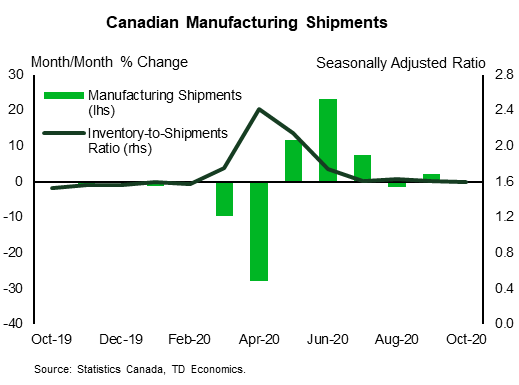

Canadian Manufacturing Sales – November*

Release Date: January 19

Previous: 0.3%

TD Forecast: 0.3%

Consensus: NA

Manufacturing sales are forecast to extend their recovery with another 0.3% increase for November. This is above flash estimates for a modest (0.4%) decline and follows a decent performance for export activity (excluding transportation products). Autos and other transportation products should exert a modest headwind to the headline print after shaving 0.7pp from exports, with auto production levels little changed, while real manufacturing sales should outperform the nominal print due to lower factory prices.

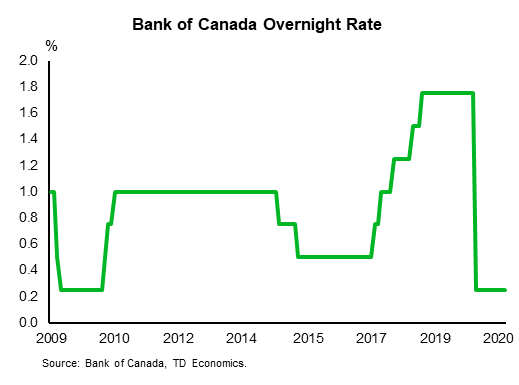

Bank of Canada Rate Decision*

Release Date: January 20

Previous: 0.25%

TD Forecast: 0.25%

Consensus: 0.25%

Our base case is for the Bank of Canada to leave the overnight rate unchanged at 0.25% next week. We look for a balanced statement from the BoC, citing stronger momentum into 2021 and a more rapid timeline for vaccines while cautioning that lockdowns will weigh on Q1 GDP. This will be backed up by positive forecast revisions to GDP growth in 2020 & 2022, along with an upgrade to the Bank’s CPI forecast. The debate around the January BoC meeting has grown more interesting following Governor Macklem’s musing around a hypothetical ELB below 0.25%, and while we do not expect this will lead to a micro-rate cut, we cannot fully discount the risk either. Setting aside the risk of a surprise micro cut, the Bank should leave its forward guidance unchanged by pledging to continue QE until the recovery is well underway and leave rates at the ELB until the inflation target is sustainably achieved.

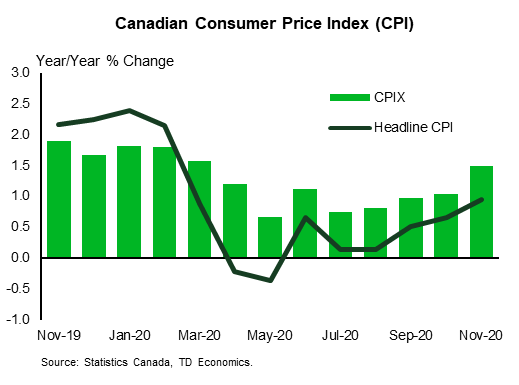

Canadian Consumer Price Index– December*

Release Date: January 20

Previous: 0.1% m/m, 1.0% y/y, Index: 137.7

TD Forecast: -0.2% m/m, 0.8% y/y, Index: 137.4

Consensus: NA

Headline CPI is projected to edge lower to 0.8% y/y in December, with prices down 0.2% on the month. Seasonal headwinds to December CPI have weakened in recent years, due in part to methodological changes to airfares, but the index averaged a -0.4 m/m decline for five years prior to 2018. Lower gasoline prices will provide a catalyst for the pullback, along with a further decline in apparel prices and travel services. Airfares have been a significant source of strength for December in recent years, averaging +22% m/m over 2018/19, but this tailwind is unlikely to fully materialize given ongoing travel restrictions and more recent guidance to avoid travel over the holidays. Homeowner replacement costs will still provide some lift on a m/m basis, but a deceleration in new home prices hints at a more modest contribution than last month. Our forecast for headline CPI to soften 0.8% y/y in December would also leave the Q4 average sitting at 0.8%, well above BoC projections (0.2% in October MPR), with CPI on track to push higher before peaking above 2% in Q2. Core CPI measures should hold steady near 1.7% y/y on average, leaving core inflation unchanged for the third consecutive month.

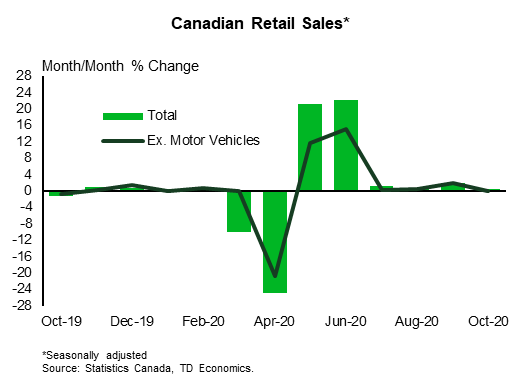

Canadian Retail Sales– November*

Release Date: January 22

Previous: 0.4%, ex-auto: 0.0%

TD Forecast: 0.1%, ex-auto: 0.3%

Consensus: NA

TD looks for retail sales to rise by 0.1% in November, roughly in line with flash estimates from Statistics Canada, with a modest drag from lower auto sales. Preliminary auto sales showed a moderate decline in vehicles sold (units) even though dealerships were largely spared by early measures to combat the 2nd wave of COVID. Elsewhere, new COVID measures will exert a modest headwind to the sale of non-essential goods with some Ontario hotspots moving into a modified lockdown in mid-November. Food and beverage sales should offer a source of strength as a portion of reduced restaurant spending is put towards groceries. This will provide the driving force behind a projected 0.3% increase in ex-auto sales, with volumes coming in slightly below the nominal print.