We look for the Bank of Canada’s quarterly Business Outlook Survey (BOS) to reiterate that the near-term economic background remains challenging albeit more for some businesses than others. The survey was likely collected from mid-November to mid-December as virus containment measures were being re-imposed across Canada, and those measures have continued to be extended and expanded into 2021 (including more aggressive lockdowns imposed province-wide in both Ontario and Quebec).

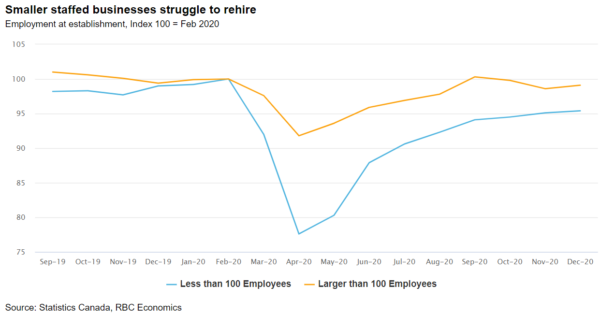

Still, vaccine news has been significantly more positive than expected since the Q3 survey. And, to-date containment measures have been heavily targeted at the hospitality/travel sectors, with limits also placed on ‘non-essential’ retailers in a growing number of regions. Early indicators suggest that manufacturing momentum continued to improve in December, both in Canada and abroad. Higher oil prices, and a drift up in oil & gas drilling activity (albeit to levels still far below pre-shock trends) have created a more upbeat backdrop for natural resource sectors. While many businesses may report modest hiring plans, the hospitality sector has been aggressively cutting jobs again – employment in accommodation & food services alone fell by almost 130k over the last three months of 2020, and now accounts for half of the remaining total shortfall in employment relative to pre-shock levels. The added concern however is whether rising case counts will force governments to extend restrictions to industries outside the hospitality sector.

Amid a weakening economic backdrop, businesses are expected to lean further on enhanced and extended fiscal supports (CEBA, CERS, CEWS). These programs will help cushion the shock for businesses through the second round of lockdowns. But the unfortunate reality is that despite these support, some businesses will struggle to make it through the winter. Beyond that, the outlook is significantly brighter, provided that effective vaccines can be produced and distributed as planned.

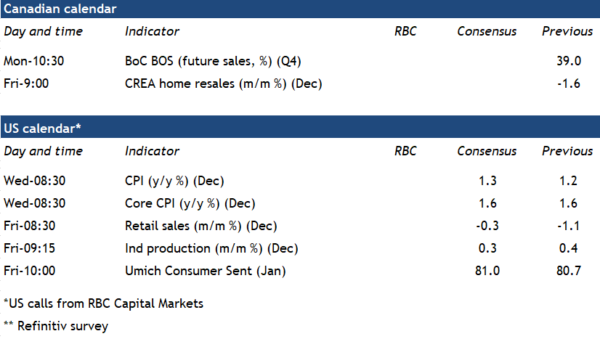

Week ahead data watch:

- Canadian home resale will record yet another strong gain in December. Early reports from local real estate boards showed that Canadians’ strong desire to own a home was not restrained by virus resurgence.

- US Headline CPI likely inched marginally higher in December holding well below the Fed’s target. We expect the Fed to remain focused on risks of vaccine roll out and rising COVID-19 infections.

- US industrial production is expected to increase in December, owing from gains in the manufacturing sector. The ISM manufacturing index increased to 60.7 (highest level in over two years) with 16 of 18 industries recording growth.