The Japanese yen was little changed in the American and Asian sessions as traders reacted to the November household spending data from the country. Spending dropped by 1.8% in November leading to a 1.1% annualised increase. The numbers were worse than the previous month’s increase of 2.1% and 1.9%, respectively. These numbers came a day after the country released relatively weak income numbers. The average cash earnings dropped by 2.2% while overtime pay fell by 10.30%.

The US dollar index rose slightly ahead of the US nonfarm payroll numbers that will come out in the afternoon session. Expectations are low. The median estimate for the nonfarm payrolls is a 71,000 increase, which will be the lowest number in months. Also, they expect the data to show that the unemployment rate rose from 6.7% to 6.8% while the average hourly earnings remained steady at 4.4%. On Wednesday, data by ADP showed that private employers lost 123,000 jobs.

The Canadian dollar is relatively steady ahead of the country’s December jobs numbers. Like in the United States, economists expect the data to show that the unemployment rate rose from 8.5% to 8.6%. They also expect that the economy lost 27.5k jobs after it added 62.1k in the previous month. Elsewhere, Halifax will deliver the UK house price index while the Swedish statistics office will release the November industrial production numbers. In Germany, the statistics office will deliver the November import and export numbers.

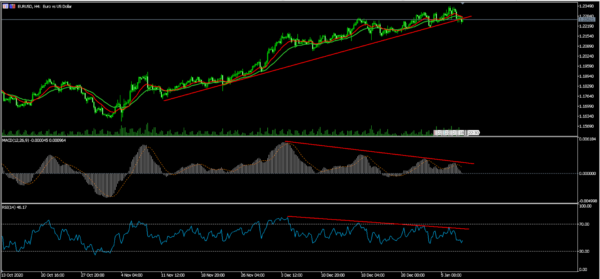

EUR/USD

The EUR/USD is under pressure ahead of the nonfarm payroll numbers. It is trading at 1.2262, which is lower than this month’s high of 1.2345. The four-hour chart shows that there are signs of divergence. For example, while the price has been in a previous rally, the Relative Strength Index (RSI) has been dropping. The same is true with the MACD indicator. Therefore, there is a possibility that the pair will continue falling as bears target the next support at 1.2200.

USD/JPY

The USD/JPY pair is little changed today after it rose sharply yesterday. It is trading at 103.83, which is the highest it has been since December 29. On the four-hour chart, it has moved above 25-day and 15-day exponential moving averages. It has also risen above the important resistance level of 103.63 while the Average True Range (ATR) has continued to rise. The pair is also forming a bullish pennant pattern. Therefore, it will likely bounce back higher, with the next level to watch being 104.0.

XAU/USD

The XAU/USD pair dropped sharply overnight partly due to the stronger dollar. It is trading at 1,911, which is at the same level as the ascending trendline that connects the lowest levels from December. It is also along the 25-day exponential moving average. The MACD and the Relative Strength Index (RSI) have continued to fall. Notably, it is also forming a bearish pennant pattern, which is a sign that it will continue falling.