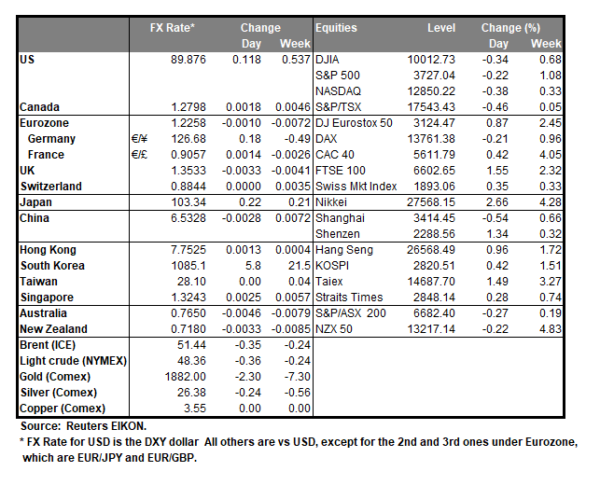

The USD continued to weaken yesterday, with a number of major currency pairs not seeing such a weak dollar for the past two and a half years. Greenbacks’ bears largely ignored a number of worrying signs, as safe-haven demand seemed to be lacking for the USD, yet three fundamental issues could threaten the bear’s dominance. The first would be the fact that Republican Senate Majority Leader McConnell yesterday postponed a vote in the Senate on increasing COVID-19 relief checks from $600 to $2,000 while also urged senators to override President Donald Trump’s veto of a defence bill, practically challenging Trump. The second issue is that the first US case of the superspreading new COVID 19 variant was reported increasing worries for the path of the pandemic in the US, while President elect Biden stated that at the current rate it could take years for Americans to get vaccinated. Last but not least, California’s coronavirus lockdowns were renewed indefinitely as hospitals are reported to be on the brink of a crisis. Overall, should market worries intensify due to the prementioned issues, we could see the USD to enjoy some safe-haven inflows, otherwise the greenback’s slide may be allowed to continue.

USD/CHF dropped breaking the 0.8855 (R1) support line now turned to resistance. We tend to maintain a bearish outlook for the pair as long as it remains below the downward trendline incepted since the 28th of December. It should be noted though that the RSI indicator below our 4-hour chart has reached the reading of 30 which on the one hand confirms the bear’s dominance, yet on the other tends to imply that the pair’s short position is rather overcrowded and a correction higher is possible. Should the bears maintain control over the pair, we could see it breaking the 0.8780 (S1) line and aim for the 0.8700 (S2) level. Should the bulls take over, we could see the pair breaking the 0.8855 (R1) resistance line and aim for the 0.8935 (R2) level.

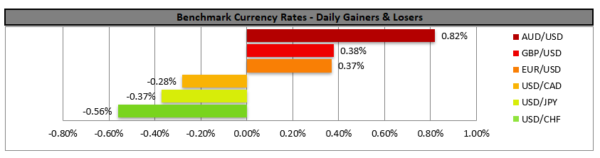

AUD on the rise pushed by positive market sentiment

The Aussie tended to be on the rise yesterday against the USD as well as JPY as investors may have felt that better days lay ahead for global trade and were pushed also by the positive market sentiment characterizing the markets. The start of vaccination for Covid‑19 in a number of countries as well as the additional U.S. fiscal support package could be reducing the downside risk to the global economy benefiting the commodity currency. Also, the depreciation of the USD tends to push prices of some commodities higher, practically boosting earnings from Australian resource exports. Australia’s exports of iron ore are on the rise for the past eleven months, while economic activity in the Chinese manufacturing sector which is one of the main importers of Australian raw materials seems to remain rather stable providing some reassurance for future orders. On the other hand, we have to note that the recent COVID 19 outbreak in Sydney may create some worries back home weakening the Aussie somewhat. We expect the market sentiment to remain the main driver for the Aussie and should it remain on the positive side, we may see the Aussie gaining further, while AUD traders may also be eyeing China’s December PMIs due out tomorrow.

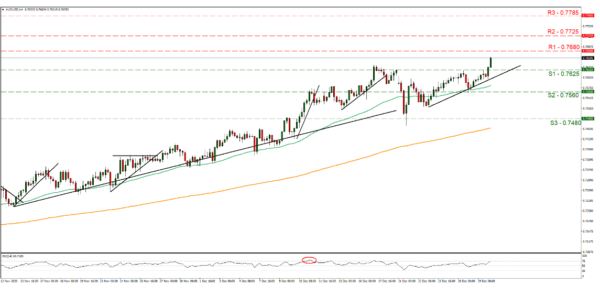

AUD/USD steepened its rise during today’s Asian session, breaking the 0.7625 (S1) resistance line now turned to support. We maintain a bullish outlook for the pair given its movement since the 23rd of the month, yet some correction lower could be in play after the steep ascent. If the pair finds fresh buying orders along its path, we could see AUD/USD breaking the 0.7680 (R1) line and aim for the 0.7725 (R2) level. Should a selling interest be displayed, we could see the pair breaking the 0.7625 (S1) line and aim for the 0.7560 (S2) level.

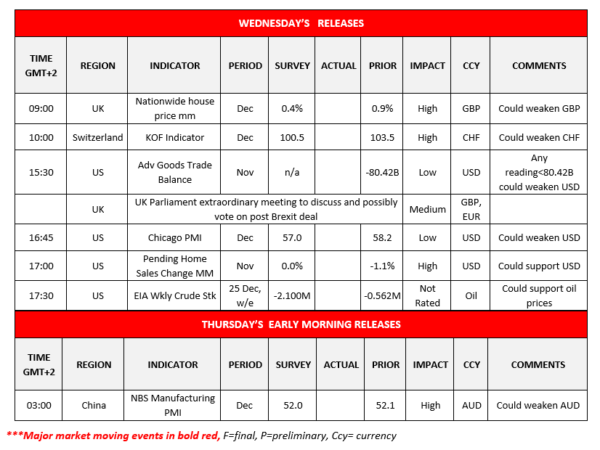

Other economic highlights today and early Tuesday:

We highlight today’s UK nationwide house prices for and Switzerland’s KOF indicator, both for December, while in the American session we get the US pending home sales for November. In tomorrow’s Asian session we get China’s NBS Manufacturing PMI for December. Also note that the UK Parliament is to discuss and possibly vote on post Brexit trade deal and an approval could support the pound.

Support:0.8780 (S1), 0.8700 (S2), 0.8610 (S3)

Resistance:0.8855 (R1), 0.8935 (R2), 0.9010 (R3)

Support:0.7625 (S1), 0.7560 (S2), 0.7480 (S3)

Resistance:0.7680 (R1), 0.7725 (R2), 0.7785 (R3)