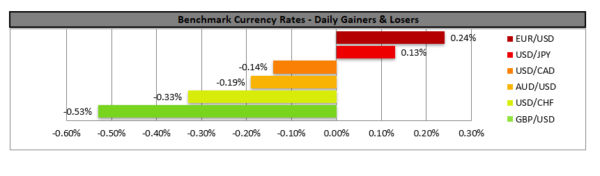

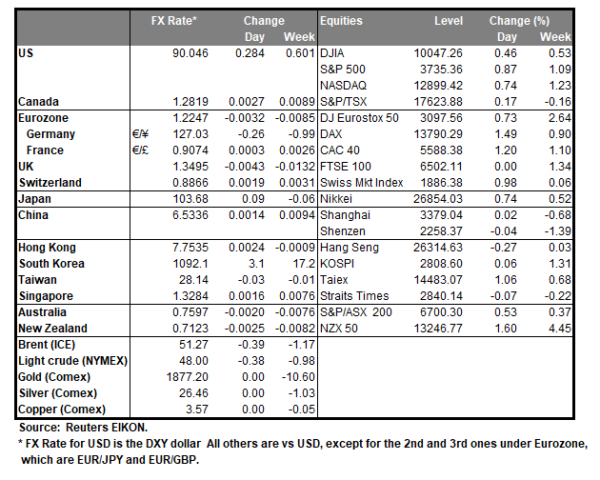

The dollar remained near a 2 ½ year low against a number of its counterparts yesterday due to demand for safe-havens remaining rather low, as U.S. lawmakers continued to push forward with a COVID-19 relief package. The risk on mood of the market got another boost, as the US House of Representatives voted yesterday to increase the stimulus payments to qualified US citizens from $600 to $2000, forwarding the new measure to the Senate for a vote. At the same time, it should be noted that the US House of Representatives also voted to override Trump’s veto of a defence bill, sending the measures also to the Senate. US stock-markets closed at record highs on Monday as investors were encouraged by the $900 billion stimulus package that US President Trump signed on Sunday. The risk on sentiment of the markets seems to continue and should it intensify further, we may see the USD losing some ground while riskier assets such as stocks could get further demand.

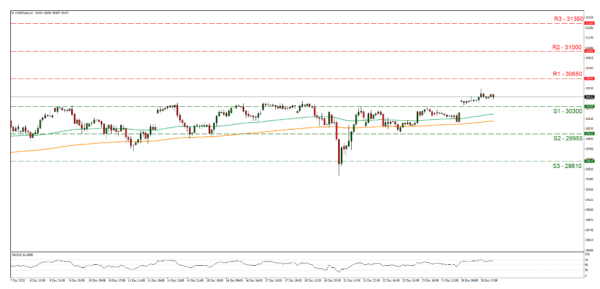

Dow Jones opened with a positive gap yesterday breaking the 30300 (S1) resistance line, now turned to support and continued even higher. We tend to maintain a bias for a bullish movement given the current fundamentals, yet the situation seems to be still somewhat fluid. Also it should be noted that the RSI indicator below our 1 hour chart seems to have stabilised somewhat above the reading of the 50, implying the presence of the bulls, yet declined somewhat in the last trading hour and the index is allready at record high levels, hence some cautiousness could be advisable. Should the index find fresh buying orders along its path, we could see it rising and testing if not breaking the 30650 (R1) resistance line. Should a selling interest be displayed by the market, we could see Dow Jones breaking the 30300 (S1) support line and start taking aim for the 29955 (S2) support level.

Pound continues to weaken

The pound continued its retreat against the USD as the market sentiment tended to be more cautious regarding Brexit given that the agreement between the UK and the EU about their post Brexit trade relationship still has substantial gaps. It’s characteristic as we mentioned yesterday that the largest and key financial sector for the UK economy, remains vulnerable as the deal does not cover it, thus limiting the access of UK finance companies to the EU market. In the auto industry the post Brexit deal may also not be enough as Bloomberg reported, as the Honda plant is to close and Nissan is to call off plans for new models. On the other hand, the EU states seem to approve the provisional application of the Brexit trade deal, practically providing a green light while the EU Parliament is to approve it at a later stage. Also, it should be noted that despite worries for the path of the pandemic in the UK remaining high, Astra Zeneca’s vaccine seems to be 95% effective and could be approved by the UK as early as this week. We expect that should the market worries for the UK-EU deal continue to guide pound traders the sterling could weaken while a possible excitement about AstraZeneca’s vaccine could provide some support. GBP/USD retreated further yesterday and at some point, even broke the 1.3470 (S1) support line, yet during today’s Asian session managed to surface above it. We could expect some stabilisation, given also that the RSI indicator below our 4-hour chart is at the reading of 50, implying a rather indecisive market, yet fundamentals seem to weigh on the pound side of the pair somewhat. Should the bears actually take charge, GBP/USD could clearly break the 1.3470 (S1) line and aim for the 1.3375 (S2) level. Should the bulls regain momentum, cable could once again take aim for the 1.3585 (R1) resistance hurdle, taking its chances with the 2 ½ year high level it tested on Christmas eve.

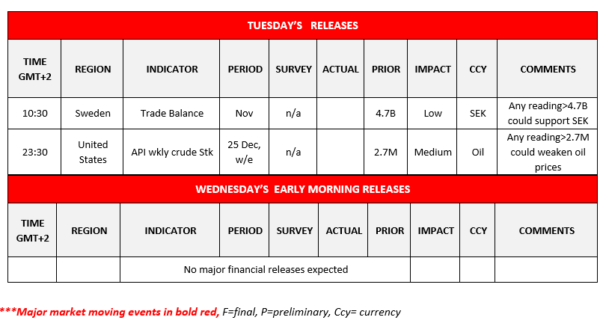

Other economic highlights today and early Tuesday:

No major financial releases are scheduled for the day, hence fundamentals could take the lead once again as the market experiences rather thin trading conditions.

US30 Cash H1 Chart

Support:30300 (S1), 29955 (S2), 29610 (S3)

Resistance:30650 (R1), 31000 (R2), 31350 (R3)

Support:1.3470 (S1), 1.3375 (S2), 1.3285 (S3)

Resistance:1.3585 (R1), 1.3700 (R2), 1.3835 (R3)