US equities rallied in overnight trading as the market reflected on the progress of stimulus talks and government funding bills. Democrats and Republicans have narrowed their differences and analysts expect that the two sides will reach a deal in the next few days. Such a deal will be positive for the country since the economic situation is tenuous. Yesterday, data from the Bureau of Labour Statistics showed that more than 900k Americans filed for unemployment claims last week. That was the third consecutive week of gains.

The Japanese yen declined slightly against the US dollar after the Bank of Japan delivered its final interest rate decision of the year. The bank decided to leave interest rates unchanged as most economists were expecting. It also left the ongoing bond purchases unchanged and pledged to do more to support the economy. Other central banks that have released their rates decision this week are the Fed, Bank of England, and Norges Bank.

The economic calendar will be relatively eventful today. In the United Kingdom, the Office of National Statistics will publish the latest retail sales numbers. Economists expect these numbers to show that the overall sales fell by 4.2% leading to an annual increase of 2.8%. In Russia, the country’s central bank will deliver its final decision of the year. Additionally, in Canada, the statistics office will publish October retail sales and housing sales numbers. Also, the Ifo Institute will release the German sentiment numbers.

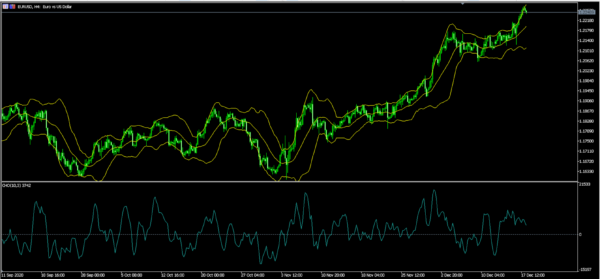

EUR/USD

The EUR/USD pair has been in a strong upward trend, as shown on the four-hour chart below. It is trading at 1.2245, which is slightly below this year’s high of 1.2272. On the four-hour chart, the pair is above the 25 day moving average and is slightly below the upper side of the Bollinger Bands. The Chaikin Oscillator is also above the neutral level. Therefore, the pair may continue rising as bulls aim for the next psychological level at 1.2280.

GBP/USD

The GBP/USD pulled back overnight as worries of a no-deal Brexit continued. It is trading at 1.3530, which is lower than the overnight high of 1.3626. It has also moved slightly lower than the important support at 1.3537. Similarly, the Average True Range (ATR) has dropped, in a signal that volatility is falling. The price is also slightly above the 25 day and 50 day moving average. Therefore, the pair will likely continue falling today with the next target being at 1.3500.

USD/JPY

The USD/JPY price bounced back after the BOJ decision. It is trading at 103.35, which is slightly higher than the intraday low of 102.85. On the four-hour chart, the Average True Range (ATR) has started to rise while the price has tested the 14-day exponential moving average. It is also slightly below the important resistance level at 103.65, which is where it formed a double bottom in November and December. Therefore, the pair may continue rising as bulls aim for this level.