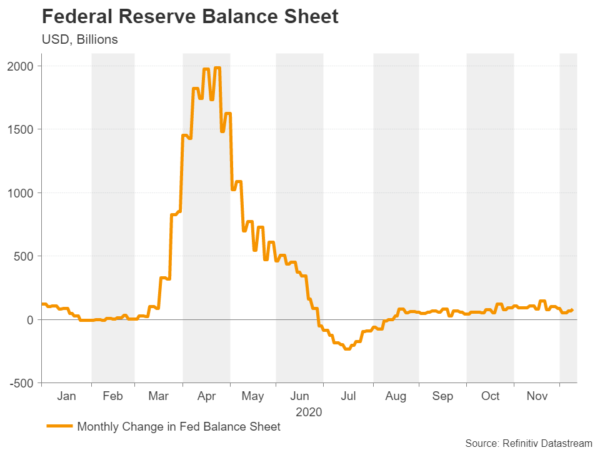

The Federal Open Market Committee (FOMC) begins its two-day policy meeting on Tuesday, with a decision expected on Wednesday at 19:00 GMT. Federal Reserve Chair Jerome Powell will give his last post-meeting press briefing of the year 30 minutes later. After a tumultuous year that saw an unprecedented amount of central bank intervention globally, Powell may draw 2020 to a close with one final dose of stimulus to steer the bumpy US recovery through stormy waters. But with investors betting that the Fed will do whatever it takes to keep a lid on long-term interest rates, which have been creeping higher since summer, is the US dollar about to get a leg up if policymakers under-deliver?

The deadliest wave of the virus yet

The United States is currently in the midst of a third wave of the coronavirus outbreak. But while the country was reluctant to go back into anything resembling a lockdown during the second wave, it may not have a choice this time round as the third wave is proving to be the deadliest yet. Most of California is already under a stay-at-home order and businesses like restaurants and gyms are either closed or operating under tough restrictions in many other states.

To top it all up, Congress is still dithering over the details of a new virus relief package. Without a deal soon, millions of Americans will have their pandemic unemployment benefits cut off at the end of December. This puts the Fed in a tricky spot as the central bank has done all it can from a monetary policy perspective, and it sees the right remedy for the US economy’s current troubles to be a fiscal one.

Can the Fed afford to do nothing?

However, doing nothing is probably not an option as this would send the wrong signal to the markets and could spark unwarranted volatility as well as a tightening in financial conditions. Hence, most punters anticipate the Fed to overhaul its forward guidance, specifically around its bond buying plan.

It’s likely policymakers will set out the conditions that would prompt them to change the pace of asset purchases (currently set at $120 billion a month). In other words, telegraphing to the markets how bad things would have to get before bond purchases are scaled up and how much further the economy needs to recover before they are scaled down would help provide more clarity and transparency around the decision-making process.

A new forward guidance may crush long-term yields

More significantly for the markets, the Fed could also change the composition of its purchases of Treasury notes so that there’s a bigger concentration on longer-dated Treasuries than on short-dated ones. Such a move would push down the yield on 10-year Treasuries, which spiked to almost 1% at the beginning of December, making it one of the highest among advanced economies.

Although higher yields have done little to prop up the beleaguered US dollar, since real yields have actually been falling due to rising inflation expectations, a drop in nominal long-term interest rates too could deepen the currency’s slump.

Fed decision could swing dollar either way

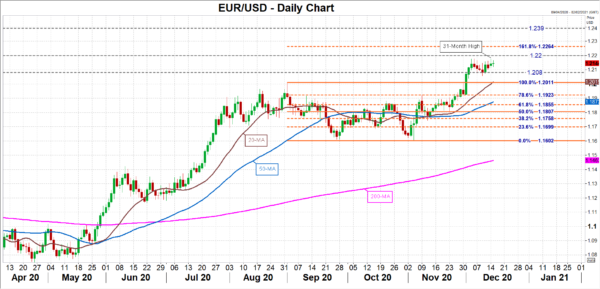

Against the euro, the next point of call for USD bears is the 161.8% Fibonacci extension of the September-November down move at $1.2264. If the Fed goes all out to sound dovish and reinforces expectations that low rates and yields are here to stay, euro/dollar could break above this key resistance, bringing into scope the $1.2390 area – a frequently visited neighbourhood from 2018.

However, if the Fed refrains from making substantial alterations to its forward guidance and sticks to updating its dot plot chart to convey its future policy intentions, yields may spike in response and disappointed investors may unwind some of their dollar selling. Euro/dollar would then be at risk of retreating towards the $1.2080 support. Slipping below this level would turn attention to the 20-day moving average (MA) at $1.20, followed by the $1.1860 region, which encapsulates the 50-day MA and the 61.8% Fibonacci retracement.