U.S. Highlights

- The S&P 500 edged lower this week on the back up in weekly jobless claims and sentiment that negotiations over the additional relief package have come to a standstill.

- On the economic front, besides jobless claims, optimism among small businesses was dialed back, and the consumer price index rose more than expected.

- The pandemic continues to dictate the path of economic recovery in the short run. The lack of progress on the stimulus package creates a risk of setting back the hard-won progress the U.S. has made over the past six months

Canadian Highlights

- The Bank of Canada left the overnight rate unchanged at 0.25% this week. Its quantitative easing (QE) program will continue at its current pace of at least $4 billion per week.

- Canada’s central bank is relatively new to the QE game, but it has played it with panache. Its balance sheet has ballooned from around 5% of GDP at the start of the year to nearly 25% in the third quarter.

- Accommodative monetary policy has gone a long way to supporting financial conditions. This has shown up in rising levels of household net worth, but also debt accumulation.

U.S. – Economic Progress Shows Signs of Waning

The week was a relatively quiet one on economic and financial fronts. Wall Street was chasing unicorns as share prices of home-sharing Airbnb and food-delivery DoorDash apps surged in their first days of trading. Nonetheless, the broad market edged lower this week on rising jobless claims and the sense that negotiations over a fiscal relief package have come to an impasse.

Besides the weekly release of jobless claims, the economic calendar was marked by reports on small business confidence and consumer price inflation. Optimism among small business owners pulled back by 2.6 points in November, reflecting the resurgence in COVID19 cases. The share of businesses expecting economic improvement declined, while the proportion of firms anticipating rising price pressures picked up on expectations of lower earnings and increased operating costs.

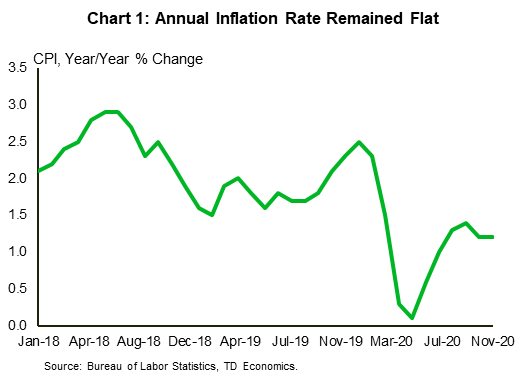

As if in corroboration of this sentiment, the consumer price index rose one tick higher than expected with a bump of 0.2% month-on-month but remained flat at 1.2% year-on-year (Chart 1). The core index, which excludes food and energy, remained unchanged from the prior month at 1.6% on a year-on-year basis. Inflation is still not a pressing concern, but it is worth paying attention to it. The economic shock also has supply-side implications – as noted by small businesses – which could show up in higher inflation even in the absence of robust economic growth.

This in turn could muddy the waters for the Fed. Today, markets expect that the policy rate will not see a hike until 2024. That’s a long time from now and if inflation does pick up, it could very well move sooner. Still, with the Federal Reserve signaling an increased willingness to tolerate inflation above its 2% it will take a convincing move to budge expectations.

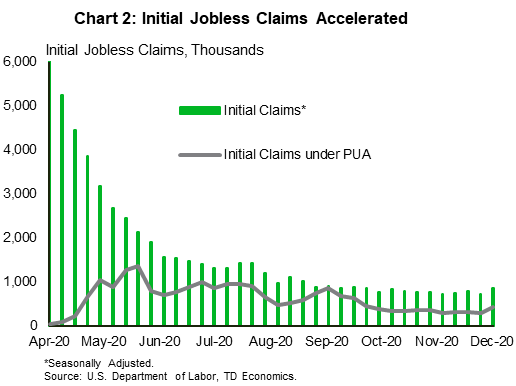

In the meantime, the unexpected acceleration in weekly jobless claims shows that the economy is far from a full recovery. Initial unemployment claims jumped by 137,000 to 853,000, while claims under the Pandemic Unemployment Assistance program (supporting self-employed and contract workers), increased by 139,000 to 427,000 (Chart 2). These were the highest increases since September. Unfortunately, the upward trend is likely to persist as restrictions increase.

This proves that the pandemic continues to dictate path of economic recovery. This week, an unprecedented record of 3,088 deaths on December 9th was yet another macabre reminder of the toll of the virus. The Institute for Health Metrics and Evaluation estimates that the need for hospital resources, such as intensive care units and invasive ventilators, has surpassed mid-April’s highs and is expected increase further. Tighter hospital capacity appears likely to force local governments to increase business restrictions further.

While the vaccine offers a light at the end of the tunnel, without some additional supports the economy’s resilience will once again be tested by the virus. Here’s hoping an agreement can be reached that maintains the solid progress made to date.

Canada – Bank of Canada, Last But Not Least To The QE Party

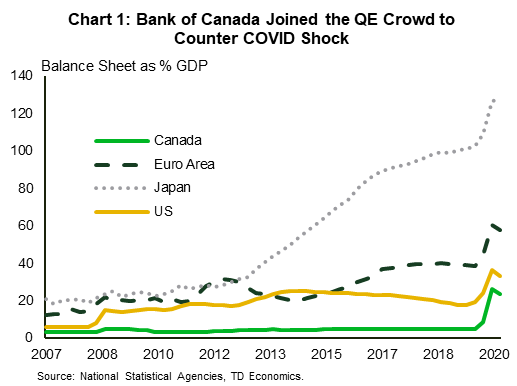

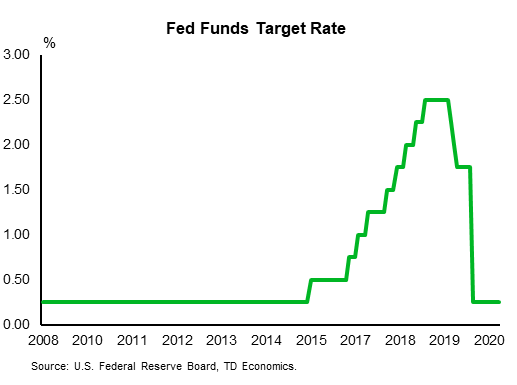

The Bank of Canada (BoC) entered a brave new world this year. Unlike most other advanced economy central banks, it managed to enter the COVID-19 downturn without a hugely bloated balance sheet. While other central banks went on buying sprees to the tune of 20% of GDP (Federal Reserve), 40% (European Central Bank), and a whopping 100% (Bank of Japan), the Bank of Canada kept its books relatively trim at just 5% of GDP (Chart 1).

That changed this year with the onset of the pandemic. Upon dropping the overnight rate to 0.25%, it began purchasing longer-term government bonds, expanding its balance sheet by $400 billion or nearly 19% of GDP over the scope of a few months. The later entry into quantitative easing allowed the Bank of Canada to go for the gusto. While other major central banks have also been in bond buying mode, the growth of the BoC balance sheet is surpassed only by the Bank of Japan.

The central bank’s enthusiastic foray into quantitative easing has put it under increased scrutiny. There is concern that creating money (or to be more accurate “reserve balances”) out of thin air, that the Bank is risking rampant inflation. Enter Deputy Governor Paul Beaudry to explain the program and the Bank’s motivation. In a speech this week, Beaudry noted that the Bank’s intention in purchasing bonds is the same as when it lowers the overnight rate – to decrease borrowing costs for Canadians – households, businesses, and yes, governments.

Rather than money printing, the Bank’s actions are more akin to maturity transformation. It is exchanging one form of short-term asset/liability (bank reserve balances) for a longer one (government bonds), thereby adding liquidity to the system. The Bank is not increasing the number of bank notes in circulation. As Beaudry explained, the liabilities it creates pay interest, (though this rate is currently just 25 basis points, the same as the overnight rate). As long the Bank is willing to raise this rate as the economy heats up, there is no reason to expect inflation to get out of hand.

Still, there is little doubt that lower interest rates are an important driver of household and business balance sheets as well as the government’s and central bank’s. This could be seen in Canadian wealth data released this week. The net worth of Canadian households, which more than recovered its first quarter decline in the second quarter, continued to advance in the third.

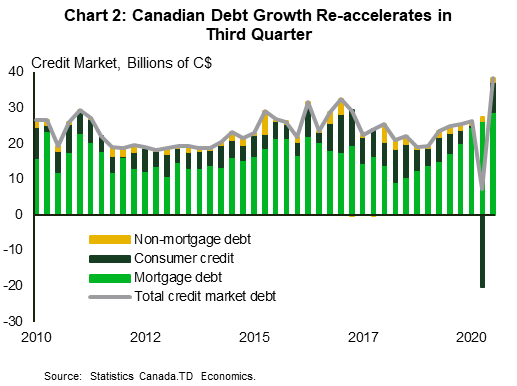

At the same time, lower interest rates encourage greater debt accumulation. After slowing in the second quarter, as households paid off credit cards, debt growth re-accelerated in the third quarter, driven by mortgage debt. As a result, the level of household debt relative to income rose to 170.1% from 162.8%

As long as interest rates remain low, the costs of servicing this debt will remain manageable. The challenge will come when inflation picks up. That’s not a story for today, but that doesn’t mean we shouldn’t pay attention to it. How policy supports are unwound as we come out of the crisis will be just as important as those taken during it.

U.S: Upcoming Key Economic Releases

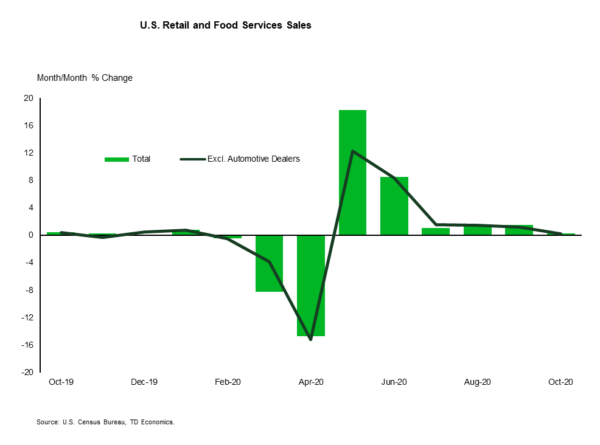

US Retail Sales – November

Release Date: December 16th

Previous: 0.3% total, 0.2% ex-autos

TD Forecast: -0.6% total, -0.5% ex-autos

Consensus: -0.3% total, 0.1% ex-autos

After slowing in October, retail sales probably declined in November. A decline in the auto component has been signaled by units data, and spending at bars and restaurants was likely held down by new COVID restrictions, but the control series probably fell as well, with holiday spending up less than allowed for by the seasonal factors. That said, the expected weakening follows significant strengthening in previous months.

U.S. FOMC Meeting

Release Date: December 16, 2020

Previous: 0.25%

TD Forecast: 0.25%

Consensus: 0.25%

We expect follow-through from Fed officials at the FOMC meeting on discussions about making the asset purchase/quantitative easing (QE) program more accommodative. At a minimum, the statement is likely to include new forward guidance stating that QE will continue until there is clear-cut progress toward the employment and inflation goals. We also expect a lengthening of the average maturity of purchases, although that is a closer call. The median dot plot projection is likely to show no rate increases through at least the end of 2023.

Canada: Upcoming Key Economic Releases

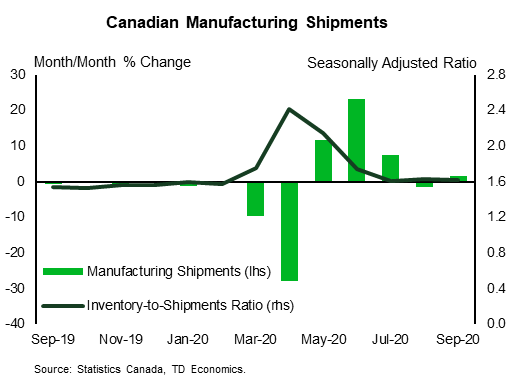

Canadian Manufacturing Sales – October

Release Date: December 15

Previous: 1.5%

TD Forecast: 0.6%

Consensus: NA

TD looks for manufacturing sales to rise by another 0.6% in October, in line with flash estimates, on the heels of broad export gains with the exception of transportation products. Transportation products will weigh on durable goods and the headline print owing to a pullback in auto production and aerospace exports, while primary metals and forestry products provide a source of strength. Real manufacturing sales should print slightly above the nominal increase owing to lower factory prices, which hints at some outperformance across manufacturing relative to other industries given StatCan’s tracking for a 0.2% m/m increase in October GDP.

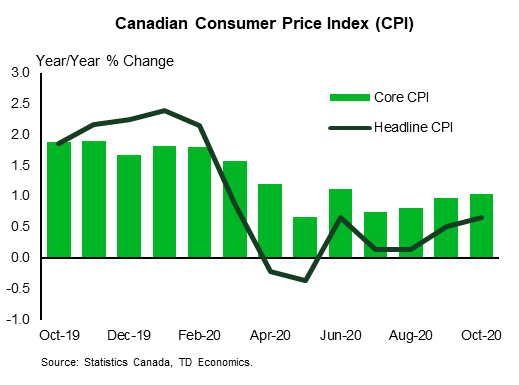

Canadian CPI – November

Release Date: December 16

Previous: 0.4% m/m, 0.7% y/y

TD Forecast: 0.0% m/m, 0.8% y/y

Consensus: NA

Headline CPI is projected to edged higher to 0.8% y/y in November, with prices unchanged on the month. Energy prices will exert a slight headwind due to lower prices at the pump, however, this is partially offset by higher electricity prices in Ontario. Elsewhere, we anticipate seasonal headwinds to clothing/apparel, airfares, and travel services will be less pronounced than usual given the significant disruptions from COVID-19, while shelter will provide a tailwind on higher new home prices. Looking to core inflation measures, we expect the ex. food & energy index (xFE) to firm by 0.2pp to 1.0% y/y, which will help to close the gap to other measures as the average of CPI trim/median/core should hold in the 1.7-1.8% range.

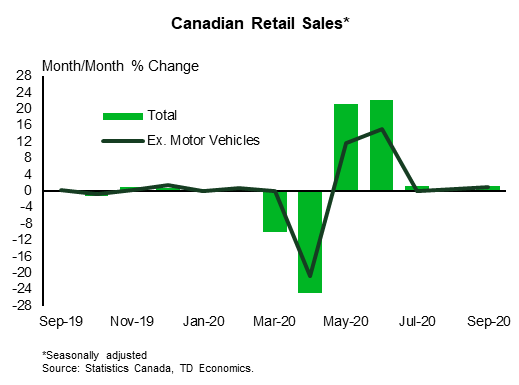

Canadian Retail Sales – October

Release Date: December 18, 2020

Previous: 1.1%, ex-auto: 1.0%

TD Forecast: 0.3%, ex-auto: 0.4%

Consensus: NA

Retail sales are forecast to push further above pre-covid levels with another 0.3% m/m advance in October. This is slightly above flash estimates for an unchanged print but consistent with labour market data that showed a solid performance across the retail industry. Motor vehicles should weigh modestly on the nominal increase, leaving ex-auto sales up 0.4%, with food/beverage sales likely to benefit from the anticipated decline in restaurant spending. Regional COVID measures were largely targeted at restaurants/bars in October and are unlikely to have any broader impact on the retail sector but present a risk for November and beyond.