U.S. Highlights

- COVID-19 concerns took center stage again this week as cases surged to new daily records. This overshadowed optimism on vaccine progress and mostly positive economic data, with U.S. equity markets trending modestly lower as a result.

- Retail sales grew by 0.3% in October, extending their winning streak. Housing market data meanwhile continued to surprise on the upside, with existing home sales up 4.3% on the month and housing starts up 4.9%.

- Signals from the labor market were not quite as upbeat, with initial jobless claims recording a mild increase to 742k last week from 711k the week earlier.

Canadian Highlights

- Positive news on the vaccine front was enough to push up the Canadian stock market this week. Oil prices also reacted by improving from $40 to $42, the highest reading since August.

- The vaccine is still many months away. In the near-term, surging COVID-19 infections are compelling provincial governments to impose tighter restrictions. Most have already started to do so.

- Rising cases and tighter restrictions could set the recovery in reverse. But positive vaccine developments bring promise that the pain will only be temporary. The spring can’t come soon enough.

U.S. – It’s Always Darkest Before the Dawn

Concerns around the spread of COVID-19 took center stage once again this week as infections surged to new records. Optimism over vaccine progress and broadly positive economic data generally played second fiddle. Equity markets trended modestly lower on the week as a result.

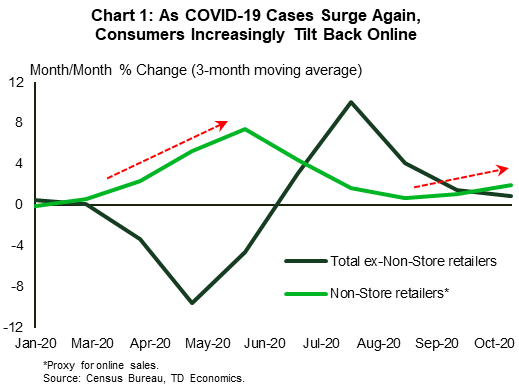

On the economic data front, retail sales improved by 0.3% in October, extending their winning streak to six months. The outturn, however, was below market expectations and a marked deceleration in the pace of gains from the 1.5% averaged in the three months prior. Within this slowing trend, there’s a noticeable shift toward online shopping. Sales at non-store retailers, a proxy for online sales, appear to be taking the lead once again as in-store sales moderate – a divergence that is in line with the third wave of COVID cases (Chart 1).

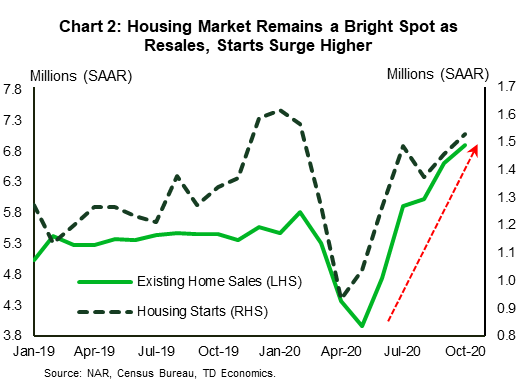

Home sales, meanwhile, continued to be robust in October. Existing home sales defied market expectations, rising by 4.3% (Chart 2). The growth in resale activity over the past several months has been nothing short of remarkable. Sales are now up nearly 27% from year-ago and 19% from the pre-crisis peak. The number of homes for sale, on the other hand, is in short supply. At the current sales pace, there is just 2.5 months of supply on the market – a record low. With such little product for homebuyers to choose from, the median sales price accelerated further, to 15.5% year-over-year. The strong acceleration in home price growth has overwhelmed the positive impact of record-low mortgage rates on housing affordability. The combination of deteriorating affordability and low supply is likely to lead to a more moderate pace of sales growth going forward.

The good news is that new supply does appear to be responding to these market forces. With builder confidence riding high, housing starts also defied expectations in October, rising a better-than-expected 4.9%. The increase was driven entirely by single-family starts – a clear signal of the shift in housing preferences during the pandemic.

Signals from the labor market were not as upbeat. While continuing jobless claims trended lower at the beginning of the month, initial jobless claims recorded a mild increase to 742k last week from 711k the week earlier. The still-elevated level of initial claims, a proxy for layoffs, points to softer labor market momentum. The rising spread of COVID-19 is an added near-term risk. With hospitalizations also trending higher, several jurisdictions throughout the U.S. are leaning more heavily on containment measures, which will weigh on business activity and hiring. What’s more, with the virus spreading out of control, stronger measures, such as lockdowns, cannot be ruled out for some parts of the country.

With more containment measures, no new fiscal supports, and the expiry of several Fed emergency lending programs (corporate credit, municipal lending and Main Street Lending programs), the near-term outlook is looking darker. Indeed, it appears that a sustained improvement in economic activity will likely have to wait for a vaccine. Fortunately, there is a light at the end of the tunnel. Major positive developments on the vaccine front in recent days suggest potentially earlier availability and the return to normal in 2021. It’s always darkest before the dawn.

Canada – Winter Is Coming

This week began with a bang. The biotechnology company, Moderna, followed Pfizer last week and announced that, based on preliminary data, its COVID-19 vaccine appears to be 94.5% effective. The good news injected further optimism in financial markets. At the time of writing, the S&P/TSX Composite Index was 1.6% higher than the close of last week. The positivity also found its way to oil markets. the benchmark WTI price jumped from $40/barrel at the beginning of the week to around $42 on Friday, the highest reading since August.

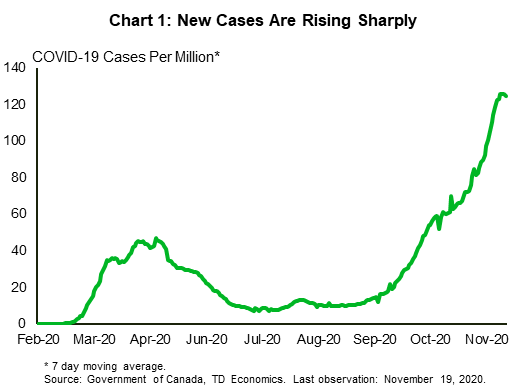

The vaccine news, while undoubtedly positive, is still a story for 2021. In the here and now, containing the spread of the virus and reducing the toll on human lives is still public health task number one. This week saw cases continue to surge in Canada. There were a little over 4,500 new cases a day over the past seven days (Chart 1), with the bulk of infections concentrated in larger provinces. More importantly, hospitalizations and the number deaths are rising day by day.

The initial reluctance of provinces to impose restrictions is quickly fading. Ontario, Quebec, and Manitoba have already levied new measures mandating temporary closures of businesses in high contact industries. Ontario will likely announce additional restrictions today. B.C. and Alberta, two provinces that have been the most hesitant on this front, have also started to tighten guidelines. Although they have so far been relatively minor, we could see further tightening in coming weeks. News of highly effective vaccines provides provinces with more impetus to impose harder-hitting restrictions now, given that there finally appears to be light at the end of tunnel.

However, this will almost certainly mean weaker economic activity in the near-term. More stringent rules will compound the pain the pandemic has already caused in some industries like food and accommodation services. Some businesses may not survive the winter.

For the most part, economic data released this week did not reflect this harsh reality. Retail and manufacturing sales data were from September, when caseloads were considerably more manageable. Retail sales improved 1.1% m/m, while manufacturing sales rose 1.5%. Future data points are unlikely to be as cheery. Indeed, the flash reading for retail sales points to zero growth in October.

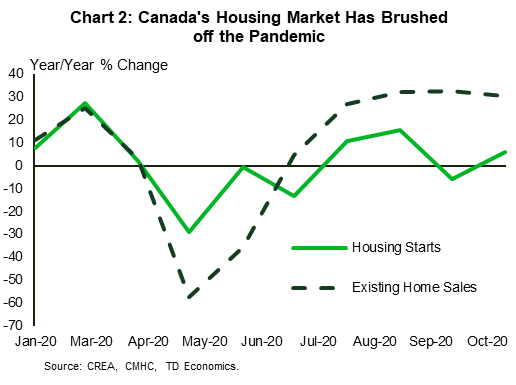

Conversely, the housing market has stood up remarkably well to the impacts of the pandemic (Chart 2). Existing home sales and housing starts both showed strength in October and were 30.6% and 5.8% above year ago levels. Inflation also picked up some steam, rising to 0.7% y/y. But this was mainly due to food prices. The core price measures remained below 2% and continue to reflect the deficiency in demand present in the economy right now.

This winter will be especially challenging for the Canadian economy. Rising infections and tighter restrictions could put the recovery in reverse. But positive vaccine developments bring promise that the pain will only be temporary. It looks to be a long and hard winter; the spring can’t come soon enough.

U.S: Upcoming Key Economic Releases

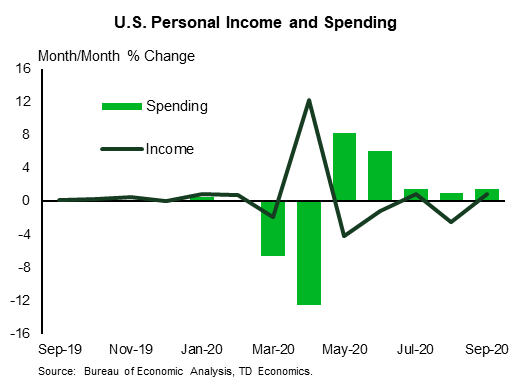

U.S. Personal Income and Spending – October

Release Date: November 25, 2020

Previous: Spending: 1.4% m/m; Income: 0.9% m/m

TD Forecast: Spending: 0.4% m/m; Income: -0.8% m/m

Consensus: Spending: 0.4% m/m; Income: 0.1% m/m

Consumption likely rose again in October, but with the pace slowing as fiscal stimulus faded. The fading of stimulus is likely to be reflected in a decline in income, even with a strong gain in payrolls. We expect more weakening in coming months, due to fallout from new COVID restrictions as well as further fading of stimulus. We estimate a 1.4% y/y pace for core PCE prices, down from 1.5% in September and 1.9% in February (pre-COVID). The overall PCE price index probably slowed to 1.2% y/y from 1.4% y/y; the y/y pace was 1.8% in February. COVID has been disinflationary, on balance.