Nearly four years ago, Donald Trump shocked the world by winning the US presidential election, pulling off one of the biggest political upsets in American history.

With polling stations opening in a few hours’ time, the lingering question is whether history will repeat itself with Trump catching markets off-guard once again and securing a decisive electoral college win. National polls favour Democrat candidate Joe Biden to defeat the incumbent, a development that is mysteriously similar to 2016. Whatever the outcome of this momentous day, it will certainly have a profound impact on financial markets.

US futures and Asian stocks have marched into Tuesday with a spring in their step as encouraging factory activity data and expectations of a ‘blue wave’ victory for Democrat candidate Joe Biden have boosted risk sentiment. A clear Biden win, where his party retains control of the House and wins the Senate, seems like the most positive outcome for markets. Such a result will open the doors to a round of large-scale fiscal stimulus that could nurse some of the damage COVID-19 has inflicted on the US economy. Should Biden win with Republicans retaining the Senate, this may reduce the odds of a larger fiscal stimulus and could be less positive for global risk sentiment.

A Trump victory will certainly catch markets by surprise and prove the polls wrong again. Although this outcome may result in a smaller or even delayed fiscal package, the policy continuity from his re-election could send stock prices higher over the medium term.

In the event of a contested result, risk aversion is likely to sweep across global markets which would trigger a stock market selloff, while boosting appetite for the safe-haven Dollar, Yen and Gold.

Dollar outlook hangs on election outcome

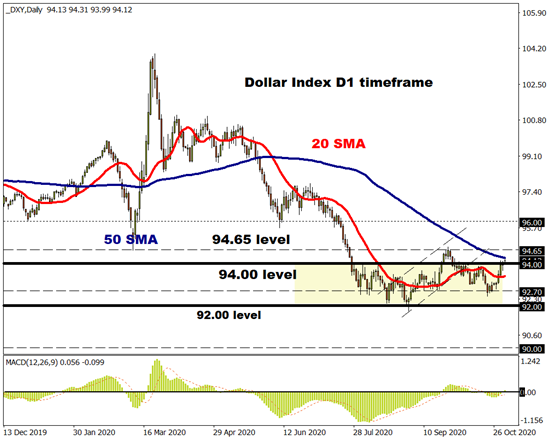

King Dollar’s performance over the next few days will be heavily influenced by the election outcome. As results start flowing in later this morning, the Dollar is poised to remain highly sensitive and volatile as investors attempt to figure out who the next President of the United States will be. A ‘blue wave’ outcome may be negative for the Greenback due to an even bigger stimulus package by Democrats lifting inflationary pressures. On the other hand, a contested result might inject bulls with fresh inspiration to push the DXY beyond the 94.00 resistance level, given the Dollar’s safe-haven status.

Talking technicals, a solid daily close above the 94.00 level could open a path towards 94.65 and beyond. Alternatively, a clear Biden sweep should see the Dollar weaken and trigger a decline back towards 92.70.

Commodity spotlight – Gold

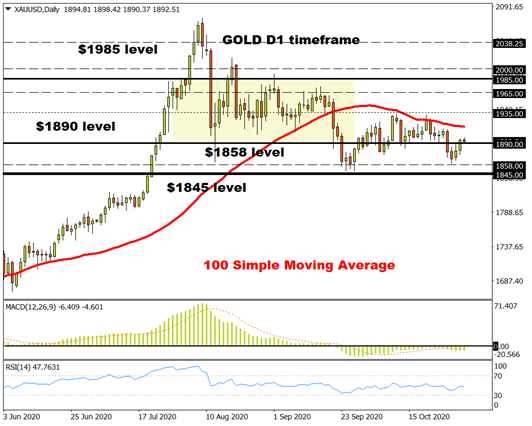

Over the past few weeks, Gold has been waiting for a fresh directional catalyst to break out of its current range. This could come in the form of the US election today.

A Democrat sweep is likely to provide Gold a handsome tailwind in the form of a weaker Dollar. Although the metal may also derive some strength from a Trump win, the upside is likely to be limited by other forces in the short to medium term. As new coronavirus cases surge in Europe and the United States, investors are rushing towards the world most liquid currency. If the Dollar ends up appreciating on a contested election outcome, this could limit Gold’s upside despite the risk aversion.

Looking at the technical picture, Gold is hovering around $1890 as of writing. The key levels of interest remain $1935 and $1965 to the upside and $1858 support if prices go lower.