The Eurozone’s calendar will get relatively busy at the end of this week, with the European Central Bank (ECB) gathering to set policy at a crucial time for the bloc on Thursday at 11:45 GMT, while on Friday, the agenda will be packed with Q3 GDP growth, October’s inflation, and September’s employment figures, all released at 09:00 GMT. Given the exponential increase in Covid cases and the new restrictive measures applied, which make a double dip in Q4 a more realistic scenario, markets anticipate more actions by the central bank. Yet, policymakers could hold patient this time and instead set the stage for more stimulus in December.

Q3 flash GDP data could be old news

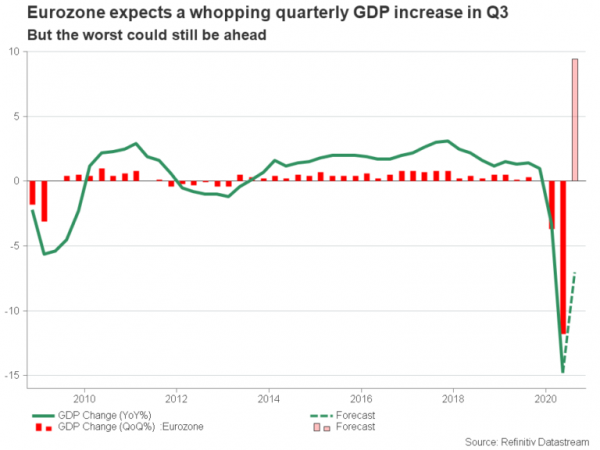

A few months ago, markets were hopeful that a V-shaped recovery will materialize in the second half of the year as governments have been gradually scaling back lockdown restrictions, allowing companies to resume operations, although within certain limits. Indeed, Friday’s preliminary GDP growth data for Q3 are forecast to show a whopping quarterly expansion of 9.4% and an annual change of -7.0%, which is still progressive when compared to the -14.7% mark registered in Q2. However, traders are not waiting excitedly for the numbers anymore. Instead, they are now seriously concerned that 2020 could conclude with another double-dip contraction as the recent tremendous resurgence in virus cases has hit every corner of the bloc before the flu season even starts, forcing member states to put drastic measures in place. Hence, this week’s flash GDP data could be old news and a weak market mover.

The ball is in the ECB’s court

The reality check is that the worst could still be ahead and more needs to be done to save the economy from another freefall, especially if hospital capacities get exhausted, resulting in another full lockdown. On the fiscal front, it seems that EU leaders are not ready to expand their budgets yet. Apparently, this was the main reason why the recovery plan and stimulus talks were not included in the summit agenda earlier this month. Moreover, what seemed to be a historical breakthrough in July when the 750 billion euros recovery fund was approved, is now looking more as an unfinished business and an issue of compliance as member states are delaying any ratifications of the scheme in national parliaments. It is also worthy to note that Germany and France are planning to cut deficits next year, while the story could get even more complicated if someone considers the German election in 2021.

Therefore, the ball is now in the monetary court, and Thursday could be the right time for the ECB to push some action. The muted inflation CPI measure, which is said to remain steady at -0.3% y/y in October, and the rising unemployment rate, which is expected to climb to 8.3% in September, could be another good excuse to adopt a more accommodative policy.

Setting the stage for more stimulus

Still, with interest rates already below zero, making any additional cuts useless, and the asset purchase program stretched near its limits, an increase in the 1.35 trillion euros Pandemic Emergency Purchase Program (PEPP) could be the main option now. Particularly, forecasts suggest a boost of 500/600 billion euros and an extension to the end of 2021 but policymakers may rather postpone such a decision to the December meeting when there will be more clarity about how US policies will adjust following the election on November 3 and how badly the new pandemic restrictions are hurting the economy. Brexit uncertainty may also lessen before the December deadline.

Nevertheless, markets will keep looking for clues that another stimulus package could be announced in the last meeting of the year, paying special attention to President Lagarde’s press conference. Probably a more dovish language and an outlook downgrade could be convincing enough that the central bank is preparing to add more liquidity to the market.

Market reaction

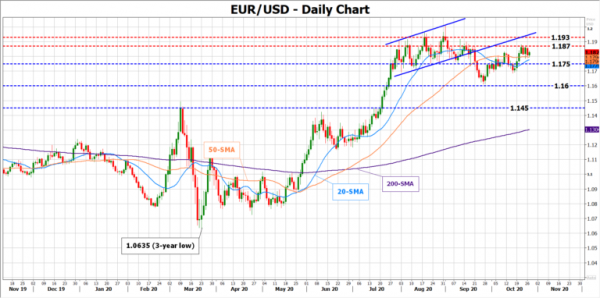

As regards the market reaction, the euro could benefit if policymakers show willingness to strengthen their stimulus package, likely pushing EUR/USD towards the 1.1870 key resistance area. A steeper rally could also hit a wall around 1.1930.

Alternatively, if the ECB strikes a more dovish tone than markets anticipate but leaves traders uncertain about whether monetary policy could turn more generous in December, the pair could decelerate towards the 1.1750 support region. In this case, President Lagarde could also call for more fiscal contribution as she did last week.