US futures dropped as traders remained concerned about the upcoming election and uncertainty over covid-19 funding. In a statement, the Director of National Intelligence (DNI) said that Russia and Iran had stepped-up election interference in the US. He said that Iran had been sending spoofing emails designed to intimidate voters and damage the current president. Also, traders were concerned about a Covid-19 vaccine after a Brazilian participant in a trial by AstraZeneca died. That risks delaying a vaccine even as the number of cases continues to rise. Also, traders are concerned that the US will not have a stimulus package before the upcoming election.

The Canadian dollar fell against the US dollar as traders reacted to the country’s inflation and retail sales numbers. According to Statistics Canada, the headline consumer price index (CPI) rose by 0.5% in September, an improvement from the previous 0.1%. The core CPI, which does not include oil and energy, rose by 1.0% after rising by 0.8% in August. Meanwhile, the headline and core retail sales increased by 0.4% and 0.5%, respectively. These inflation numbers are significantly below the Bank of Canada’s target of 2%.

The price of crude oil declined in overnight trading as traders reflected on the inventories numbers from the United States. Data from the Energy Information Administration (EIA) showed that total inventories declined by 1 million barrels. That was a smaller decline than the previous week’s decline of more than 3.8 million barrels. Gasoline inventories rose by more than 1.8 million barrels while the distillate fuel production fell by more than 138k barrels.

EUR/USD

The EUR/USD price declined slightly after it reached a high of 1.1883 in overnight trading. It is now trading at 1.1833, which is slightly above its previous October high. The price is also slightly above the 15-day and 25-day exponential moving averages. Also, the RSI dropped slightly after it moved above the overbought level of 70. It is also above the ascending trendline that is shown in pink. Therefore, even with the decline, the trend remains bullish, which means that the price may rise and test the resistance at 1.1900.

GBP/USD

The GBP/USD price rose to an intraday high of 1.3165, which is along the upper side of the previous ascending channel shown in pink. The price has also moved above the dots of the Parabolic SAR and is along the upper line of the Donchian channel. Oscillators like the RSI and Stochastics have also moved above the overbought level. Therefore, the price is likely to continue rising as bulls aim for moves above 1.3200.

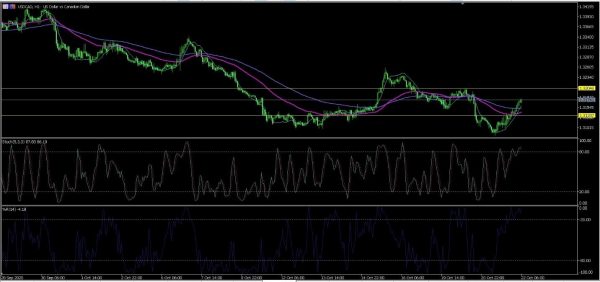

USD/CAD

The USD/CAD price rose to a high of 1.3175. On the hourly chart, this price is above the 25-day and 15-day exponential moving averages while the William % range and the commodity channels indicator have moved above the overbought level. The price is also above the dots of the Parabolic SAR indicator. The upward trend is likely to remain as bulls aim for the next support at 1.3200.