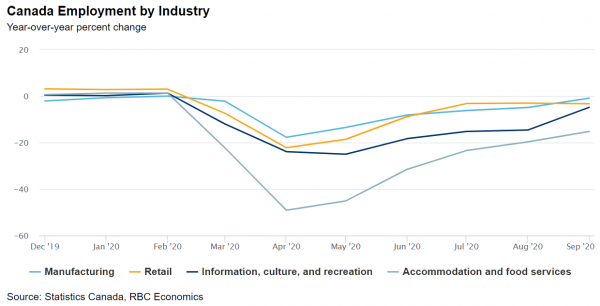

A stronger-than-expected September labour market report nonetheless was still flagging a slowdown in the pace of improvement that can be expected going forward – and also reinforced the uneven nature of the bounce-back to-date by industry. Early reports showed the housing market on track for another exceptionally strong month in September which we look to be confirmed in the official report next week. Retail sales have also bounced back quickly (even if employment in that sector has yet to fully catch up as consumers shift from brick-and-mortar to online shopping). Other sectors, especially the services industries that rely on in-person interactions like food and accommodation services have continued to lag substantially. The number of new COVID-19 cases set new records across regions over the week past, and those industries that have been slowest to recover to-date will also likely be the first to bear the brunt of a new round of containment measures.

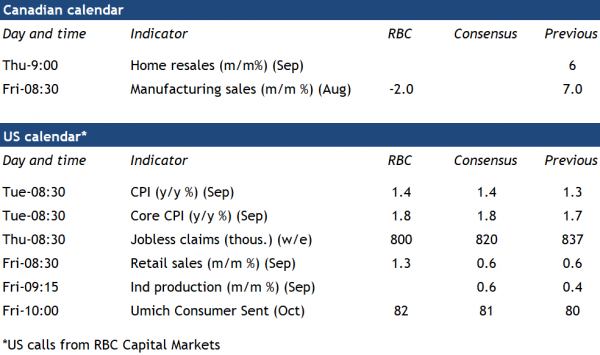

In the meantime, the industrial sector rebound looks to have stumbled in August. The advance estimate from Statcan suggests a 2% decline in manufacturing sales in the month, in line with the pullback in export volumes of both motor vehicles (after an abnormally strong July) and aerospace products. Still, even with the expected 2% decline, sales are still tracking a 5% rise in the first two months of the third quarter combined. And early data for September looks better. The Canadian manufacturing PMI ticked up in September and manufacturing hours worked rose another 3.7% — and employment in the sector was back to within 1% of year-ago levels.

Week ahead data watch:

- Despite an expiration in the CARES Act, early indicators like debit/credit card transaction data suggest that spending held up well in September. We expect to see a 1.3% increase in next week’s September US retail sales report

- US September CPI next Tuesday will be watched closely for early signs of inflationary pressure as household spending remained strong. Our forecast suggests the headline rate to tick up to 1.4% year-over-year. But that likely won’t have any implications for Fed policy

- US industrial production likely edged higher in September, driven by the manufacturing sector. The ISM manufacturing report showed 14 of the 18 manufacturing industries reported growth amid expanded demand. The index ticked slightly lower but remained well above 50

- COVID-19 case counts will continue to be watched closely – alongside any additional re-imposition of containment measures