- Stock markets erase early losses, close higher on hopes of a US fiscal deal

- Dollar sinks on concerns government deficit will blow up

- But euro falls even more as ECB teases Fed-style inflation approach

- Stimulus talks will continue to drive markets today, along with key data

Wall Street stages epic comeback

Global markets continue to dance to the tune of the US stimulus talks. Wall Street erased some early losses to close substantially higher on Wednesday as negotiators took another stab at finding a compromise deal that both political parties can get behind.

The optimism was later reined in by Senate majority leader McConnel, who said the two sides remain far apart. That took some wind out of the high-flying stock market, leading the S&P 500 to close just 0.8% higher. Tempering sentiment further was vaccine-developer Moderna, which warned that its coronavirus vaccine may not be ready until early 2021.

The negotiations will continue today, and markets remain quite confident of a breakthrough as futures point to another substantially higher open on Wall Street. While the two camps are still some distance apart on the price tag, with the Democrats at $2.2 trillion and the White House around $1.6 trillion, there is talk of an ‘escalator clause’ that could be the magic card that bridges this gap.

The package may cost something close to $1.6 trillion, but with the provision that it mechanically increases towards $2 trillion if coronavirus numbers spike again or if the economic recovery stalls. Hence, something akin to an automatic stabilizer, with the added benefit that neither side loses face politically by appearing to concede too much ground.

Overall, with the stock market’s gains this week coming almost entirely from stimulus hopes, this is turning into an asymmetric make-or-break event for many assets. If we finally see an agreement, that could catapult equities higher and sink the dollar further, whereas the absence of one might spark the opposite reactions but perhaps in even greater magnitude as a lot of optimism has been priced in already.

Dollar grinds lower as deficit worries resurface

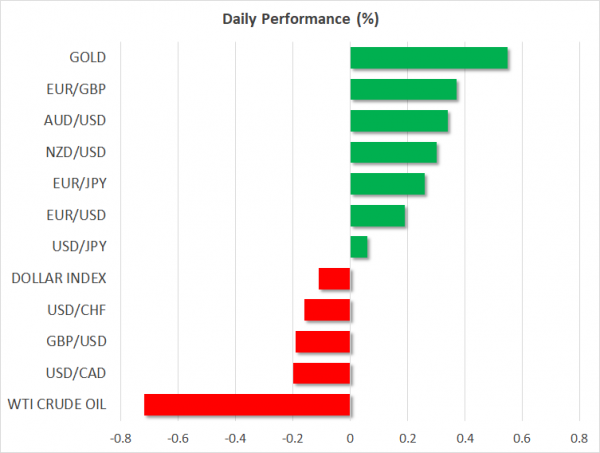

In the FX sphere, the dollar was on the ropes once again despite an increase in long-dated US Treasury yields, which is typically beneficial for a currency. It wasn’t this time though, because investors were not pricing in a stronger US economic outlook by selling bonds, but instead were factoring an explosion in debt.

The risk-on atmosphere likely played a role as well, curbing safe-haven demand for the reserve currency, which tends to move in opposite direction to equity markets nowadays.

And yet, it was the euro that performed the worst, after prominent ECB officials started to float the idea of a ‘symmetrical inflation target’, where the Bank allows inflation to overshoot its target for a while without acting. This is basically what the Fed has done, but given the ECB’s disappointing track record on inflation, there’s some understandable skepticism in market circles.

The best performers were risk-sensitive currencies such as the loonie, aussie, and kiwi. If we see a stimulus deal soon, these stand to gain the most, particularly against the dollar. They also stand to lose the most in case of no-deal, which may be especially true for the loonie given Canada’s high exposure to the US economy.

Today: ISM manufacturing, Brexit talks, EU summit, and key speakers

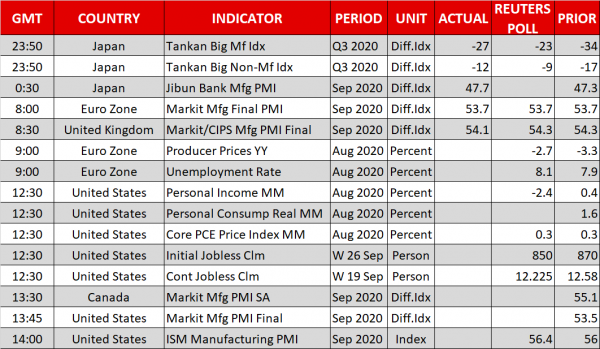

Besides the US stimulus talks, there’s also a raft of crucial data coming up, most notably the ISM manufacturing PMI. Meanwhile, personal income and spending numbers for August will tell us how big of a hit the American consumer took after crucial unemployment benefits were tapered.

In Brussels, EU leaders will meet to discuss the delays in the recovery fund and the tensions with Turkey, while Brexit talks will continue amid hopes the two sides can enter the intense ‘tunnel phase’ soon.

Finally, the charm offensive from central bankers continues with the BoE’s Haldane at 10:20 GMT, the Fed’s Williams at 15:00 GMT, and Bowman at 19:00 GMT.