Global stocks had their best day since June yesterday as investors started being optimistic about the global economy. Banks, which are having their worst year in a decade, were the best performers. In the United States, JP Morgan, Bank of America, and Citigroup rose by more than 2%. Similarly, in Europe, banks like Deutsche Bank, Commerzbank, and BNP Paribas also did well. This strong performance was partly because of data from China that showed that industrial profits rose by 19.1% in August from the same month in 2019. This was the latest sign that the vast economy was rebounding from the effects of the pandemic.

The euro rose slightly during the European and American sessions. This increase was mostly because of the possibility that the European Union and the United Kingdom will reach an agreement on Brexit. Later today, the currency will react to the business and consumer confidence data from Europe. Analysts polled by Reuters expect the data to show that consumer confidence remained unchanged at -13.9 while services sentiment improved slightly to -15.3. Most importantly, the euro will react to the preliminary inflation data from Germany.

The US dollar declined against most currencies as investors assumed that other countries will not implement lockdowns as coronavirus infections rise. Later today, the currency will react to a series of Federal Reserve officials’ statements. Among the speakers will be John Williams, Patrick Harker, and Randal Quarles. Also, the dollar will react to the consumer confidence data and retail inventories and wholesale inventories from the United States.

EUR/USD

The EUR/USD pair rose to an intraday high of 1.1675, which was the highest it has been since Thursday last week. On the four-hour chart, this price was also along the upper line of the Donchian channels indicator. It was also along the 25-day exponential moving averages. Still, the price is slightly below the important resistance level at 1.1750, which is the neckline of the previous head and shoulders pattern. Therefore, while the pair is likely to continue rising today, there is also a likelihood that it could also decline and retest last Friday’s low at 1.1600.

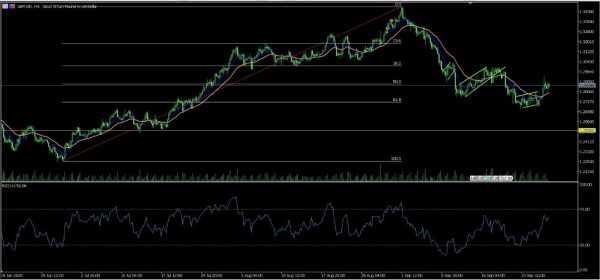

GBP/USD

The GBP/USD pair rose to a high of 1.2935. On the four-hour chart, the price is along the 50% Fibonacci retracement level. It is also slightly above the 25-day and 50-day exponential moving averages while the RSI has moved up to almost 60. The pair also seems to be in consolidation mode after yesterday’s rise. Therefore, like the EUR/USD, it could continue rising today or also have a pullback and possibly move below 1.2900 again.

NZD/USD

The NZD/USD pair was little changed in overnight trading. It is trading at 0.6568, which is along the 25-day exponential moving averages. The signal and main lines of the MACD have started going up. Also, the price seems to be forming a bearish pennant pattern that is shown in white. As such, while the pair is likely to continue consolidating, there is a possibility that it will ultimately break out lower.