US stocks declined sharply as the decline of technology stocks continued. The Dow Jones declined by more than 632 points while the S&P 500 and Nasdaq 100 fell by more than 95 and 465 points, respectively. Among the biggest losers were technology stocks like Apple, Amazon, Tesla, and Facebook. These stocks fell partly because investors are worried about their valuations. At the peak, Apple had a market capitalisation of more than $2.3 trillion while the biggest five tech companies were valued at more than $8 trillion. Investors are also worried about the rising tensions between the US and China. In an interview on Monday, President Trump said that he would consider decoupling from China if he won the upcoming election.

The US dollar index continued rallying during the Asian session as traders reacted to news that AstraZeneca and Oxford University were pausing their vaccine trial after a participant got an adverse reaction. This is a major setback for AstraZeneca, which has already received orders worth billions of dollars. It is also a setback to many investors who were expecting a vaccine to be unveiled in the next few months. The dollar also rose because of the recent strong economic data from the United States. These include the recent employment, manufacturing, and services PMI numbers.

The Canadian dollar declined against the US dollar because of falling crude oil prices. Brent and West Texas Intermediate (WTI) has declined by 0.90% and 1.06%, respectively today. The two have also fallen by more than 10% in the past week. As a major oil exporter, lower oil prices affect Canada and the Canadian dollar negatively. The currency has also dropped because of the BOC interest rate decision that will come out today. Analysts expect the bank will leave rates unchanged at the current rate of 0.25%.

USD/CAD

The USD/CAD pair is trading at 1.3236, which is the highest it has been since August 25. On the four-hour chart, the price is slightly below the 38.2% Fibonacci retracement level. It is also above the 50-day and 100-day exponential moving averages, which is a bullish sign. The RSI has also moved back to the overbought level. Therefore, the price is likely to continue rising since it seems bulls have taken over. If it does, the next target will be the 50% retracement at 1.3355.

GBP/USD

The GBP/USD pair dropped to an intraday low of 1.2960 as traders continued to worry about Brexit. This price is significantly lower than last month’s high of 1.3488. On the four-hour chart, the price has moved below the 50-day and 100-day exponential moving averages. The price is also along the lower line of the Bollinger bands while the RSI has continued to fall. Therefore, it seems like a reversal has happened, which will likely see the price continue to fall.

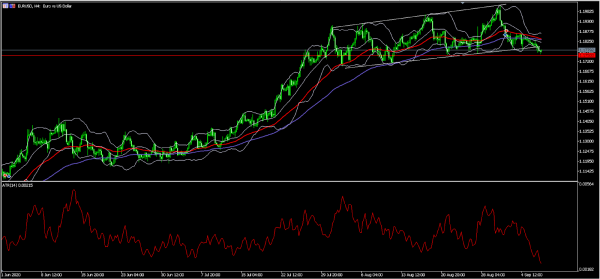

EUR/USD

The EUR/USD pair declined to an intraday low of 1.1750, which was an important support. The pair has also moved below the white ascending channel and the 50-day and 25-day moving averages. As the GBP/USD, the pair is along the lower line of the Bollinger bands while the average true range has continued to fall. The price is likely to continue falling as bears attempt to move below 1.1700.