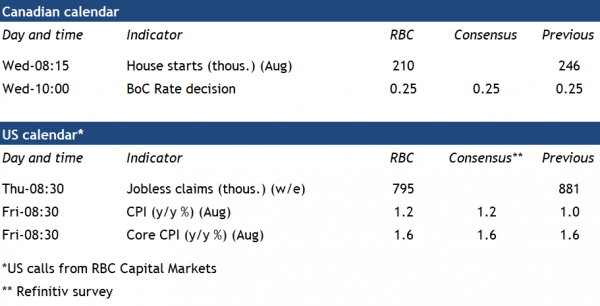

Expect the Bank of Canada to stay focused on economic growth rather than damage control during its policy deliberations next week.

Another gain in August employment – this time more heavily weighted to full-time work – added a measure of reassurance that labour markets are still rebounding after an unprecedented plunge in the spring. And the economic fallout in Q2 wasn’t quite as severe as many feared. The 38.7% (annualized) drop in GDP growth during the quarter was only slightly better than the 43% decline noted in the bank’s ‘central-tendency’ forecast – but also bested even the most optimistic scenarios laid out in the April Monetary Policy Report. What’s more, sizeable increases in monthly output reported for June and July have left the Q3 rebound tracking in the 40% range – above the 30%-ish increases both ourselves and the Bank of Canada had called for.

Nevertheless, the fact that a 39% drop in GDP in Q2 counts as a positive surprise reflects just how unparalleled this shock has been – rather than something to get too excited about.

Household income risks may be smaller but economy still weak

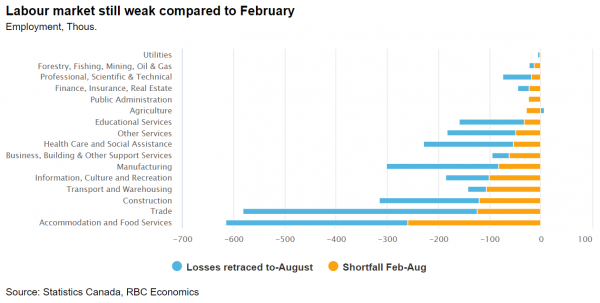

Indeed, encouraging news aside, the economy is still running well below capacity. Employment remains down a million from February despite already recovering two thirds of the massive losses posted in March and April. Investment in the oil & gas sector remains sharply depressed. And price growth is still below target. The central bank’s preferred core CPI measures have held up better than expected, but headline CPI growth was still just 0.1% year-over-year in July.

New government aid to replace CERB will soothe worries that exceptionally weak labour markets will outlast policy supports. So policymakers might strike a more upbeat tone. But the latest economic improvements won’t be enough to move the bank’s stance on accommodative monetary support. The main thrust – a commitment to keep the policy rate in place until economic slack has been absorbed and a continuation of GoC purchases of at least C$5bn per week – is unlikely to budge in next week’s meeting.

Housing market blazing in the summer

After leaping to a two and a half year high in June, we expect Canadian housing starts to slow a bit in July – settling at 210k, a level that’s still historically strong. National starts averaged almost exactly those levels over the same period in 2019 (99.2%) to July, illustrating just how solid the rebound in new building has been, despite COVID containment measures that pushed Quebec starts to zero in April. This momentum will likely continue in coming months, signaled by still resilient permits data.

Meantime, the surge in home resales in Canada has been almost breathtaking, with sales soaring 30% above year-ago levels nationally in July. And early indications from local real-estate boards suggest things didn’t cool off much in August. We expect both resale and new building activity to remain elevated before declining towards the end of this year. In the longer run though, due to lower household formation and a substantial slowdown in migration from COVID-19, demand for new builds will likely fall.