Policy meetings by the European Central Bank and the Bank of Canada will heat up the September central banks schedule in the coming days, adding some excitement to an otherwise uneventful week. Neither central bank is expected to announce any new measures so the focus will be on what policymakers say about the recovery and the outlook. The ECB, in particular, will be one to watch as deflation worries are mounting and a stronger euro could jeopardise an already weakening recovery. The latest trade data out of China will also be on investors’ radar, while a new round of Brexit talks and July growth figures are bound to bring some volatility for the pound.

China’s recovery remains on track

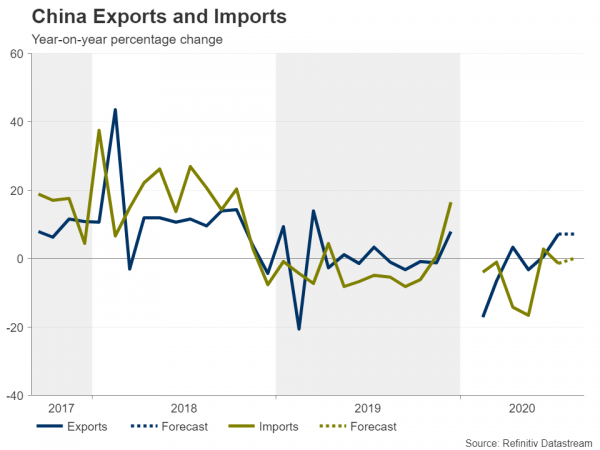

China’s bounce back from the virus slump hasn’t exactly been spectacular but it’s proving to be more sustainable than that of its major peers. The steady improvement recorded since March has been one of the factors fostering the markets’ conviction for a full global economic rehabilitation from the COVID-19 pandemic. Monday’s trade numbers for August could further bolster that view if they follow in the path of the upbeat PMIs.

Exports are projected to have risen by 7.1% year-on-year in August, maintaining a similar pace to July, while imports are expected to have nudged up by 0.1% y/y. Other releases out of China will include producer and consumer prices for the same period on Wednesday.

Should the August hard data match the survey reports, the Australian dollar – a commonly used proxy for China-related trades – could enjoy some support, having suffered a sharp pull back in the past few sessions from two-year highs. Australian business and consumer sentiment surveys due on Tuesday and Wednesday could also rouse the aussie, although, ultimately, whether it can rebound will depend on how far the US dollar’s mini revival lasts.

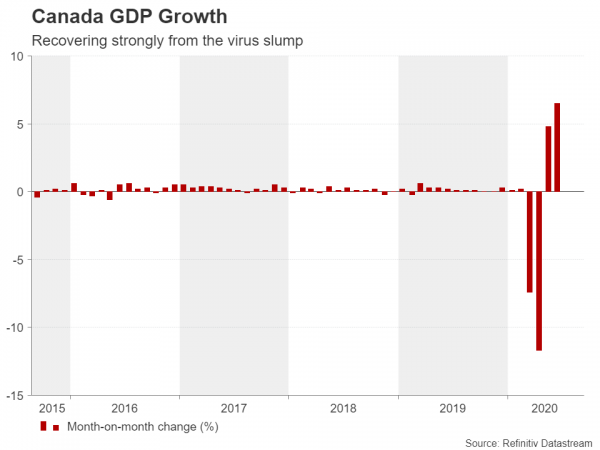

Bank of Canada to hold tight in September

The Bank of Canada will announce its latest policy decision on Wednesday and is widely anticipated to stand pat as Canada’s recovery gains traction. The combination of a strong monetary and fiscal response to the virus crisis in Canada appears to be bearing fruit. Both employment and consumption have picked up sharply and GDP growth accelerated to 6.5% month-on-month in June. With signs the recovery in the United States – the primary destination for Canadian exports – has merely slowed rather than faltered from the virus resurgence, and Canada so far steering clear of a second wave of its own, the economic picture is looking up.

That probably explains why the Canadian dollar has finally come within sight of erasing its year-to-date losses versus the greenback as investors have given up on the possibility of the BoC cutting rates below 0.25% anytime soon. That’s not to say, however, that policymakers won’t be tempted to take a dovish turn.

Like the Federal Reserve, the BoC is considering alternative methods to inflation targeting as its monetary policy framework is up for renewal next year. Recent remarks have fuelled speculation that the BoC could follow the Fed in adopting average inflation targeting, which could mean rates could stay at 0.25% for far longer than the two years currently being signalled by the Bank.

Such expectations could damage the loonie’s long-term prospects, but in the short-term, the currency could be boosted by hints from the BoC that it is satisfied with the progress of the recovery.

Will Lagarde attempt to strike down the euro?

The ECB meets one day after the BoC and no change is expected across the Atlantic either. Although there are signs the European recovery is slowing, it’s too early to draw any conclusions from the data and the euro area may yet outperform the US in the second half of 2020. However, fears of a major second wave persist as the approaching colder weather and the reopening of schools across the continent could inflame the summer surge of the coronavirus.

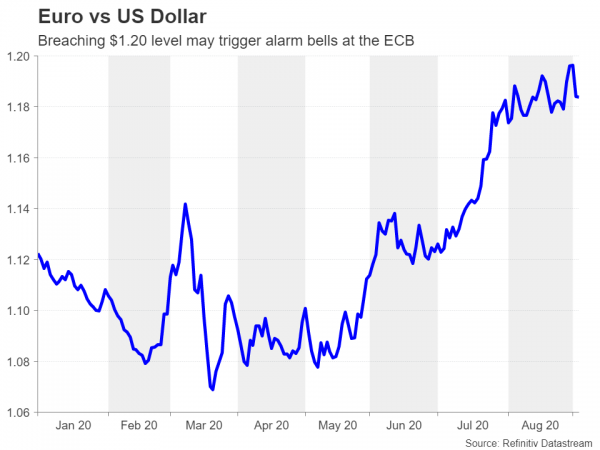

This worrying trend of rising virus cases is likely to keep the ECB on the cautious side, with President Christine Lagarde expected to re-stress the huge uncertainty surrounding the outlook. A bigger question mark, however, for investors is whether Lagarde sees the euro’s recent appreciation as problematic enough to make a verbal intervention. Recent reports suggest several Governing Council members are uneasy about the speed and size of the euro rally.

Given that inflation in the Eurozone just turned negative and how dependent businesses are on exports, those concerns are understandable. But it could be too soon for Lagarde to resort to strong language to directly talk down the currency and she may instead sound a more downbeat note on the recovery to take some of the shine off the euro.

Given that inflation in the Eurozone just turned negative and how dependent businesses are on exports, those concerns are understandable. But it could be too soon for Lagarde to resort to strong language to directly talk down the currency and she may instead sound a more downbeat note on the recovery to take some of the shine off the euro.

Ahead of the ECB’s meeting on Thursday, German industrial production figures for July and the Eurozone sentix index for September might attract some attention on Monday, as well the final Q2 GDP estimates for the bloc on Tuesday.

Brexit ‘Round 8’ vs GDP bounce for the pound

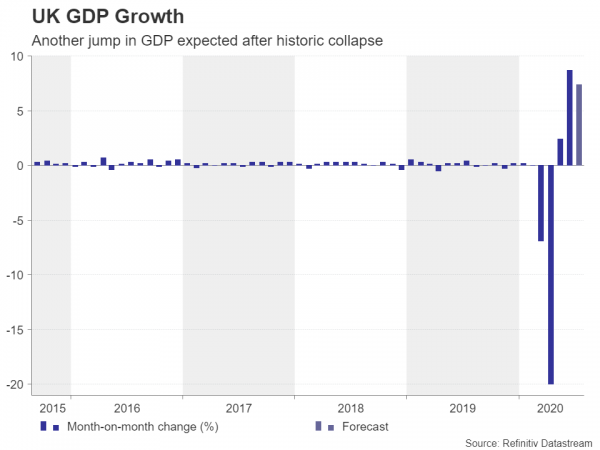

Brexit talks resume next week in what will be a crucial round that will determine whether an October deal on the future relationship between the UK and the EU is a realistic prospect. After seven rounds, the two sides have made little progress on key issues such as fishing rights and establishing a level playing field. Yet, with expectations of close trading ties already dashed after Boris Johnson took over as prime minister, investors are hopeful that some kind of a deal is still doable, even if it’s just a basic free-trade agreement.

That’s probably one reason why the stalemate in the negotiations hasn’t gotten traders too worried for now as they hold out for an 11th hour deal. But with the clock ticking and the end of October seen as the farthest possible deadline to reach an agreement, Brexit headlines are likely to spark greater market reactions in the coming weeks than they have been over the past few months.

Should the talks go all awry, UK economic indicators could save the pound from taking a major tumble. The GDP estimate for July is due on Friday and is expected to show the UK’s economic rebound strengthening further at the start of the third quarter. Industrial and manufacturing output numbers will also be published on the same day.

However, even if the pound is able to survive the Brexit drama and the data on the recovery is robust, cable may nevertheless come under pressure if the dollar extends its upside correction into next week.

Quiet week in the US, barring political explosions

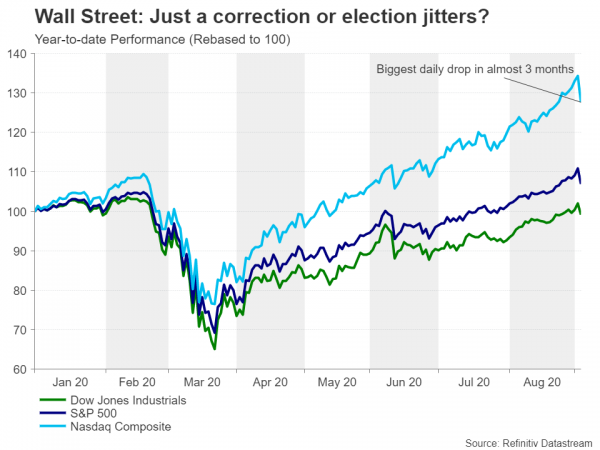

Apart from the August readings of the producer price index (Thursday) and the consumer price index (Friday), there’s not much on the US calendar that could stir up the dollar over the next seven days. Neither are there any Fed speeches on the agenda as the blackout period begins in the lead up to the FOMC meeting on September 15-16. This could leave the election campaign as the sole focal point for traders as Democratic candidate Joe Biden maintains a comfortable lead in the polls over incumbent President Trump.

Poor poll showings for Trump and his Republican party are likely to weigh on stocks more than the dollar at this point. Having said that, a Biden win is not perceived to be as big a threat as it used to be and what investors may fear more is another term of a split Congress, which would make it difficult for a new fiscal package to be passed.

The election could matter even less for the markets if plans by US health authorities to begin distributing a COVID-19 vaccine on November 1 go ahead.

Meanwhile in Japan, a number of key economic gauges will be watched as markets wait for Prime Minister Abe’s successor to be chosen. Household spending for July is out on Tuesday, along with revised GDP estimates for the second quarter. The Q2 GDP figure is forecast to be revised lower following the downward revision in capital expenditure. July machinery orders will follow on Thursday and rounding up the week on Friday are corporate goods prices.