The US employment report for August will be released at 12:30 GMT Friday, and forecasts suggest the economy continued to recover jobs at a healthy clip. For markets though, this data set might present an asymmetric risk, with a negative surprise likely affecting the dollar and equities more than a positive one. In the bigger picture, this data is unlikely to change the ‘dollar-hating, stock-loving’ trend currently at play.

Dollar falls from grace

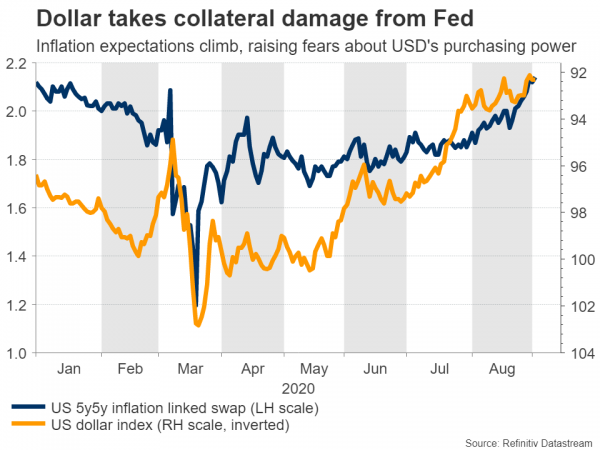

There is absolutely no love for the US dollar out there. The greenback just recorded its fourth straight month of sharp losses, as the euphoric atmosphere in the markets has suppressed demand for the world’s reserve currency. A barrage of signals from the Fed that it will tolerate inflation overshooting its 2% target did not help either, as higher inflation implies less purchasing power for a currency in the future.

Whether this ‘weak dollar’ trend will continue over the coming months might depend on two key elements: whether Congress manages to hammer out a deal on another virus relief package, and how opinion polls evolve as we approach the November presidential election.

Another decent report expected, but mind the risks

For now though, the upcoming payrolls data might inject some volatility.

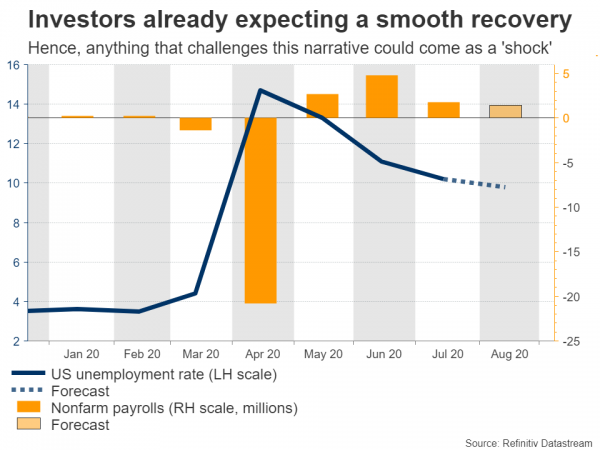

The consensus is for the US economy to have added another 1.4 million jobs in August, which would push the unemployment rate down to 9.8%, from 10.2% previously. That would still leave the unemployment rate just beneath its peak from the 2008 financial crisis, so even though this is a step in the right direction, there are still miles to go before the labor market truly recovers.

More importantly, this report will capture the mid-July to mid-August period, when infections were on the rise and several states rolled back their reopening plans, causing high-frequency indicators to lose steam. Crucial unemployment benefits also expired at the end of July, cutting off a vital economic lifeline for many US households, so it will be interesting to see whether all this impacted employment.

Ahead of the jobs data, there is also the ISM non-manufacturing PMI for August, due on Thursday.

Asymmetric risks

All told, the risks surrounding the dollar and stocks from this data set seem asymmetric, with a potential disappointment generating a bigger negative reaction than the corresponding upside one in case of stronger numbers.

Investors are already working with the assumption that the recovery is progressing well, so a mere confirmation of that might push the dollar and equities higher, but only modestly. The Fed will not be raising interest rates anytime soon even in case of stellar data, and stock markets are already priced for perfection.

On the other hand, a disappointment could bring this cheerful narrative into doubt, and ignite bigger moves to the downside. This may be especially true for equity markets, which seem vulnerable to a correction after such a relentless run higher.

Volatility, not a trend

Overall, US employment reports tend to be more of an intraday volatility event for markets nowadays, not something that generates longer lasting trends. As such, it is crucial not to lose sight of those bigger trends.

At the moment, the markets hate the dollar because of fears that inflation might be around the corner, and love stocks because there is no other real alternative now that most bonds have turned into negative-yielding assets.

It is highly unlikely that the upcoming employment data will change these bigger trends.

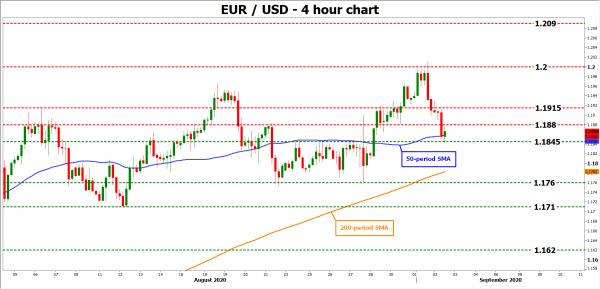

Taking a technical look at euro/dollar, if the bears manage to pierce below the 1.1845 level, their next target may be the area around 1.1760.

On the upside, a move back above 1.1880 would turn the focus to the 1.1915 territory.