The Australian dollar was little changed during the Asian session as traders reacted to mixed data from Australia and China. In a statement today, China Logistics said that the country’s manufacturing PMI declined to 51.0 in August. That was lower than last month’s increase to 51.1 and the consensus expectation of 51.2. The non-manufacturing PMI increased to 55.2 while the composite PMI rose to 54.5. Meanwhile, in Australia, data showed that business inventories fell by 3.0% in the second quarter while the firm’s gross operating profits rose by 15.0%.

The Japanese yen wavered today as investors reacted to the industrial data from Japan. According to the Ministry of Economy, Trade, and Industry, the preliminary industrial production increased by 8.0% in July. That was better than the previous increase of 1.9% and the consensus estimates of 5.8%. The production is forecast to have risen by 4% in August and by 1.9% in September. Meanwhile, retail sales dropped by 2.8% in July after rising by 3.9% in the previous month. These numbers show that the Japanese economy is still struggling as the country faces its worst economic crisis in recent history.

The euro rose slightly against the US dollar during the Asian session. The currency will react to important economic data from the region. In Italy, the statistics office will release the second quarter GDP data. Analysts expect that the economy contracted by 17.3% in the second quarter. The statistics office will also release Italian inflation data. Similarly, in Germany, Destatis will release the preliminary August inflation data. Analysts expect that the headline CPI rose by 0.1% in August while the harmonised CPI fell by 0.2%.

EUR/USD

The EUR/USD pair rose to an intraday high of 1.1928. On the four-hour chart, the price is above the 50-day and 100-day exponential moving averages. The signal and main line of the MACD have continued to rise. Similarly, the price is along the upper line of the Bollinger bands. Therefore, the pair is likely to continue rising as bulls aim for this month’s high of 1.1970.

GBP/USD

The GBP/USD pair rose to an intraday high of 1.3350, which is the highest level it has been since December 16. The pair is above the two lines of the envelopes indicator and above the 50-day and 100-day exponential moving averages. The RSI has moved back to the overbought level while the price is above the 23.6% Fibonacci retracement level. The pair is likely to continue moving upwards as traders aim for the next resistance at 1.3505.

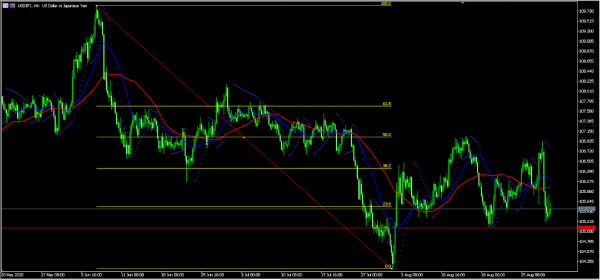

USD/JPY

The USD/JPY pair dropped sharply on Friday after Shinzo Abe announced his resignation. Today, the pair rose from Friday’s low of 105.20 to the current level of 105.50. On the daily chart, the price has moved below the short and medium-term moving averages. It is also below the dots of the Parabolic SAR and is along the 23.6% Fibonacci retracement level. The pair is likely to resume the downward trend as traders aim for the next support at 105.07.