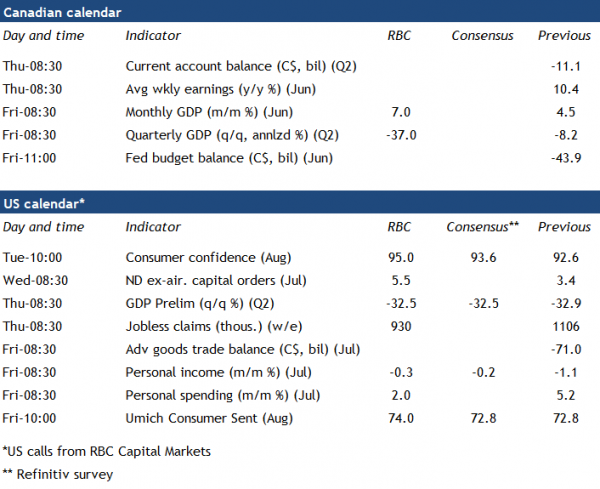

There is little doubt that the Canadian GDP report next week will show a gut-churning decline in activity in Q2, but the initial rebound has also been eye-catching. And early indicators for the US economy in Q3 have also looked less-bad than feared, despite the resurgence of COVID-19 infections. But the initial recovery-phase was always expected to look quite sharp as containment measures eased. The pullback in March and April was so large that record increases in Q3 GDP will still leave both the Canadian and US economies operating well-below capacity limits, and further growth will be harder to come by.

One of the big lingering concerns has been the risk that exceptional labour market weakness would outlive massive government income supports. In Canada, employment was still down 1.3 million from February as of July. The job count in the United States was still 14 million below pre-shock levels in the month. That jobs figure is certainly a pressing concern in the United States, where the $600/week top-up of unemployment insurance has already expired and there remains confusion about exactly how, and how quickly, the reduced benefits from President Trump’s executive order will be paid out. Meantime, still-elevated levels of virus spread are threatening to weigh on future spending growth.

But in Canada, the announcement of a 4 week extension of CERB, followed by an enhancement to employment insurance payments and the establishment of additional programs for those not eligible for EI (like the self-employed) have reduced the risk of a dramatic household income pullback into the end of this year. There are still growth headwinds in Canada. The oil & gas sector still looks very soft, and spending on services (particularly related to tourism) remain sharply depressed even with recent improvements. And any faltering in the US economy will have repercussions here as well.

But the outlook for Canadian household income and spending continues to be propped up by an unprecedented level of policy support, perhaps even adding an element of two-sided risk for the domestic economy for the end-of-year. A significant development, given all of the risk appeared to be on the downside just a few short months ago.

Economic recovery pushes on after atrocious spring pullback

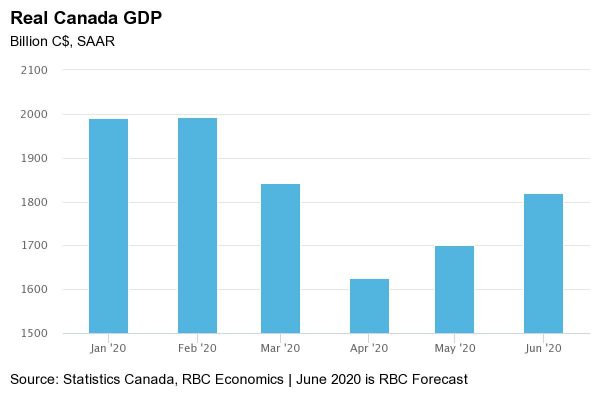

That unprecedented pullback in the Canadian economy in Q2 was concentrated in April when output fell an unprecedented 11.7% amid a full month of COVID-19 containment measures. Activity looked decidedly less-bad towards the end of the quarter. Statistics Canada reported that GDP grew 4.5% in May followed by a preliminary estimate of another 5% in June. Our own tracking suggests growth may have been even stronger in June – we are pencilling in a 7% increase given sizeable increases in manufacturing, wholesale and retail sale volumes. But that would still leave the decline in Q2 at close to the “roughly” 40% in annualized decline estimated a month ago by the statistics agency.

Household consumption likely fell less dramatically than business investment as massive government income support to-date put a floor under disposable incomes. Household spending on retail products was already back above year-ago levels in June after plunging by almost a third over March and April. Both business spending and international trade flows have been slower to return after their own record declines in April. Net international trade was probably one of the few positive contributors to GDP growth in Q2, but only because imports saw a larger quarterly drop than exports (in part because a closed border significantly shrunk what is typically a sizeable Canadian deficit in travel services.)

Solid (but still partial) rebound in Q3 to‑date

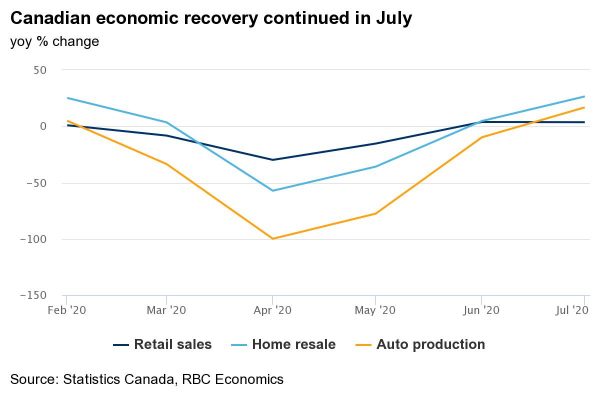

As ugly as Q2 economic data will look, the near-term bounce-back appears to have continued in July, led by strong household spending. Early estimates are that retail sales continued to edge higher. Home resales surged 30% compared to year-ago levels in July, and have now declined just 3% year-to-date versus the first 7 months of 2019, despite a massive pullback in the normally busy spring market. Auto sales grew to an annualized ~1.8 million in July, still a tad weaker than pre-shock February levels but much stronger than the 0.5 million in April sales. Even spending on hard-hit travel services appear to be ticking up from exceptionally low levels.

Despite an early rebound, the industrial sector has recently lagged household spending, but early indicators suggest the recovery there gained traction in July as well. Canadian auto production was 17% above year-ago levels in the month (after falling to zero in April) with some plants foregoing typical summer re-tooling shutdowns.