- US NFP would impact the gold price

- Technicals are showing some important signals

Investors have one focus, which is what the impact of the US non-farm payroll data on the Fed interest rate hike will be. The odds are very low that we are going to see another rate hike this year and this has stimulated the rally for the gold price. We are up nearly 10.6% so far this year and this is despite the fact that we have seen a few interest rate hikes this year. What really matters is the economic data and if it confirms that the economy is not facing any major threat, we think that the Fed would resume their gradual interest rate hike.

When it comes to the US NFP number, only an extreme reading on either side is going to change the Fed’s stance. An extreme reading on either side would also shake the floor for the gold price which is stuck in a tight range of $1254-1274. What would that extreme reading be? We think a number above 250K or below 100K would do the job. But remember, that is only the headline number, we have also other vitally important factors such as wage growth, average hourly earnings and the participation rate.

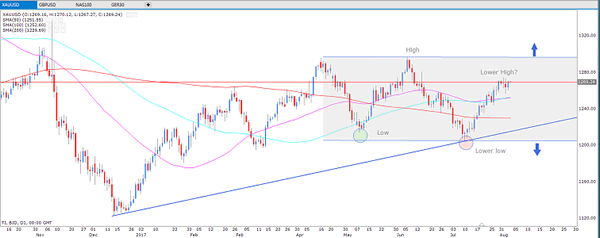

Technical Analysis

The uptrend is strong as the price is trading above the 100 and 200 day moving average – a clear signal for a strong uptrend. Moreover, we are consolidating in a sideway pattern. However, something which we need to watch out for, is that we have formed a lower low and perhaps we are in a process of forming a lower high (as shown on the chart). A break below the 200-day moving average would signal that the game is about to change and the break of the upward trend line would validate that we may have another lower low.