Congressional talks in the United States on a new virus relief package will dominate the market headlines yet again in the coming week as the durability of the latest risk-on episode rests on a deal being reached. But investors will also be keeping a close watch on US retail sales figures to gauge how well consumption is holding up amid renewed virus restrictions. Progress on the recovery will be preoccupying the pound too as UK GDP numbers for Q2 and June are due, while the Reserve Bank of New Zealand is unlikely to be fazed by the improving mood when it meets for its latest policy decision.RBNZ to expand QE, update on negative rates

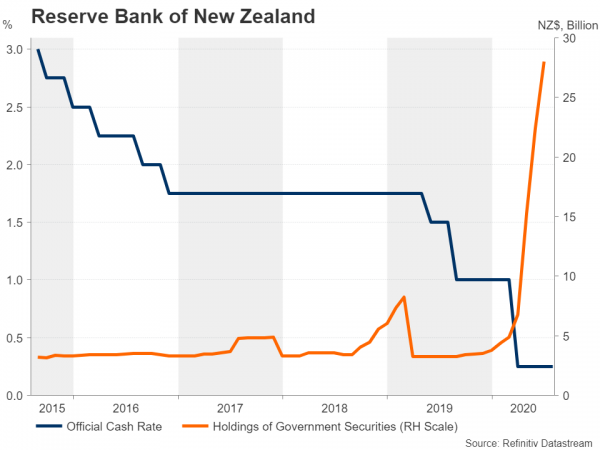

Wednesday will be an eventful day for New Zealand’s central bank when it announces its monetary policy settings and provides an update on its review into negative rates, as well as publish its quarterly forecasts. Looking at the virus and economic data, there is every reason to expect a less dovish language. New Zealand has so far avoided a second wave of COVID-19 infections, despite a flare-up in the region, and employment numbers released in the past week revealed the jobless rate actually fell in the second quarter, confounding expectations of a big jump.

However, while the RBNZ might sound a little less gloomy, it may still see the need to expand its asset purchase programme, as it frets over the long-term prospects of the labour market, and would want to keep its options open on alternative policy tools. With New Zealand’s borders sealed off to the outside world, it’s only a matter of time before job losses begin to mount in the country’s crucial tourism sector. Moreover, if the road to recovery in other economies turns rockier, it will be difficult for New Zealand not to feel the bumps as well.

All these should offer policymakers a good excuse to maintain plenty of pessimism, as apart from the fact that the RBNZ has a dual mandate to achieve maximum employment, the Bank also always has one eye on the exchange rate. Hence, the New Zealand dollar’s ascent towards the $0.67 level may not sit too well with policymakers, who might just attempt to talk it down.

Aussie looks to jobs data for reality check

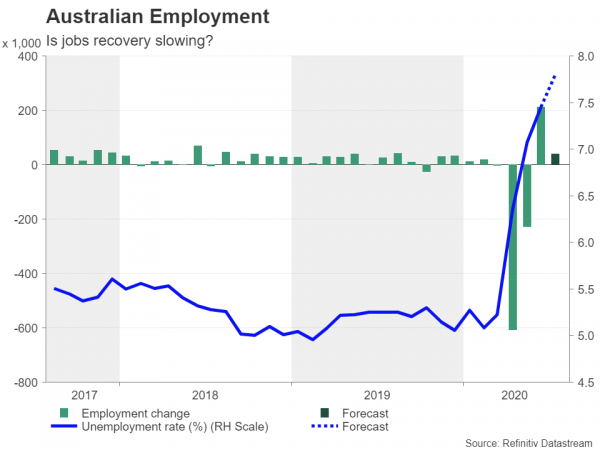

Across the Tasman Sea, new virus cases continue to surge in Australia, forcing tougher restrictions to be reimposed in Victoria and other states. Yet, the Reserve Bank of Australia hasn’t displayed the same readiness as the RBNZ when it comes to additional easing, giving aussie traders little reason to sell the currency, which has skyrocketed by 30% from its March lows.

Early indicators for July, such as the PMIs, are far from flashing red but perhaps Thursday’s employment report might give the RBA some cause for concern. Governor Philip Lowe will be testifying before lawmakers later in the day so any signs of a slowdown in the jobs rebound in July could prompt a shift in tone.

However, unless the numbers are exceedingly bad, the Australian dollar should not stray off course from its uptrend and it will probably require a series of poor data to undermine confidence in the positive outlook.

Those additional warning flags could arrive as early as the following day when China reports industrial output and retail sales figures on Friday. It’s been steady as she goes for China’s emergence out of the pandemic slump, but the recovery hasn’t exactly been dynamic either. Industrial production was up just 4.8% year-on-year in June, which is modest by Chinese standards, while retail sales remain down over the year. Another underwhelming improvement in July could take some of the heat out of the risk rally, possibly weighing on the aussie as Australia’s economic prosperity is strongly tied to China’s.

Other releases due out of China over the next few days include the producer and consumer price indices for July on Monday.

UK data may further help pound defy gravity

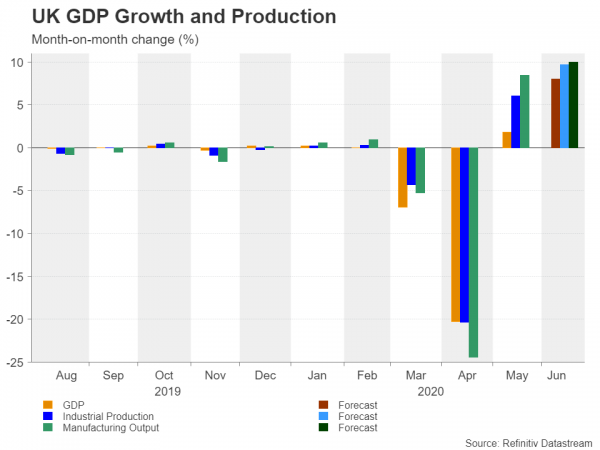

The Bank of England struck a somewhat more upbeat tone at its August policy meeting but warned that the outlook remains uncertain. More significantly for the pound, even though Governor Andrew Bailey did not rule out the use of negative interest rates in the future, he clearly stated they were “not the current plan”. That was music to the pound’s ears and key indicators out of the United Kingdom next week will likely further reduce the temptation for the Bank to experiment with negative rates.

The monthly prints on GDP and industrial and manufacturing output due on Wednesday are expected to show the recovery gained traction in June as lockdown restrictions were relaxed substantially across the UK.

However, it won’t be a completely rosy picture as the full quarter GDP estimate for the April-June period will also be released on Wednesday, which could put Britain at the bottom of the Q2 growth table. In addition, job figures for June out a day earlier on Tuesday are anticipated to be quite bleak as scores of businesses hit by plunging consumption have slashed headcount in recent weeks.

Nevertheless, the bounce back in economic output in June will be the main focal point for traders as it would underline the view that the UK’s recovery is on the right track, reinforcing the pound’s positive momentum.

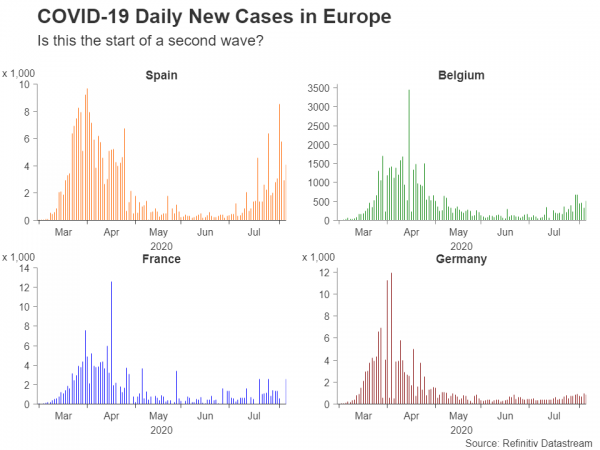

Is Europe facing a second wave?

One of the factors driving the pound higher lately has been the tailwind from the euro’s own turbo-charged rally. The brightened prospects for the Eurozone economy on the heels of the EU’s virus rescue fund has propelled the single currency to two-year highs. There’s little on the calendar next week that should spoil things for the beaming euro.

The sentix index, which measures investor morale in the euro bloc, will start the week on Monday and there will be more business surveys on Tuesday with Germany’s ZEW economic sentiment gauge. On Wednesday, the focus will be on how robustly Eurozone industrial production recovered in June, and finally on Friday, the second reading of second quarter GDP is expected to be left unrevised at -12.1% quarter-on-quarter.

Given the muted week, investors might begin to pay more attention to the continent’s virus numbers, which have been steadily worsening since mid-July. Fears of Europe being engulfed by a second virus wave have been intensifying and should some countries begin to enforce business shutdowns again, the euro may lose some of its newfound allure.

A lose-lose situation for the US dollar?

As the resurgence of virus cases in the US applies the brakes on the economy’s comeback, the incoming data will be watched closely by investors for a better sense on where the recovery is headed.

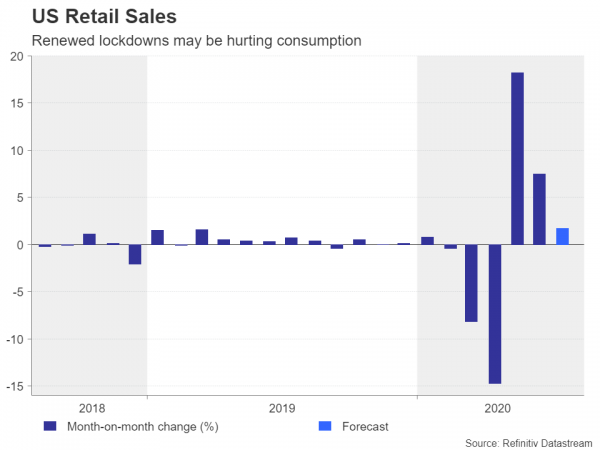

The JOLTS job openings due on Monday, while somewhat outdated, are an important measure of the overall health of the labour market. A strong rebound in new vacancies in June would suggest corporate America was actively rehiring after the lockdown rules were eased. Producer prices out on Tuesday and the consumer price index on Wednesday, both for July, are not anticipated to be market moving given that inflation is the least of the Federal Reserve’s concerns at the moment. Friday’s retail sales, on the other hand, couldn’t be more important for the markets amid some conflicting signals on how badly consumption was set back by the tougher social distancing rules in July.

Forecasts are for retail sales to have risen by 1.7% m/m in July, slowing sharply from the prior month but nevertheless enough to produce a year-on-year gain. Also due on Friday are industrial output figures for the same month as well as the preliminary print of the University of Michigan’s consumer sentiment index.

Worse-than-expected readings in the retail sales data could heighten concerns about a slowing recovery, weighing on already depressed Treasury yields and pressuring the greenback further. However, a positive surprise would not necessarily do the US currency any favours either as it would only fuel the prevailing risk appetite, thus diminishing its safe-haven appeal.

Can Congress agree on a new relief bill?

There’s likely to be a similar response to the negotiations on Capitol Hill on the coronavirus relief bill. If Democrats and Republicans manage to reach a deal on a new fiscal aid, the dollar would probably continue to slide on the back of the subsequent risk-on moves, although a large package would also put a floor under Treasury yields, limiting the greenback’s downside scope.

What is less predictable, however, is how markets would react to a no deal. While stocks would almost certainly fall if Congress fails to supply fresh stimulus, the dollar may not necessarily benefit from the increased risk aversion if investors don’t see the absence of a deal threatening the recovery elsewhere in the world. But whatever US lawmakers decide, or not decide in the coming days, markets should be braced for some volatility in the August lull.